In today’s fast-paced digital era, convenience has become the holy grail of modern living. From near-instant food delivery to seamless transportation services, technology continuously strives to make our lives easier. One notable advancement in this realm is embedded payments, in which transactions are seamlessly integrated into the user experience. Although embedded payments offer undeniable convenience for both consumers and businesses, it’s essential to carefully examine whether this convenience comes at an acceptable cost.

THE RISE OF EMBEDDED PAYMENTS

Embedded payments, the seamless embedding of transaction capabilities into everyday digital experiences, have become a ubiquitous part of modern life. To understand their origins and meteoric rise, we need to delve into the not-so-distant past of the digital payments landscape. We can trace embedded payments back to the early days of e-commerce when online marketplaces sought ways to simplify the checkout process. PayPal, founded in 1998, played a pioneering role by allowing users to make payments on various websites using an email address and password. This marked a significant step toward reducing friction in online transactions.

Until recently, the term “integrated payments” (e.g., a payment gateway integrated to an online platform) was used interchangeably with “embedded payments” (e.g., in-app payment using Apple Pay). But this is no longer a valid reflection of reality. While in the case of integrated payments, the payments process is attached to (the experience on) the platform, oftentimes with a different look and feel, embedded payments are fully embedded in the platform’s native customer journey, becoming increasingly invisible and highly convenient for the end customer (e.g., through stored payment details).

The true catalyst for embedded payments came with the proliferation of smartphones and the app economy. Apple’s App Store, launched in 2008, introduced the concept of in-app purchases, letting users seamlessly buy digital content and services. This model not only revolutionized mobile gaming, but it also set the stage for a new era of embedded payments. Ride-sharing services like Uber and Grab, which emerged in the 2010s, further popularized embedded payments. They eliminated the need for physical cash/credit cards, letting passengers effortlessly pay for rides via their apps. Social media platforms like Facebook and Instagram followed suit, introducing “buy” buttons that let users purchase products featured in ads without leaving the app. This innovation blurred the lines between social networking and e-commerce and gave rise to the concept of “social commerce.”

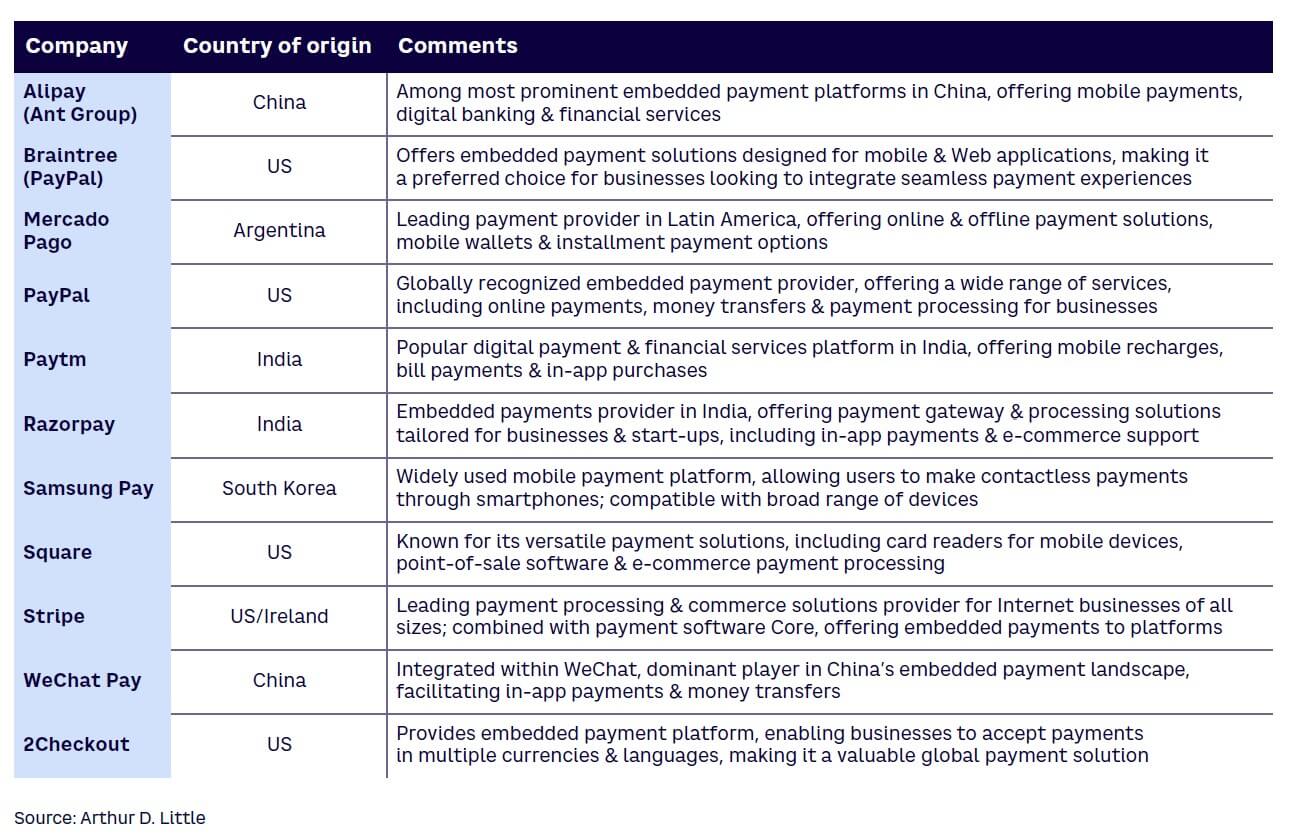

The growth in embedded payments is a global phenomenon, with some market leaders becoming household names across generations. Table 1 provides a list of notable players in the embedded payments space.

Two mobile phone ecosystem players are in their own category: Google and Apple. Their payment apps facilitate physical and app marketplace payments on mobile platforms, driving traffic, attention, and engagement to their electronic wallets.

HOW EMBEDDED PAYMENTS RESHAPE COMMERCE

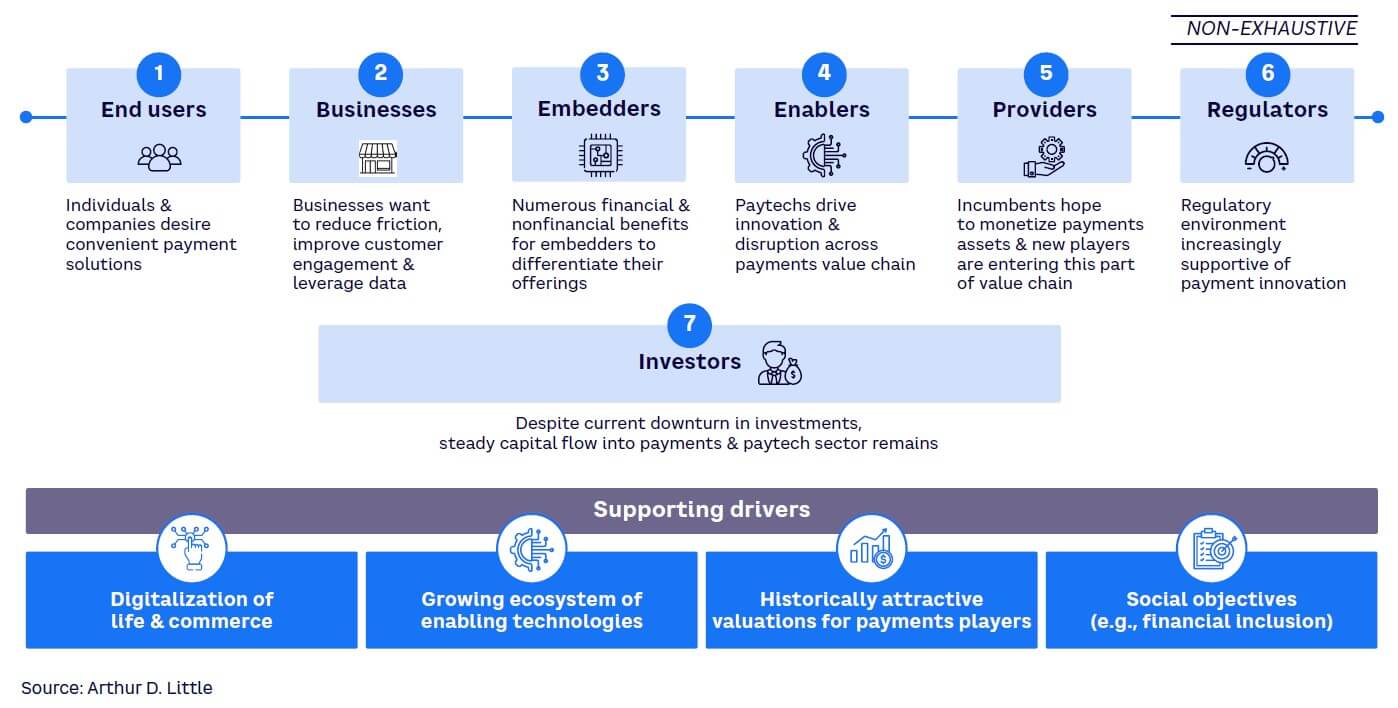

Embedded payments have infiltrated nearly every aspect of our digital lives, from food delivery to streaming-service subscriptions. Indeed, they have become a posterchild for embedded finance, bringing together technology, convenience, and commerce to offer users frictionless payment while fueling the growth of the digital economy. Specifically, as Figure 1 shows, we see seven key growth drivers responsible for the past and future proliferation of embedded payments.

Multiple use cases have emerged and scaled on the back of embedded payments’ growing popularity, each impacting the methods of commerce. Some more familiar use cases include:

-

E-commerce platforms. One of the most common use cases is within e-commerce websites and mobile apps. Embedded payments streamline the checkout process, letting customers make purchases without leaving the platform.

-

Ride-sharing services. Ride-sharing apps like Uber and Lyft use embedded payments to automatically charge passengers for their rides, eliminating the need for cash or card transactions.

-

Food-delivery apps. Food-delivery platforms like DoorDash and Grubhub let users pay for their orders seamlessly within the app, enhancing the overall dining experience.

-

Subscription services. Streaming platforms like Netflix and Spotify use embedded payments to handle recurring subscription charges, making it easy for users to access premium content.

-

In-app purchases. Mobile games and apps frequently use embedded payments to give users the option to buy virtual goods, upgrades, or additional content without leaving the app.

-

Travel and booking services. Travel websites and apps use embedded payments to facilitate hotel bookings, flight reservations, and other travel-related transactions, providing a one-stop shop for travelers.

-

Social commerce. Social media platforms like Instagram and Facebook have integrated payment options, letting users purchase products directly through ads and posts.

-

Online marketplaces. Marketplaces like eBay and Etsy use embedded payments to process transactions between buyers and sellers, ensuring a secure and efficient exchange of goods and services.

-

Healthcare payments. Telemedicine and healthcare apps offer embedded payment solutions to help users easily pay for consultations, prescriptions, and medical services online.

-

Utilities and bill payments. Utility companies and service providers use embedded payments to make it easy for customers to pay bills, manage accounts, and set up automated recurring payments through their websites and apps.

These diverse use cases highlight the versatility and convenience that embedded payments bring to various industries. Whether it’s simplifying e-commerce, enhancing the user experience in mobile apps, or automating recurring payments, embedded payments are reshaping how businesses and consumers interact in the digital age.

STREAMLINING EVERYDAY TRANSACTIONS

Embedded payments eliminate the need to navigate to separate payment gateways or switch between apps to complete transactions. Whether it’s ordering a ride through a ride-sharing app, purchasing products via social media, or paying for services within a software application, embedded payments streamline the process, reducing friction and saving time.

Consumer-centric convenience

Embedded payments cater to the desires of consumers in an age where time is of the essence. One of the most significant contributions is eliminating the “checkout hassle.” Traditional online shopping involved navigating through multiple screens, inputting details like shipping addresses and payment information, and, at times, facing compatibility issues or slowdowns. Embedded payments transform this experience into a single-click affair.

Consider a scenario in which a user is shopping for groceries online. Traditionally, this would involve clicking through a website, adding items to a cart, proceeding to a separate checkout page, and entering payment information. This multistep process created ample opportunities for user fatigue and cart abandonment. Embedded payments allow users to select their items and finalize their purchase seamlessly within the same app or website, minimizing interruptions and transaction abandonment.

The most successful players are able to tie payment convenience to other types of convenience: predefined delivery address, delivery schedule, knowledge of preferred products, predefined shopping lists, predefined destinations, frequently bought products, automatic invoicing address, and email and phone contact selection. Pre-filling eliminates the need to enter repetitive administrative information, and automation reduces the need to search for a request or product.

Embedded payments leverage the familiarity of existing platforms and apps. People already spend a substantial portion of their digital lives within these ecosystems, from social media to ride-sharing apps. The convenience of making payments within these platforms adds to the trust users have established, making the transition from browsing to buying feel like a natural progression. Enhanced security is another benefit: by consolidating transactions within trusted platforms, users are less likely to worry about the safety of their financial data.

This instills confidence and reduces the cognitive load associated with managing multiple accounts and payment methods, simplifying the consumer experience.

Business-centric convenience

Embedded payments offer substantial advantages to businesses, including a potential reduction in cart abandonment. Studies from PayPal and Baymard Institute have shown that a convoluted checkout process is a primary driver of cart abandonment. Embedded payments address this issue by streamlining the transaction process, from selection to payment, all within the same digital environment and typically with prestored payment details. Conversely, with traditional payments integration, customers are typically forwarded to a separate payments front end where they must manually enter their payment details. This not only increases the risk of technical issues during website transfer but also makes it more cumbersome and error-prone for the customer to complete the transaction by correctly entering their payment details.

Embedded payments also contribute to customer loyalty and retention. When customers have a seamless, hassle-free payment experience, they are more likely to return to the same platform for future transactions. This fosters brand loyalty while lowering costs, since retaining existing customers is less expensive than acquiring new ones.

EMBEDDERS’ DELIGHT

A key driver behind the rapid growth of embedded payments is the universal willingness among trusted brands (across sectors) to adopt embedded payments deep inside their customer journeys. This rapid adoption, coupled with constant innovation in the payment arena, allows embedded payments to revolutionize the way businesses and platforms operate in the digital realm.

The commercial and customer benefits of embedding payments are obvious to embedders that have championed this shift in how customers pay and how businesses receive payments. Figure 2 highlights the many benefits of embedded payments.

HIDDEN COSTS & MONOPOLISTIC TENDENCIES

The convenience of embedded payments is undeniable, but it’s important to acknowledge the potential downsides. One notable concern is the possibility of hidden fees. In the pursuit of seamless transactions, consumers might overlook the fine print, inadvertently subjecting themselves to hidden charges imposed by platforms or payment providers. For instance, booking a flight through a travel app might come with undisclosed service fees or unfavorable foreign exchange rates that only become apparent in the final stages of the transaction.

Security is another concern. Despite their much-touted security advantages, embedded payment systems are not immune to breaches. If a platform’s security measures are compromised, the financial information of countless users is at risk. The interconnected nature of embedded payments makes them an attractive target for cybercriminals seeking to exploit vulnerabilities.

Another consideration is the potential for monopolies. As embedded payments become more prevalent, a few dominant platforms could consolidate their control over a sizable portion of online transactions. This power concentration could stifle competition and innovation, leading to reduced choices for consumers and potentially higher costs. For example, certain e-commerce giants not only facilitate transactions, but they also dictate terms to smaller businesses operating on their platforms.

The list of threats and concerns also includes:

-

Legal issues. Navigating the complex web of international and local payment regulations can be challenging for businesses offering embedded payment solutions, potentially leading to legal issues.

-

Data privacy concerns. The collection and use of customer data for payment processing can raise concerns about privacy and data protection, especially when not handled transparently.

-

Data monopolization. Large platforms with embedded payments, such as Amazon, can tie customer interests, preferences, and behavioral data to payments (i.e., actual purchases) and can thereby identify effective conversion rate. This endangers (smaller) competitors that lack this two-fold data and further increases data monopolization.

-

Inadequate fraud protection. Despite security measures, fraud remains a concern, and users might be vulnerable to unauthorized transactions or identity theft.

-

Impacted user trust. Users may be hesitant to trust embedded payment systems, especially if they have concerns about the security of their financial data or hidden fees.

-

Technical glitches. Technical issues, such as system outages or payment failures, can disrupt the user experience and harm a platform’s reputation.

-

Dependency on third-party providers. Embedding payments often means relying on third-party payment processors, which can pose risks if these providers experience downtime, data breaches, or other issues. Moreover, it can negatively impact the consistency of the user experience if customer support by the payment processor is different than the platform’s process.

-

Increased cost of integrations and upgrades. Embedded payments can impact the flexibility of platforms in terms of new integrations and upgrades.

-

Commoditization of “unaligned” payment processors. The increasing ownership of the payment journey by platforms commoditizes (in-background) classical payment processors and impacts their margins.

Conclusion

WEIGHING BENEFITS AGAINST CONCERNS

Embedded payments are bringing a new level of convenience to our increasingly digital lives. Embedded payments simplify transactions, enhance user experiences, and boost business revenues. Of course, the allure of convenience should not blind us to the potential for hidden fees, security vulnerabilities, and monopolistic tendencies to undermine the benefits. If businesses and users are to fully benefit from embedded payment solutions, the following protocols should all be top of mind for platform owners:

-

Platforms offering embedded payments must be diligent in disclosing all associated fees up front. This transparency lets consumers make informed decisions and builds trust in the platform.

-

Robust security protocols must be in place to safeguard user data; regular security audits, encryption technologies, and authentication measures can go a long way in fortifying the payment ecosystem.

-

Governments should monitor and enforce fair competition practices to prevent monopolistic behaviors. Ensuring a level playing field encourages innovation and prevents a handful of players from gaining undue control over the market.