11 min read • Energy, Utilities & Resources, Sustainability

Hydrogen

The electroshock to the energy transition

While much of the focus on achieving net zero has been on green electricity, momentum is growing behind hydrogen within the energy transition, with the IEA predicting a four-fold increase in demand between now and 2040.

Governments are increasingly supporting its adoption through a range of incentives, such as those within the US Inflation Reduction Act (IRA), EU funding programs, India’s Hydrogen Mission, and Australia’s Hydrogen Headstart program. Together with electrification, hydrogen will help accelerate transformative decarbonization, especially in sectors in which emissions are otherwise hard to abate.

However, uncertainties still exist around hydrogen’s growth and relevant business models, including questions around supply, demand, transportation, and regulation. For this reason, players in the energy ecosystem, whether suppliers, customers, or investors, all need to take a fresh look at their strategies and investment plans. This article explores the opportunities for hydrogen in the energy sector and outlines the critical factors that companies across the ecosystem must consider to successfully integrate it into their strategies.

The role of hydrogen across the energy value chain

Hydrogen has the potential to impact the upstream, midstream, and downstream energy value chains.

Upstream

Adding Carbon Capture Utilization and Storage (CCUS) technology to fossil fuel-based hydrogen production or electrolysis using renewable electricity significantly reduce greenhouse gas (GHG) emissions. However, viability relies on the availability of affordable renewable electricity – for example, electrolysis-based hydrogen production typically requires the availability of at least 4,000-5,000 hours of electricity per year.

Midstream

Hydrogen can be transported via pipelines, trucks, or ships. However, existing pipelines and storage facilities are designed for natural gas and will require large-scale transformation to transport and store hydrogen. Hydrogen transportation through trucks or ships (as liquid hydrogen, ammonia[1], or a liquid organic hydrogen carrier [LOHC]) will also require new or repurposed infrastructure.

Large-scale storage of hydrogen has the potential to dramatically increase system resilience, as it can be used to store energy generated from renewable sources, which can then be used during peak demand periods. Midstream impacts will depend on the cost and availability of infrastructure and the regulatory framework for hydrogen transportation. Many gas transmission system operators (TSOs) are already analyzing the required changes, running pilots, designing projects, attracting investments, and starting preparatory construction works.

Downstream

Hydrogen can be used for transportation, industrial processes (such as steelmaking, refining, and chemical production), power generation, and residential heating, as illustrated in Figure 1. Another viable use is as a source for e-fuel[2] when coupled with CCUS technologies, an example being the Haru Oni pilot plant in Chile. Adoption and the impact on the downstream value chain will depend on hydrogen availability, as well as the cost and efficiency of hydrogen-based technologies such as vehicles and heating systems.

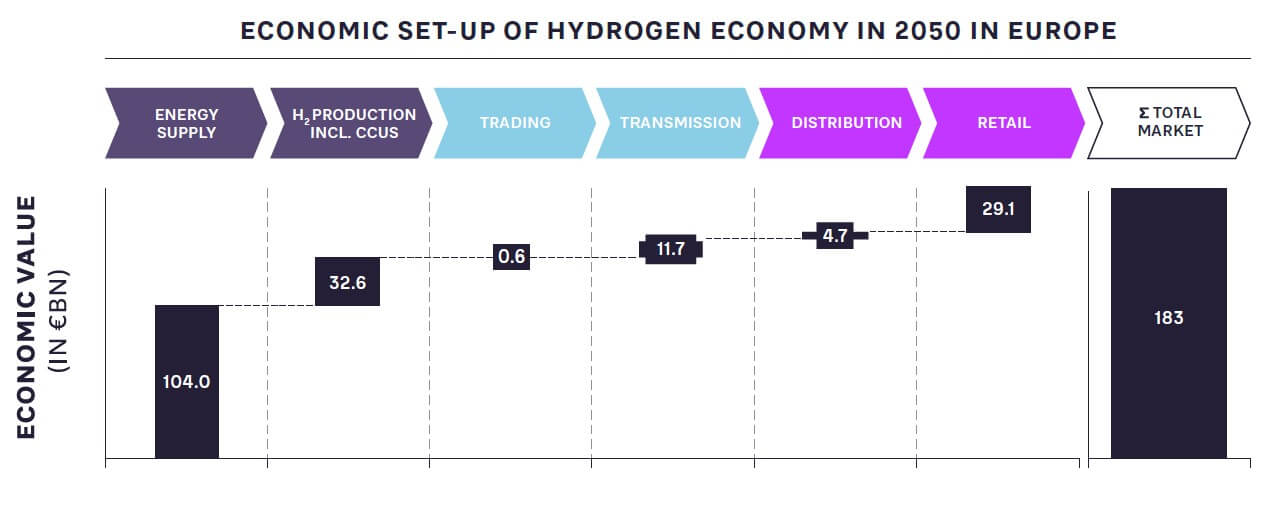

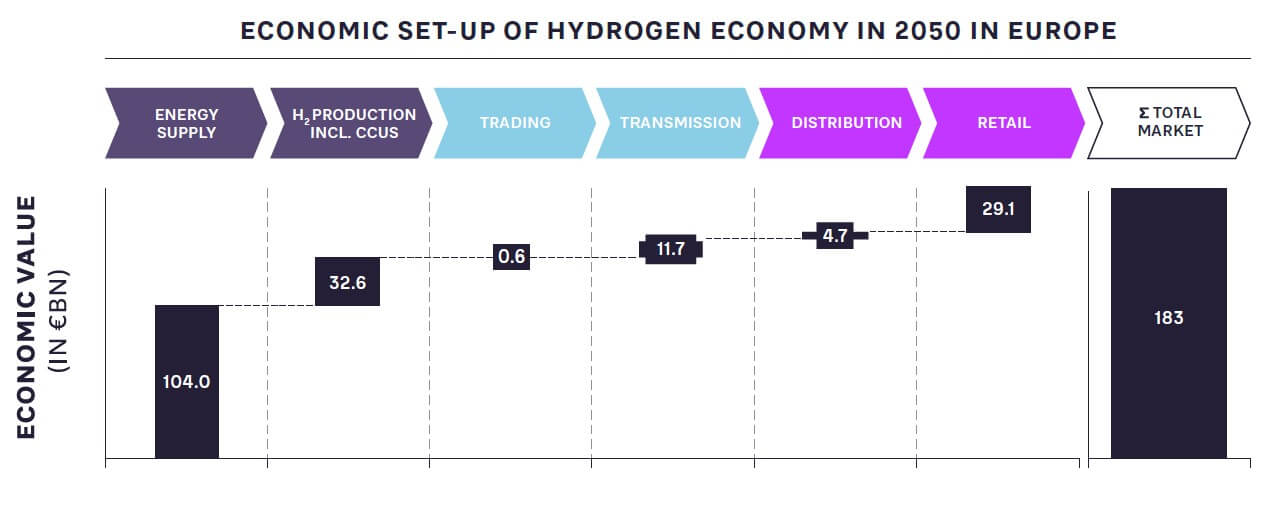

As detailed in Figure 2, a range of opportunities will emerge across the value chain, particularly around green energy supply and hydrogen production. Businesses should explore where these fit with their overall strategy, capabilities, and risk appetite, and move quickly to secure the right energy sources and form partnerships to access hydrogen volumes at good prices.

Risks to the development of the hydrogen economy

While the hydrogen value chain provides major opportunities for incumbents and new players, it also faces multiple risks and uncertainties, including:

-

Cost/competitiveness: The cost of producing, transporting, and storing hydrogen is currently higher than that for conventional fossil fuels, due to the immature technologies across the value chain and expensive long-haul transport. Although costs are expected to decrease significantly in the long term, companies investing now in hydrogen infrastructure and technology may not generate short-term profits. Even if costs fall, producing hydrogen may still be more expensive than alternatives such as renewable power from an upstream perspective. However, due to its ability as a stored energy carrier, and its usage in otherwise difficult-to-decarbonize sectors, many expect it to be ultimately competitive with alternatives.

-

Lack of infrastructure: Available infrastructure to support the production, transportation, and storage of hydrogen is limited, preventing scaling of supply and demand. For example, fuel cell vehicle uptake will go hand-in-hand with the ramp-up of hydrogen refueling stations. The underlying challenge is that infrastructure is expensive to operate and maintain safely. According to the European Hydrogen Backbone, pipeline OPEX could amount to USD 3.6 billion per year in Europe alone. To overcome this, alongside direct financial support, many economies (such as the United States, Canada, Australia, and Korea) are establishing regional hydrogen hubs. Establishing hydrogen production close to end users minimizes the cost of infrastructure construction and operation, jumpstarting adoption.

-

Market design/regulatory development: The regulatory framework for hydrogen is still evolving, and there is uncertainty around how governments will incentivize or regulate hydrogen technology. For example, the role TSOs can play in the upstream part of the value chain, or which requirements will be set regarding the carbon intensity of hydrogen to classify it as low emission, are still unclear. Potential new internationally agreed emissions accounting frameworks could also create short-term uncertainty. This presents an opportunity for countries/regions to differentiate themselves and accelerate development by rapidly creating favorable regulatory environments for investment.

-

Technology evolution/uncertainty: The technology for producing and storing hydrogen is still developing, and how to best optimize processes for maximum efficiency and cost-effectiveness is currently unclear. Scalability is lacking around many technologies, such as ammonia cracking (to reconvert ammonia to hydrogen) or liquefaction/re-gasification. These are therefore likely to see significant future improvements in efficiency.

-

Market demand: While interest in hydrogen as a fuel and energy storage medium is increasing, how quickly and widely it will be adopted is still unclear. However, awareness of hydrogen as an alternate energy solution is growing, as shown by the range of strategies and initiatives being put in place across leading economies.

-

Competition: A growing number of companies are entering the hydrogen market, including traditional energy players, grid companies, automotive manufacturers, industrial gas providers, and technology and chemical companies. This could lead to increased competition and potential market saturation.

-

Geopolitical risk: If the majority of hydrogen is supplied by Middle Eastern and African states (such as Qatar, Saudi Arabia, and Morocco), regions such as Europe will simply trade dependency on Russian gas for dependency on hydrogen from other countries, which could create risk.

These factors complicate the decision-making process around which investments to make and when and where to make them for all actors within the ecosystem, from suppliers to users.

The necessity and added value of innovation

Innovation along the hydrogen value chain will be essential to overcome technical and economic challenges, scale up hydrogen production and utilization, reduce costs, and drive the transition to a sustainable and low-carbon energy future.

As well as advances within generation, storage, and transport innovation, hydrogen’s versatility will enable multiple sectors to innovate, create synergies, and optimize energy systems. For instance, innovations in hydrogen utilization technologies, such as fuel cells and hydrogen-powered vehicles, will drive the adoption of hydrogen as an alternative energy source.

Embracing hydrogen will enable businesses to align with sustainability goals, attract customers, differentiate their offerings, foster collaborations, and drive business model innovation. By generating hydrogen without emitting carbon, companies will earn carbon credits, which can be sold or used to offset emissions across their wider operations, providing a further financial incentive for hydrogen investment. By adhering to certification requirements (not limited to carbon footprint, but also including purity and safety), businesses can build trust and credibility, opening up opportunities for new partnerships, market access, and premium pricing.

Successfully playing in the hydrogen economy

Given the fast-moving and dynamic nature of the hydrogen economy, organizations and investors will need to be extremely agile to build a competitive position, which will require them to transform internally.

Defining new business models

Organizations need to understand and plan their positioning in the hydrogen economy. For example, hydrogen players in Japan and Korea might need to invest in electrolyzer capacity and hydrogen production overseas in Australia or Malaysia, and create a supply chain back to their country. This international business model is likely to impact the capabilities and organizational structures they develop and the partnerships they form.

Developing a customer-centric mind-set

Greater competitiveness and uncertainty require previously dominant players in the gas industry, such as TSOs, to transform their mind-set and operations. They are unlikely to be the sole player in hydrogen markets, so they need to move away from monopolistic thinking and focus on becoming agile, fast-moving, and customer centric. They must start by understanding client requirements and using this to build stronger relationships.

Creating ecosystem partnerships

Exploiting new opportunities will require collaboration with partners all around the globe, for example, with companies using solar power to create hydrogen in regions such as the Middle East and Australia, as well as forming joint venture agreements with worldwide customers to guarantee large-scale, stable demand. Partnerships between the public and private sector will drive change. One example is the establishment of Thailand Hydrogen Group, initiated by oil and gas company PTT, which aims to engage public and private sector players to promote the development and adoption of hydrogen in Thailand.

Developing new organizational structures

To deal with the broad uncertainties around feasibility and investment choices, companies need to create new organizational structures that are faster-moving and more adaptable to changing conditions. This should include creating teams with skills in business development, engineering (especially technical expertise in the hydrogen space), and finance, as well as effective communication to create awareness, build stakeholder support, and lobby for the right regulatory frameworks and support mechanisms.

Building informed and diversified investment strategies

To reduce risks in a rapidly evolving and complex market, companies should diversify investments across hydrogen technologies and market segments, such as by allocating resources to both fuel cell technology and hydrogen production technology. Alternatively, they could consider projects outside (but related to) hydrogen, such as green ammonia and methanol, especially as hydrogen is part of a broader ecosystem. Investments should also be divided evenly between hydrogen and other less volatile energy sectors to spread financial risks, guided by the company’s risk appetite.

In this challenging landscape, making informed decisions is crucial. Scenario planning serves as a valuable tool to assess the resilience of potential strategies across different scenarios. It aids in identifying “no regret” decisions that can be implemented immediately, while also establishing monitoring mechanisms for triggers that may impact other investment choices. Sustainability scenario planning is described in more detail in Navigating the sustainability journey (Prism S1 2023).

Building a long-term perspective

In the evolving hydrogen ecosystem, roles within the value chain remain fluid, particularly due to evolving regulatory policies and incentives. Players need to take a long-term perspective, assessing the potential growth and scalability of hydrogen technologies and the market before making investment decisions. For example, producers and transporters need to evaluate the potential hydrogen volumes per sector in their respective areas and identify attractive business models while considering their specific circumstances.

By actively collaborating with industry stakeholders, such as technology providers, energy companies, hydrogen users (off-takers), and government agencies, producers, transporters, and investors can gain valuable insights into market developments. Building long-term partnerships and working together allows for cross-leveraging of capabilities, reduces inherent uncertainty, and mitigates operational and demand risks.

Assessing policy evolutions and regulatory frameworks on a global scale is essential to understand their potential impact on investment decisions. For example, subsidies and tax incentives can create favorable investment environments in specific areas of the value chain. Initiatives to focus on include the US Inflation Reduction Act, Hydrogen Headstart in Australia, the EU Hydrogen Strategy, the Fit-for-55 package, the Innovation Fund, and the European Green Deal.

Insights for the executive

Hydrogen has a key role to play in successfully delivering a low-carbon economy. However, its ecosystem is still developing, meaning opportunities are not yet clear for players such as producers, energy companies, transporters, distributors, retailers, end users, and investors. To understand how to play, organizations should focus on:

-

Building internal understanding: Investigate market opportunities, potential impacts on operations, and the optimal timing around entering the hydrogen market. Companies should evaluate hydrogen volumes, market prospects, and required business models, and understand customer needs. Implementing technology and market monitoring, along with scenario planning, ensures strategic preparedness.

-

Developing the right organization and capabilities: For existing energy players, success in the hydrogen economy will require organizational transformation. This could include developing a more commercial, customer-focused mind-set, with new teams hunting for and realizing opportunities in the hydrogen value chain.

-

Working closely with regulators: Across the globe, from the EU to the United States and Asia, national and regional governments are actively involved in setting the ground rules for the hydrogen economy. Be clear on the opportunities that are available (such as through subsidies) and the regulatory decisions that could constrain strategies or operations.

-

Capitalizing on value pockets: Go beyond the hype around the demand side to understand where opportunities exist (such as in e-fuels, direct combustion, or heavy transport) and focus and capture them.

-

Collaborating across the ecosystem: Building a successful hydrogen economy requires collaboration across upstream, midstream, and downstream operations. Complex global ecosystems are emerging, involving a range of new and incumbent players. Understand the opportunities and build partnerships to position your organization in key relevant areas, technologies, projects, and geographies.

-

Investing in innovation: Embracing innovation in technologies, processes, and business models will help to differentiate, go beyond basic regulatory compliance, and allow price premiums.

Notes

[1] Ammonia can be used as a hydrogen carrier to transport it more effectively and safely over long distances due to its more favorable characteristics, having higher energy density and being less flammable

[2] E-fuels are fuels produced from renewable sources such as solar or wind power.

11 min read • Energy, Utilities & Resources, Sustainability

Hydrogen

The electroshock to the energy transition

DATE

While much of the focus on achieving net zero has been on green electricity, momentum is growing behind hydrogen within the energy transition, with the IEA predicting a four-fold increase in demand between now and 2040.

Governments are increasingly supporting its adoption through a range of incentives, such as those within the US Inflation Reduction Act (IRA), EU funding programs, India’s Hydrogen Mission, and Australia’s Hydrogen Headstart program. Together with electrification, hydrogen will help accelerate transformative decarbonization, especially in sectors in which emissions are otherwise hard to abate.

However, uncertainties still exist around hydrogen’s growth and relevant business models, including questions around supply, demand, transportation, and regulation. For this reason, players in the energy ecosystem, whether suppliers, customers, or investors, all need to take a fresh look at their strategies and investment plans. This article explores the opportunities for hydrogen in the energy sector and outlines the critical factors that companies across the ecosystem must consider to successfully integrate it into their strategies.

The role of hydrogen across the energy value chain

Hydrogen has the potential to impact the upstream, midstream, and downstream energy value chains.

Upstream

Adding Carbon Capture Utilization and Storage (CCUS) technology to fossil fuel-based hydrogen production or electrolysis using renewable electricity significantly reduce greenhouse gas (GHG) emissions. However, viability relies on the availability of affordable renewable electricity – for example, electrolysis-based hydrogen production typically requires the availability of at least 4,000-5,000 hours of electricity per year.

Midstream

Hydrogen can be transported via pipelines, trucks, or ships. However, existing pipelines and storage facilities are designed for natural gas and will require large-scale transformation to transport and store hydrogen. Hydrogen transportation through trucks or ships (as liquid hydrogen, ammonia[1], or a liquid organic hydrogen carrier [LOHC]) will also require new or repurposed infrastructure.

Large-scale storage of hydrogen has the potential to dramatically increase system resilience, as it can be used to store energy generated from renewable sources, which can then be used during peak demand periods. Midstream impacts will depend on the cost and availability of infrastructure and the regulatory framework for hydrogen transportation. Many gas transmission system operators (TSOs) are already analyzing the required changes, running pilots, designing projects, attracting investments, and starting preparatory construction works.

Downstream

Hydrogen can be used for transportation, industrial processes (such as steelmaking, refining, and chemical production), power generation, and residential heating, as illustrated in Figure 1. Another viable use is as a source for e-fuel[2] when coupled with CCUS technologies, an example being the Haru Oni pilot plant in Chile. Adoption and the impact on the downstream value chain will depend on hydrogen availability, as well as the cost and efficiency of hydrogen-based technologies such as vehicles and heating systems.

As detailed in Figure 2, a range of opportunities will emerge across the value chain, particularly around green energy supply and hydrogen production. Businesses should explore where these fit with their overall strategy, capabilities, and risk appetite, and move quickly to secure the right energy sources and form partnerships to access hydrogen volumes at good prices.

Risks to the development of the hydrogen economy

While the hydrogen value chain provides major opportunities for incumbents and new players, it also faces multiple risks and uncertainties, including:

-

Cost/competitiveness: The cost of producing, transporting, and storing hydrogen is currently higher than that for conventional fossil fuels, due to the immature technologies across the value chain and expensive long-haul transport. Although costs are expected to decrease significantly in the long term, companies investing now in hydrogen infrastructure and technology may not generate short-term profits. Even if costs fall, producing hydrogen may still be more expensive than alternatives such as renewable power from an upstream perspective. However, due to its ability as a stored energy carrier, and its usage in otherwise difficult-to-decarbonize sectors, many expect it to be ultimately competitive with alternatives.

-

Lack of infrastructure: Available infrastructure to support the production, transportation, and storage of hydrogen is limited, preventing scaling of supply and demand. For example, fuel cell vehicle uptake will go hand-in-hand with the ramp-up of hydrogen refueling stations. The underlying challenge is that infrastructure is expensive to operate and maintain safely. According to the European Hydrogen Backbone, pipeline OPEX could amount to USD 3.6 billion per year in Europe alone. To overcome this, alongside direct financial support, many economies (such as the United States, Canada, Australia, and Korea) are establishing regional hydrogen hubs. Establishing hydrogen production close to end users minimizes the cost of infrastructure construction and operation, jumpstarting adoption.

-

Market design/regulatory development: The regulatory framework for hydrogen is still evolving, and there is uncertainty around how governments will incentivize or regulate hydrogen technology. For example, the role TSOs can play in the upstream part of the value chain, or which requirements will be set regarding the carbon intensity of hydrogen to classify it as low emission, are still unclear. Potential new internationally agreed emissions accounting frameworks could also create short-term uncertainty. This presents an opportunity for countries/regions to differentiate themselves and accelerate development by rapidly creating favorable regulatory environments for investment.

-

Technology evolution/uncertainty: The technology for producing and storing hydrogen is still developing, and how to best optimize processes for maximum efficiency and cost-effectiveness is currently unclear. Scalability is lacking around many technologies, such as ammonia cracking (to reconvert ammonia to hydrogen) or liquefaction/re-gasification. These are therefore likely to see significant future improvements in efficiency.

-

Market demand: While interest in hydrogen as a fuel and energy storage medium is increasing, how quickly and widely it will be adopted is still unclear. However, awareness of hydrogen as an alternate energy solution is growing, as shown by the range of strategies and initiatives being put in place across leading economies.

-

Competition: A growing number of companies are entering the hydrogen market, including traditional energy players, grid companies, automotive manufacturers, industrial gas providers, and technology and chemical companies. This could lead to increased competition and potential market saturation.

-

Geopolitical risk: If the majority of hydrogen is supplied by Middle Eastern and African states (such as Qatar, Saudi Arabia, and Morocco), regions such as Europe will simply trade dependency on Russian gas for dependency on hydrogen from other countries, which could create risk.

These factors complicate the decision-making process around which investments to make and when and where to make them for all actors within the ecosystem, from suppliers to users.

The necessity and added value of innovation

Innovation along the hydrogen value chain will be essential to overcome technical and economic challenges, scale up hydrogen production and utilization, reduce costs, and drive the transition to a sustainable and low-carbon energy future.

As well as advances within generation, storage, and transport innovation, hydrogen’s versatility will enable multiple sectors to innovate, create synergies, and optimize energy systems. For instance, innovations in hydrogen utilization technologies, such as fuel cells and hydrogen-powered vehicles, will drive the adoption of hydrogen as an alternative energy source.

Embracing hydrogen will enable businesses to align with sustainability goals, attract customers, differentiate their offerings, foster collaborations, and drive business model innovation. By generating hydrogen without emitting carbon, companies will earn carbon credits, which can be sold or used to offset emissions across their wider operations, providing a further financial incentive for hydrogen investment. By adhering to certification requirements (not limited to carbon footprint, but also including purity and safety), businesses can build trust and credibility, opening up opportunities for new partnerships, market access, and premium pricing.

Successfully playing in the hydrogen economy

Given the fast-moving and dynamic nature of the hydrogen economy, organizations and investors will need to be extremely agile to build a competitive position, which will require them to transform internally.

Defining new business models

Organizations need to understand and plan their positioning in the hydrogen economy. For example, hydrogen players in Japan and Korea might need to invest in electrolyzer capacity and hydrogen production overseas in Australia or Malaysia, and create a supply chain back to their country. This international business model is likely to impact the capabilities and organizational structures they develop and the partnerships they form.

Developing a customer-centric mind-set

Greater competitiveness and uncertainty require previously dominant players in the gas industry, such as TSOs, to transform their mind-set and operations. They are unlikely to be the sole player in hydrogen markets, so they need to move away from monopolistic thinking and focus on becoming agile, fast-moving, and customer centric. They must start by understanding client requirements and using this to build stronger relationships.

Creating ecosystem partnerships

Exploiting new opportunities will require collaboration with partners all around the globe, for example, with companies using solar power to create hydrogen in regions such as the Middle East and Australia, as well as forming joint venture agreements with worldwide customers to guarantee large-scale, stable demand. Partnerships between the public and private sector will drive change. One example is the establishment of Thailand Hydrogen Group, initiated by oil and gas company PTT, which aims to engage public and private sector players to promote the development and adoption of hydrogen in Thailand.

Developing new organizational structures

To deal with the broad uncertainties around feasibility and investment choices, companies need to create new organizational structures that are faster-moving and more adaptable to changing conditions. This should include creating teams with skills in business development, engineering (especially technical expertise in the hydrogen space), and finance, as well as effective communication to create awareness, build stakeholder support, and lobby for the right regulatory frameworks and support mechanisms.

Building informed and diversified investment strategies

To reduce risks in a rapidly evolving and complex market, companies should diversify investments across hydrogen technologies and market segments, such as by allocating resources to both fuel cell technology and hydrogen production technology. Alternatively, they could consider projects outside (but related to) hydrogen, such as green ammonia and methanol, especially as hydrogen is part of a broader ecosystem. Investments should also be divided evenly between hydrogen and other less volatile energy sectors to spread financial risks, guided by the company’s risk appetite.

In this challenging landscape, making informed decisions is crucial. Scenario planning serves as a valuable tool to assess the resilience of potential strategies across different scenarios. It aids in identifying “no regret” decisions that can be implemented immediately, while also establishing monitoring mechanisms for triggers that may impact other investment choices. Sustainability scenario planning is described in more detail in Navigating the sustainability journey (Prism S1 2023).

Building a long-term perspective

In the evolving hydrogen ecosystem, roles within the value chain remain fluid, particularly due to evolving regulatory policies and incentives. Players need to take a long-term perspective, assessing the potential growth and scalability of hydrogen technologies and the market before making investment decisions. For example, producers and transporters need to evaluate the potential hydrogen volumes per sector in their respective areas and identify attractive business models while considering their specific circumstances.

By actively collaborating with industry stakeholders, such as technology providers, energy companies, hydrogen users (off-takers), and government agencies, producers, transporters, and investors can gain valuable insights into market developments. Building long-term partnerships and working together allows for cross-leveraging of capabilities, reduces inherent uncertainty, and mitigates operational and demand risks.

Assessing policy evolutions and regulatory frameworks on a global scale is essential to understand their potential impact on investment decisions. For example, subsidies and tax incentives can create favorable investment environments in specific areas of the value chain. Initiatives to focus on include the US Inflation Reduction Act, Hydrogen Headstart in Australia, the EU Hydrogen Strategy, the Fit-for-55 package, the Innovation Fund, and the European Green Deal.

Insights for the executive

Hydrogen has a key role to play in successfully delivering a low-carbon economy. However, its ecosystem is still developing, meaning opportunities are not yet clear for players such as producers, energy companies, transporters, distributors, retailers, end users, and investors. To understand how to play, organizations should focus on:

-

Building internal understanding: Investigate market opportunities, potential impacts on operations, and the optimal timing around entering the hydrogen market. Companies should evaluate hydrogen volumes, market prospects, and required business models, and understand customer needs. Implementing technology and market monitoring, along with scenario planning, ensures strategic preparedness.

-

Developing the right organization and capabilities: For existing energy players, success in the hydrogen economy will require organizational transformation. This could include developing a more commercial, customer-focused mind-set, with new teams hunting for and realizing opportunities in the hydrogen value chain.

-

Working closely with regulators: Across the globe, from the EU to the United States and Asia, national and regional governments are actively involved in setting the ground rules for the hydrogen economy. Be clear on the opportunities that are available (such as through subsidies) and the regulatory decisions that could constrain strategies or operations.

-

Capitalizing on value pockets: Go beyond the hype around the demand side to understand where opportunities exist (such as in e-fuels, direct combustion, or heavy transport) and focus and capture them.

-

Collaborating across the ecosystem: Building a successful hydrogen economy requires collaboration across upstream, midstream, and downstream operations. Complex global ecosystems are emerging, involving a range of new and incumbent players. Understand the opportunities and build partnerships to position your organization in key relevant areas, technologies, projects, and geographies.

-

Investing in innovation: Embracing innovation in technologies, processes, and business models will help to differentiate, go beyond basic regulatory compliance, and allow price premiums.

Notes

[1] Ammonia can be used as a hydrogen carrier to transport it more effectively and safely over long distances due to its more favorable characteristics, having higher energy density and being less flammable

[2] E-fuels are fuels produced from renewable sources such as solar or wind power.