Combining strength and agility

Unleashing breakthrough innovation in complex product and system manufacture

The need for companies to be able to deliver breakthrough and incremental innovation is well established by now. Much has been written about how to do this effectively, including ADL’s contributions.[1] However, one less-often- discussed aspect is how to tackle breakthrough innovation in the complex product and system manufacturing industry, such as aerospace & defense (A&D) or energy.

These sectors pose particular challenges: they are highly specialized and capital intensive, often rely on unique corporate assets to manufacture the product, and are subject to heavy regulation, with safety-critical products and systems required to meet strict assurance requirements. This means the commonly adopted solution of simply creating a separate breakthrough innovation team and allowing it to work outside normal corporate processes and constraints is much harder to implement. In this article we look at some key success factors to make the breakthrough innovation model work effectively in this type of business.

THE CHALLENGES TO OVERCOME

A breakthrough innovation project (BIP) delivers a step-change[2] in product/service performance, and/or creates new business models or new market space. We can summarize the main challenges that companies in the complex product and system manufacturing industry face in running successful BIPs into five main areas:

-

Methodologies: Complex engineered systems are developed using highly structured methods, such as the traditional V-cycle, to manage risks and assure quality. BIPs require application of agile methodologies that are fundamentally different in nature and do not lend themselves easily to these structured methods.

-

Uncertainties: Corporate processes and organization in sectors such as A&D are usually based around well-established and understood markets and business models, whereas BIPs involve higher degrees of uncertainty – for example, the market space may not already exist and user requirements may not yet be clear.

-

Resources: BIPs need different capabilities along each phase of the program. Using only external resources may fail to leverage unique corporate strengths and can be costly, while relying only on parttime internal corporate resources can be inefficient and ineffective.

-

Steering: BIPs need to have the right type of steering. They need enough flexibility to “stretch” and “fail fast”, but with enough corporate backing to avoid “kill fast” for the wrong reasons, such as short-term budget constraints or early setbacks.

-

Interfaces: There are tricky interfaces between the BIP, its customers, and the rest of the organization, for example, in terms of resourcing and use of existing corporate assets. These challenges are especially acute for complex product and system manufacture.

COMBINING AGILITY WITH STRENGTH – A FRAMEWORK

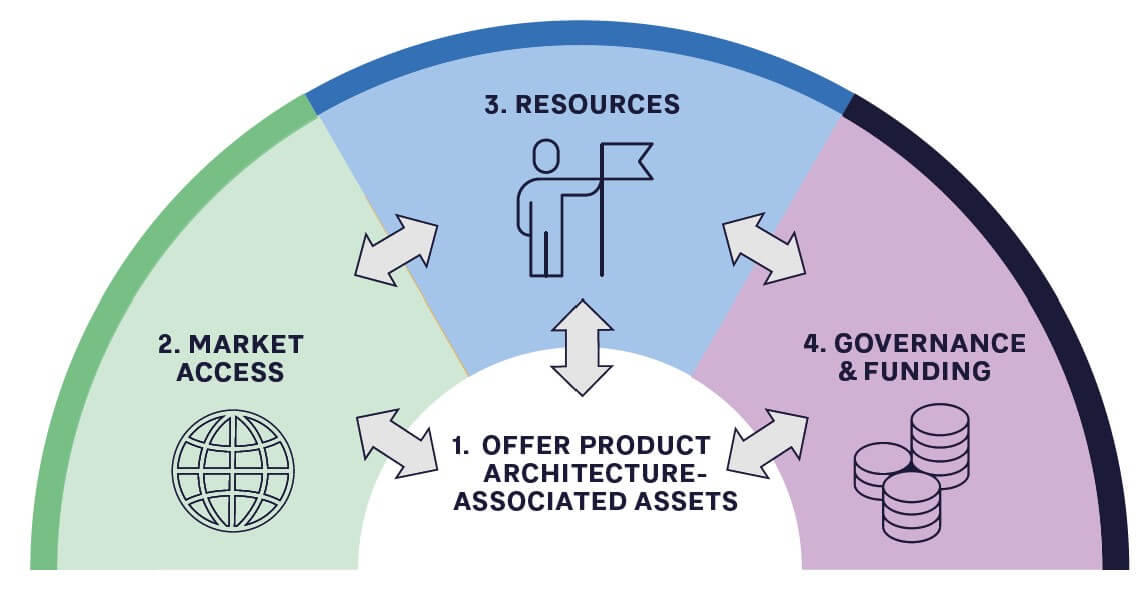

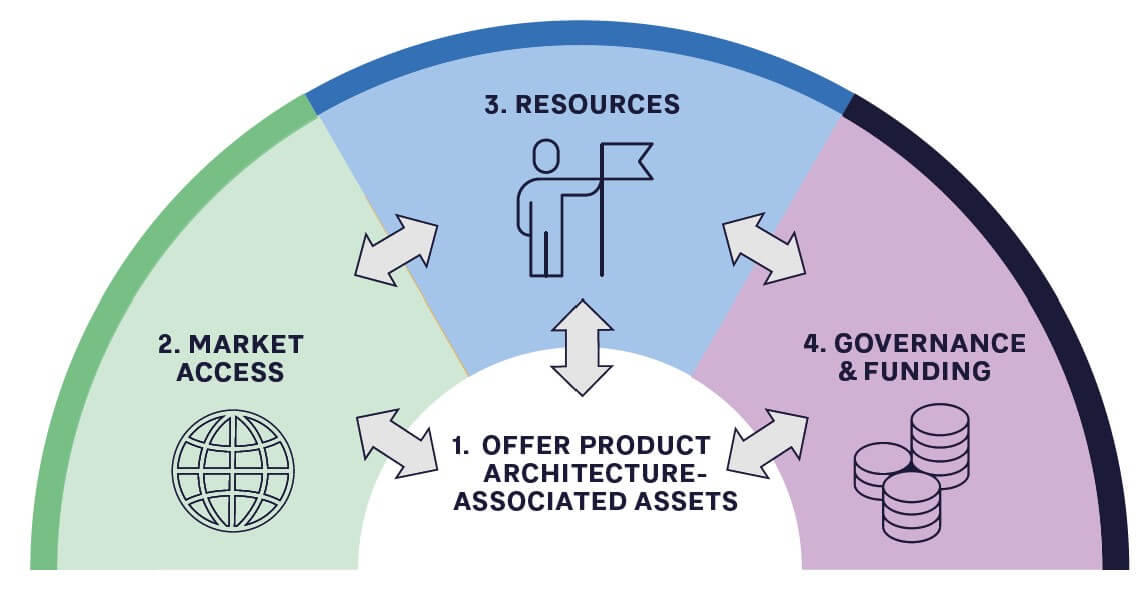

To address these challenges, BIPs in complex product and system manufacturing need to be set up with a strong focus on how the agility of the BIP teams can be best combined with the asset strengths of the corporation. In practice, this means giving attention to four key topics that are all concerned with how the interface between the BIP and the “legacy” company is organized and managed, as shown in Figure 1.

1. OFFER, PRODUCT ARCHITECTURE, AND ASSOCIATED ASSETS

The starting point for any BIP is to articulate clearly the target offer characteristics in a way that is outcome focused, stretching and not over-constraining in terms of product details – such as target performance, key functionalities, cost, and time to market. For example, one of our A&D clients determined through preliminary market research and customer interviews that its new BIP needed to achieve a big step-change in performance, reducing cost by 30 percent and time to market by 40 percent. Normal development approaches would have incurred costs that would be too high to be competitive; hence, the offer would need to be developed in a completely different way. This set the stage for how the project was ultimately taken forward.

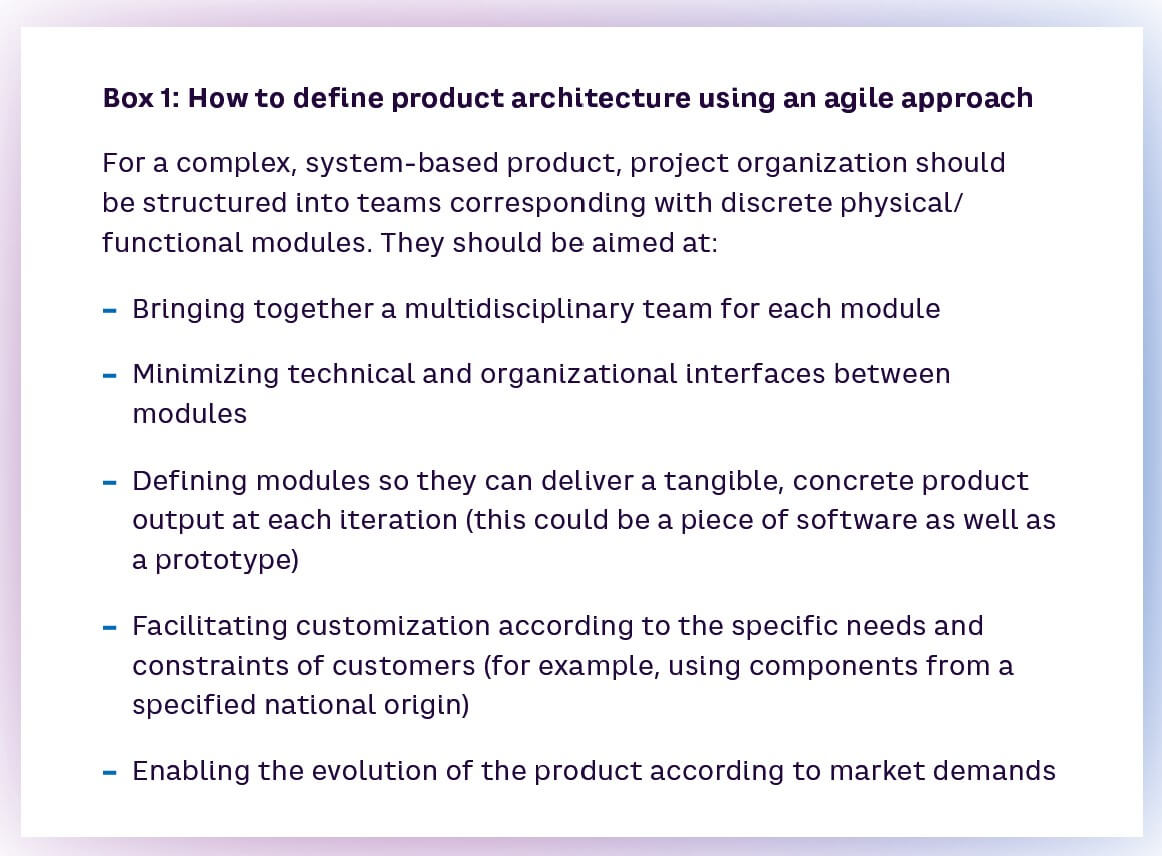

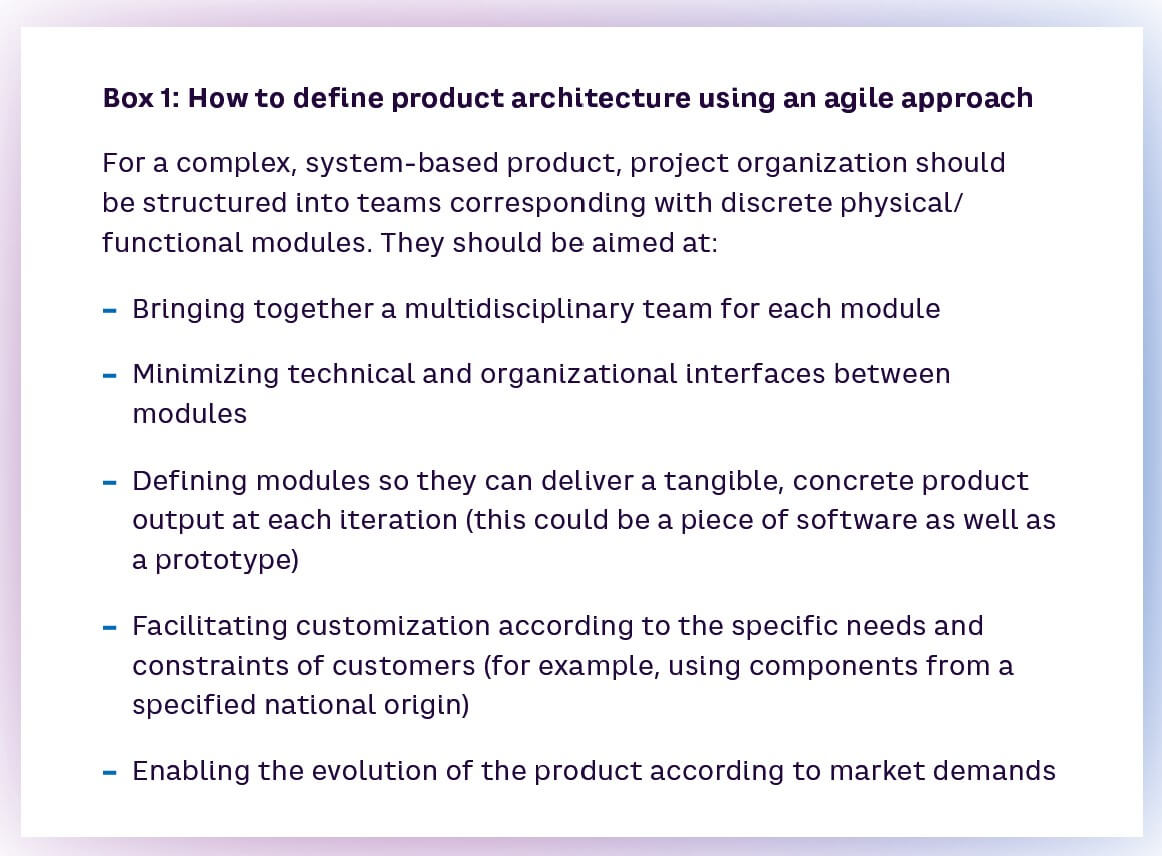

Product architecture is a central consideration at this stage. Reduction of interface complexity is a key criterion, especially when agile approaches need to be introduced. (See Box 1.)

Even for complex systems, the first level of the architecture should not be more than six modules. Adopting this approach promotes efficiency, alignment with customer needs, and competitiveness. The structure may also be reusable on other projects.

Once the various technological building blocks of the BIP product are becoming established, early attention also needs to be given to how they will be acquired, designed, and/or manufactured, and their likely ranges of capital and operating costs. This helps to prevent the BIP from failing at the scale-up stage due to unexpected cost constraints.

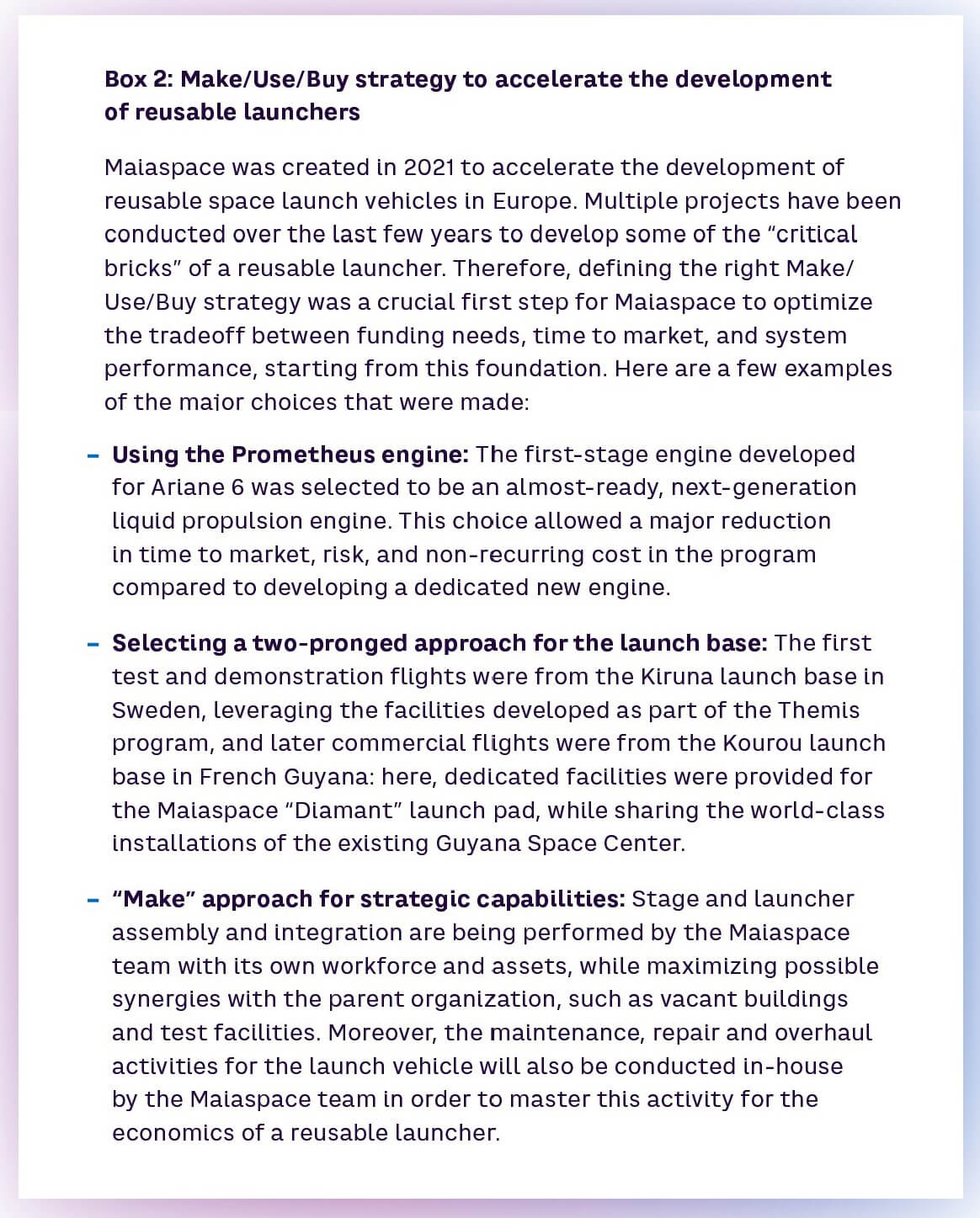

In general terms, normal “Make or Buy” principles apply: elements that are unique and strategically important (for example, in terms of sovereignty, cost impact, performance, and time-to-market influence), and for which BIP capabilities are competitive in the marketplace, lend themselves to “Make”. For other elements, especially if there are potential economies of scale, “Build to Print”[3] and “Build to Spec” can be considered – bearing in mind the need to build a future value chain of suppliers. In addition to the two alternatives “Make” or “Buy”, another option is “Use”, in which the BIP uses internal assets of the legacy corporation without managing it directly or with full autonomy. In this case, managing the planning of the unique asset is a key process to keep the flexibility the BIP needs, especially during the development and the industrialization of the target offer.

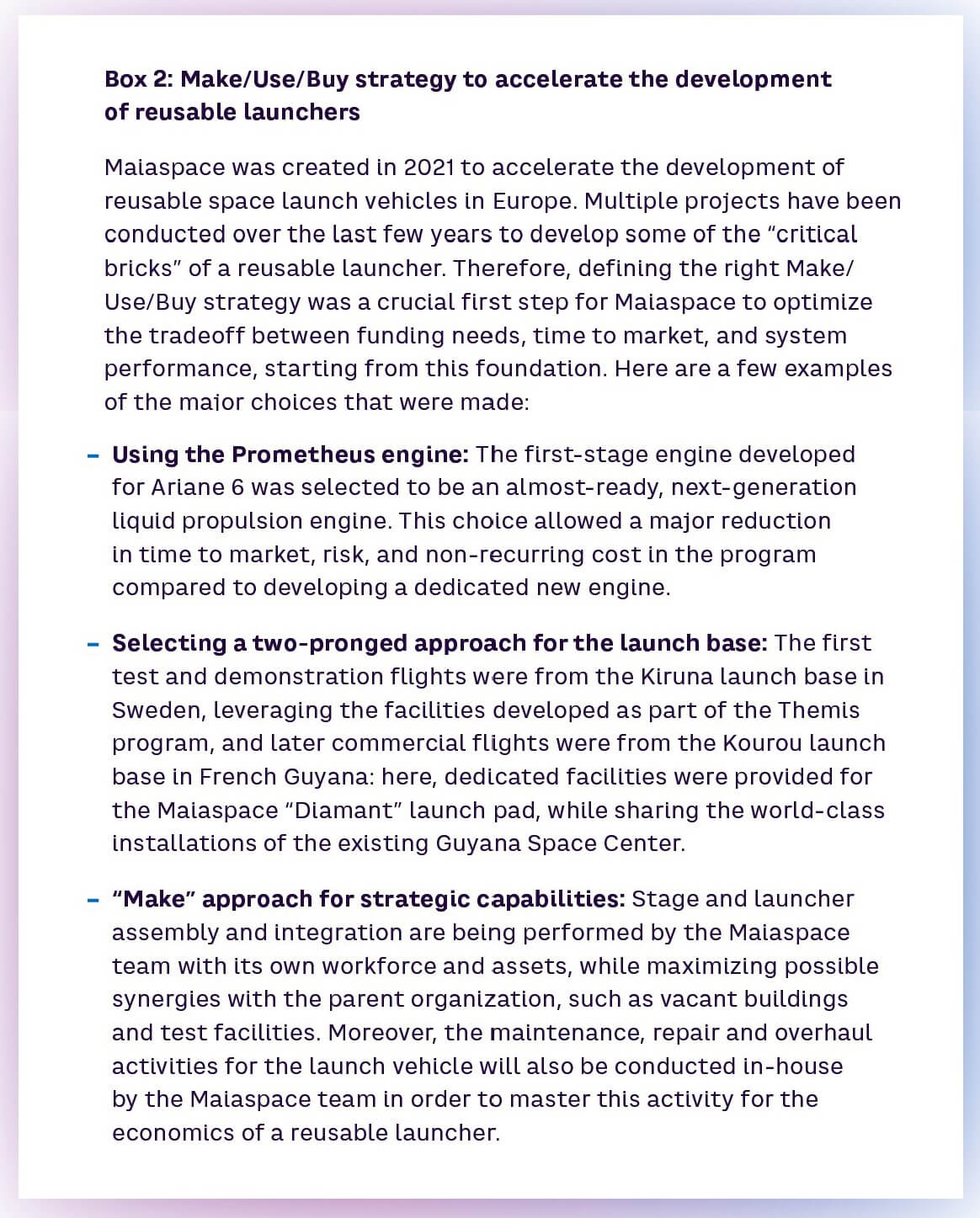

An example of such a strategy is shown in Box 2.

2. MARKET ACCESS

Developing a strategy for how the BIP’s products will ultimately go to market is a fundamental consideration that must be dealt with at an early stage.

One option is for the new BIP business to use the existing legacy brand and go-to-market channels. While taking this approach has the obvious benefit of leveraging the position and scale of the existing business, it can risk brand damage if the product fails.

Other companies, such as the tech giants, tend to use their brand for BIPs anyway because they see it as strong enough to withstand some failures without damage (for example, Google with Google Glass). Meta is another interesting example, in which the founder is betting the company’s entire brand on a huge BIP in the form of the Metaverse – with considerable short-term downsides so far, although breakthrough innovations are often long games requiring steady nerves and deep pockets.

For many companies with less market clout than Meta, Google or Microsoft, it can be prudent to create a separate, dedicated brand and market channel for the BIP, at least initially, until the BIP has established a viable product/market fit at scale.

This allows modification of the new channel(s) rapidly according to the initial market feedback, and also mitigates the risk of unproductive conflicts with the existing brand organization.

3. RESOURCES

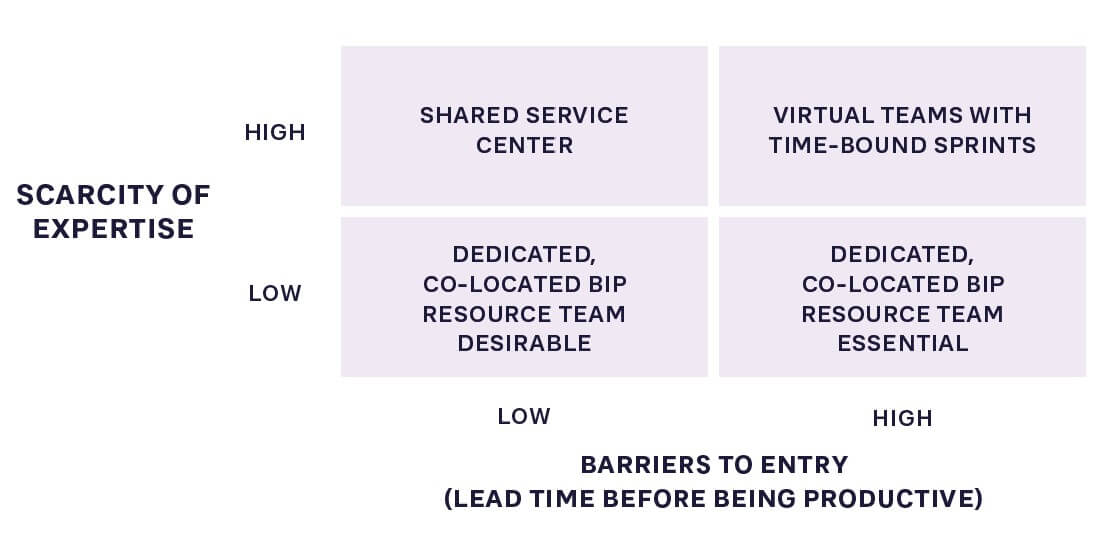

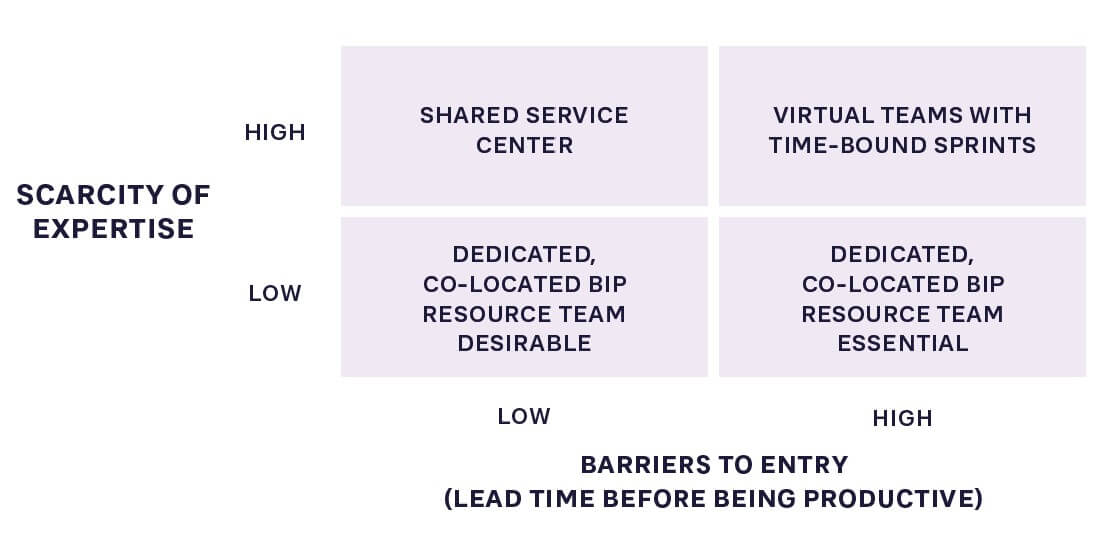

One of the main challenges of running BIPs in a complex product and systems manufacturing company is how to provide them with the best human resources, given constraints around providing the necessary specialist expertise, ensuring sufficient dedicated resources, and avoiding costly duplication of staff. (See Figure 2.)

Best practice is generally to allocate at least some staff full time to the BIP core team, as long as sufficient suitable expertise is available. (See the bottom row of the matrix in Figure 2.) This is the best way to maximize productivity and reduce time to market. It also best reflects how independent start-ups work.

However, if resources are scarce and barriers to entry are low, shared service models may be the best option for tasks such as development of engineering tools for the team. If barriers to entry are also high (top-right quadrant), which is a common challenge for complex product and system manufacture, the best solution is to develop virtual teams of part-time key resources. The main success factor here is to deploy key expert resources fully for predefined “time box periods,” rather than having them continuously work part time. (See also Box 3.) Agile methodologies, with their sprints, lend themselves well to this type of approach.

System architects are a good example of these resources, as they have key specialist expertise and are few in number, so cannot be allocated full time to the BIP. It helps to define the needs for their input at each sprint and aim to involve the same individuals for as many of the tasks as possible.

4. GOVERNANCE AND FUNDING

The governance model adopted for the BIP is critical, as it affects decision-making processes and strategy across the interface between the BIP and legacy organization. Unless there are compelling reasons to do otherwise, such as tight synergies with core business and/or regulatory constraints, best practice here is to set up a dedicated organizational structure with empowered leadership. This helps to create a sense of ownership and drive motivation, as well as protect it from de-prioritization due to its low maturity and bottom-line impact. It also helps to free up the BIP from corporate shackles such as procurement bureaucracy and hiring constraints, and facilitates agility and new ways of working.

What happens to the organizational unit when the BIP moves into the commercialization phase is an important aspect to consider when setting up the right legal structure:

-

If new shareholders are envisaged at some future point, creating a separate legal entity is often appropriate. This could be the case if the BIP opens up an adjacent, but not strategic, market, in which case it could be sold off once it has generated sufficient value. Examples of this include SecLab, a cybersecurity spin-off from EDF R&D, and H2Gen, a hydrogen-focused spin-off from Areva, which sold it to GTT (part of Engie) in 2020. Another example would be external private equity or venture capital funding envisaged to be needed until profitability; in this case normal measures need to be taken to protect the legacy company (such as intellectual property rights protection, seats on the board, and restricting sale of the BIP to competitors).

-

If the legacy company can fund BIP development until profitability, an internal entity is preferable. If the BIP creates a strategic business and can be fully funded until profitability, it is usually preferable to retain the entity within the existing legacy legal structure. (See also Box 3.) The upside of this is the ability to maximize strategic alignment and synergy with the rest of the business. However, the governance approach needs to ensure that its independence is properly safeguarded, including providing dedicated resourcing and freedom from normal corporate constraints. For this model to work in practice, the BIP needs to report to the highest level of sponsorship, preferably the CEO, who is in a position to resolve conflicts and ensure continued independence.

BRINGING IT ALL TOGETHER – THE ITERATION ZERO APPROACH

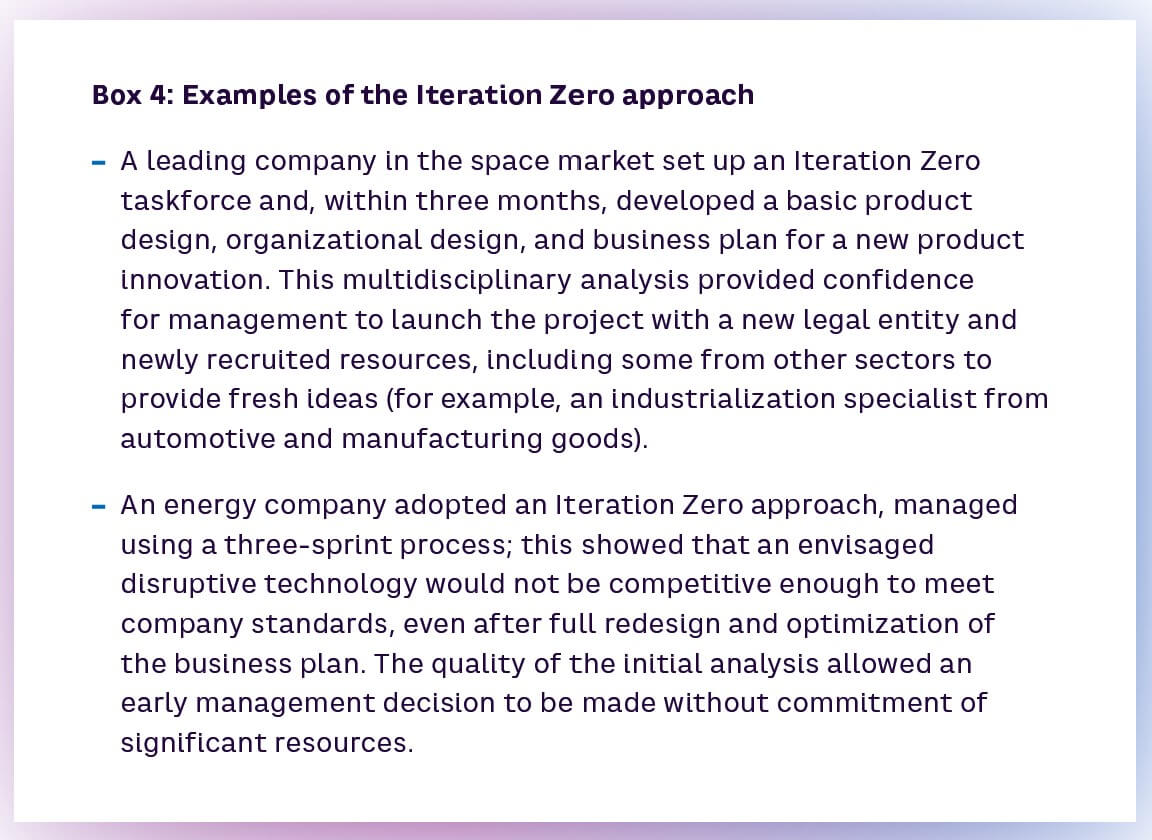

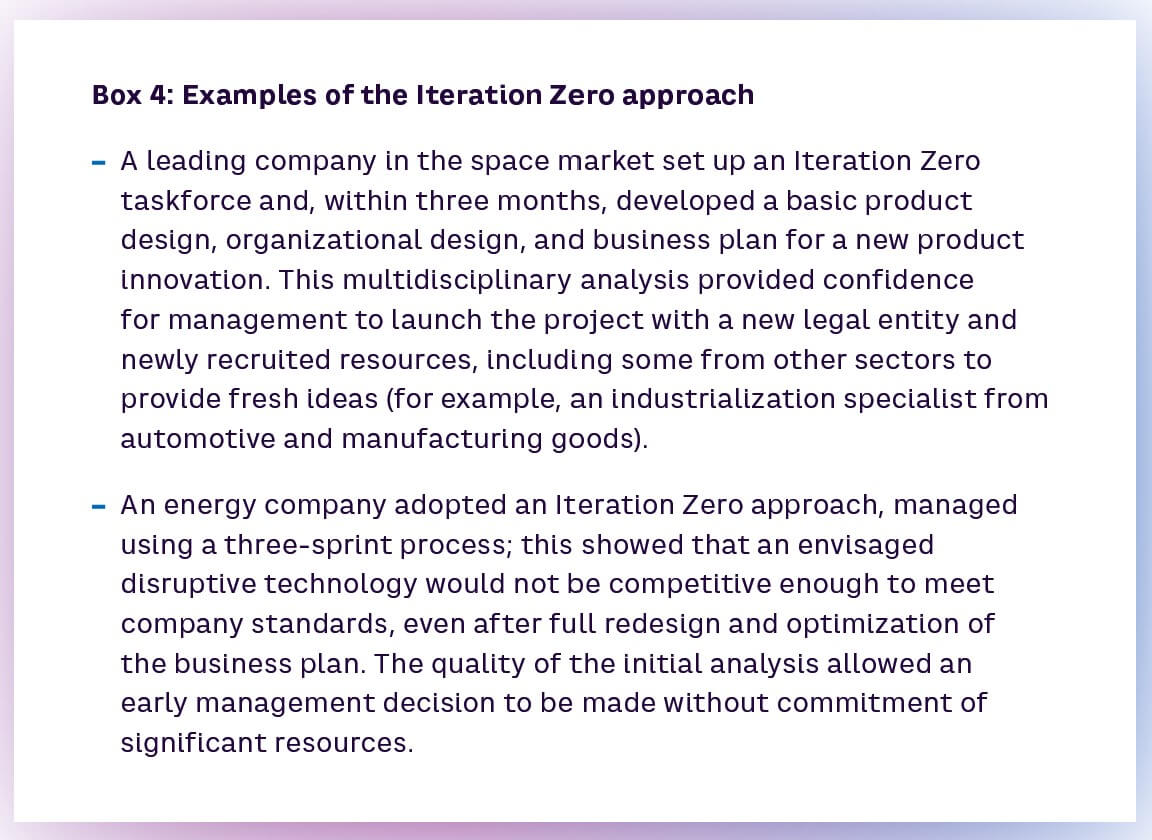

Adequate consideration of the four topics in the above BIP framework will go a long way toward ensuring the BIP’s success. However, one other key aspect is important for success, relating to how the BIP is initiated. We refer to this as the “Iteration Zero” approach. This approach involves, at the outset, setting up a multidisciplinary taskforce to identify and mitigate the main uncertainties – which, for a BIP, are much larger than for a normal project. The taskforce is set up to be the first iteration of the new company to be created, not just a concept phase study group.

The Iteration Zero taskforce starts by clarifying aims, ambitions, and scoping, including targets for features, cost and time to market. It then takes initial steps to flesh out the four-pillar framework as outlined above. It articulates the gap between the current status and capabilities and the desired target, and also identifies the main uncertainties and how they will be progressively reduced. Based on the results of this work, the leadership can then gain a much more realistic picture of the business goals of the BIP, the necessary resources, and the funding, especially for the resource-intensive delivery phase and the best organization and governance to ensure success. (See also Box 4.)

INSIGHTS FOR THE EXECUTIVE – COMBINING STRENGTH AND AGILIT Y

Breakthrough innovation is inherently more challenging for the complex product and system industry than it is for other industries. To succeed, players need to focus on the interface between the BIP and the parent organization, carefully combining the agility of the BIP with the strength of the corporation. This means focusing on practices such as:

-

Setting up a multidisciplinary Iteration Zero taskforce to identify and mitigate the main uncertainties at the outset and define the actions to mitigate them

-

Achieving early precision on the target offer requirements

-

Designing the product architecture to minimize interface complexity and enable agile working on individual modules

-

Adopting a careful Make/Use/Buy strategy that balances the need to leverage corporate assets with flexibility to engage the external innovation ecosystem

-

Considering brand and market access at an early stage to minimize the likelihood of failure at the scale-up phase

-

Using resourcing tactics that provide a dedicated core team while leveraging corporate specialist expertise in a concentrated way to enable agile approaches

-

Setting up the right governance and funding model to suit the nature of the new business, with the highest-possible level of sponsorship within the parent organization

Despite the challenges, some players in the A&D sectors have been very successful using these practices, for example, Airbus DS with its OneWeb satellites joint venture, and General Dynamics Electric Boat with its state-of-the-art Virginia-class submarine, which is the US Navy’s latest submarine. Ultimately, there is no reason any big corporate, even in a highly regulated sector, cannot combine strength with agility to deliver world-beating breakthroughs.

Notes

- For example, “The Breakthrough Incubator – How to create and rapidly launch new step-out businesses,” Prism S2 2018, and “Organizing for breakthrough Innovation,” Prism S1 2015

- A common rule-of-thumb is that breakthrough means at least 30 percent improvement in product performance and/or cost

- “Build to Print” means manufacture by a supplier according to a fully detailed customer design. “Build to Spec” means manufacture according to a customer specification, allowing for supplier design inputs

Combining strength and agility

Unleashing breakthrough innovation in complex product and system manufacture

DATE

The need for companies to be able to deliver breakthrough and incremental innovation is well established by now. Much has been written about how to do this effectively, including ADL’s contributions.[1] However, one less-often- discussed aspect is how to tackle breakthrough innovation in the complex product and system manufacturing industry, such as aerospace & defense (A&D) or energy.

These sectors pose particular challenges: they are highly specialized and capital intensive, often rely on unique corporate assets to manufacture the product, and are subject to heavy regulation, with safety-critical products and systems required to meet strict assurance requirements. This means the commonly adopted solution of simply creating a separate breakthrough innovation team and allowing it to work outside normal corporate processes and constraints is much harder to implement. In this article we look at some key success factors to make the breakthrough innovation model work effectively in this type of business.

THE CHALLENGES TO OVERCOME

A breakthrough innovation project (BIP) delivers a step-change[2] in product/service performance, and/or creates new business models or new market space. We can summarize the main challenges that companies in the complex product and system manufacturing industry face in running successful BIPs into five main areas:

-

Methodologies: Complex engineered systems are developed using highly structured methods, such as the traditional V-cycle, to manage risks and assure quality. BIPs require application of agile methodologies that are fundamentally different in nature and do not lend themselves easily to these structured methods.

-

Uncertainties: Corporate processes and organization in sectors such as A&D are usually based around well-established and understood markets and business models, whereas BIPs involve higher degrees of uncertainty – for example, the market space may not already exist and user requirements may not yet be clear.

-

Resources: BIPs need different capabilities along each phase of the program. Using only external resources may fail to leverage unique corporate strengths and can be costly, while relying only on parttime internal corporate resources can be inefficient and ineffective.

-

Steering: BIPs need to have the right type of steering. They need enough flexibility to “stretch” and “fail fast”, but with enough corporate backing to avoid “kill fast” for the wrong reasons, such as short-term budget constraints or early setbacks.

-

Interfaces: There are tricky interfaces between the BIP, its customers, and the rest of the organization, for example, in terms of resourcing and use of existing corporate assets. These challenges are especially acute for complex product and system manufacture.

COMBINING AGILITY WITH STRENGTH – A FRAMEWORK

To address these challenges, BIPs in complex product and system manufacturing need to be set up with a strong focus on how the agility of the BIP teams can be best combined with the asset strengths of the corporation. In practice, this means giving attention to four key topics that are all concerned with how the interface between the BIP and the “legacy” company is organized and managed, as shown in Figure 1.

1. OFFER, PRODUCT ARCHITECTURE, AND ASSOCIATED ASSETS

The starting point for any BIP is to articulate clearly the target offer characteristics in a way that is outcome focused, stretching and not over-constraining in terms of product details – such as target performance, key functionalities, cost, and time to market. For example, one of our A&D clients determined through preliminary market research and customer interviews that its new BIP needed to achieve a big step-change in performance, reducing cost by 30 percent and time to market by 40 percent. Normal development approaches would have incurred costs that would be too high to be competitive; hence, the offer would need to be developed in a completely different way. This set the stage for how the project was ultimately taken forward.

Product architecture is a central consideration at this stage. Reduction of interface complexity is a key criterion, especially when agile approaches need to be introduced. (See Box 1.)

Even for complex systems, the first level of the architecture should not be more than six modules. Adopting this approach promotes efficiency, alignment with customer needs, and competitiveness. The structure may also be reusable on other projects.

Once the various technological building blocks of the BIP product are becoming established, early attention also needs to be given to how they will be acquired, designed, and/or manufactured, and their likely ranges of capital and operating costs. This helps to prevent the BIP from failing at the scale-up stage due to unexpected cost constraints.

In general terms, normal “Make or Buy” principles apply: elements that are unique and strategically important (for example, in terms of sovereignty, cost impact, performance, and time-to-market influence), and for which BIP capabilities are competitive in the marketplace, lend themselves to “Make”. For other elements, especially if there are potential economies of scale, “Build to Print”[3] and “Build to Spec” can be considered – bearing in mind the need to build a future value chain of suppliers. In addition to the two alternatives “Make” or “Buy”, another option is “Use”, in which the BIP uses internal assets of the legacy corporation without managing it directly or with full autonomy. In this case, managing the planning of the unique asset is a key process to keep the flexibility the BIP needs, especially during the development and the industrialization of the target offer.

An example of such a strategy is shown in Box 2.

2. MARKET ACCESS

Developing a strategy for how the BIP’s products will ultimately go to market is a fundamental consideration that must be dealt with at an early stage.

One option is for the new BIP business to use the existing legacy brand and go-to-market channels. While taking this approach has the obvious benefit of leveraging the position and scale of the existing business, it can risk brand damage if the product fails.

Other companies, such as the tech giants, tend to use their brand for BIPs anyway because they see it as strong enough to withstand some failures without damage (for example, Google with Google Glass). Meta is another interesting example, in which the founder is betting the company’s entire brand on a huge BIP in the form of the Metaverse – with considerable short-term downsides so far, although breakthrough innovations are often long games requiring steady nerves and deep pockets.

For many companies with less market clout than Meta, Google or Microsoft, it can be prudent to create a separate, dedicated brand and market channel for the BIP, at least initially, until the BIP has established a viable product/market fit at scale.

This allows modification of the new channel(s) rapidly according to the initial market feedback, and also mitigates the risk of unproductive conflicts with the existing brand organization.

3. RESOURCES

One of the main challenges of running BIPs in a complex product and systems manufacturing company is how to provide them with the best human resources, given constraints around providing the necessary specialist expertise, ensuring sufficient dedicated resources, and avoiding costly duplication of staff. (See Figure 2.)

Best practice is generally to allocate at least some staff full time to the BIP core team, as long as sufficient suitable expertise is available. (See the bottom row of the matrix in Figure 2.) This is the best way to maximize productivity and reduce time to market. It also best reflects how independent start-ups work.

However, if resources are scarce and barriers to entry are low, shared service models may be the best option for tasks such as development of engineering tools for the team. If barriers to entry are also high (top-right quadrant), which is a common challenge for complex product and system manufacture, the best solution is to develop virtual teams of part-time key resources. The main success factor here is to deploy key expert resources fully for predefined “time box periods,” rather than having them continuously work part time. (See also Box 3.) Agile methodologies, with their sprints, lend themselves well to this type of approach.

System architects are a good example of these resources, as they have key specialist expertise and are few in number, so cannot be allocated full time to the BIP. It helps to define the needs for their input at each sprint and aim to involve the same individuals for as many of the tasks as possible.

4. GOVERNANCE AND FUNDING

The governance model adopted for the BIP is critical, as it affects decision-making processes and strategy across the interface between the BIP and legacy organization. Unless there are compelling reasons to do otherwise, such as tight synergies with core business and/or regulatory constraints, best practice here is to set up a dedicated organizational structure with empowered leadership. This helps to create a sense of ownership and drive motivation, as well as protect it from de-prioritization due to its low maturity and bottom-line impact. It also helps to free up the BIP from corporate shackles such as procurement bureaucracy and hiring constraints, and facilitates agility and new ways of working.

What happens to the organizational unit when the BIP moves into the commercialization phase is an important aspect to consider when setting up the right legal structure:

-

If new shareholders are envisaged at some future point, creating a separate legal entity is often appropriate. This could be the case if the BIP opens up an adjacent, but not strategic, market, in which case it could be sold off once it has generated sufficient value. Examples of this include SecLab, a cybersecurity spin-off from EDF R&D, and H2Gen, a hydrogen-focused spin-off from Areva, which sold it to GTT (part of Engie) in 2020. Another example would be external private equity or venture capital funding envisaged to be needed until profitability; in this case normal measures need to be taken to protect the legacy company (such as intellectual property rights protection, seats on the board, and restricting sale of the BIP to competitors).

-

If the legacy company can fund BIP development until profitability, an internal entity is preferable. If the BIP creates a strategic business and can be fully funded until profitability, it is usually preferable to retain the entity within the existing legacy legal structure. (See also Box 3.) The upside of this is the ability to maximize strategic alignment and synergy with the rest of the business. However, the governance approach needs to ensure that its independence is properly safeguarded, including providing dedicated resourcing and freedom from normal corporate constraints. For this model to work in practice, the BIP needs to report to the highest level of sponsorship, preferably the CEO, who is in a position to resolve conflicts and ensure continued independence.

BRINGING IT ALL TOGETHER – THE ITERATION ZERO APPROACH

Adequate consideration of the four topics in the above BIP framework will go a long way toward ensuring the BIP’s success. However, one other key aspect is important for success, relating to how the BIP is initiated. We refer to this as the “Iteration Zero” approach. This approach involves, at the outset, setting up a multidisciplinary taskforce to identify and mitigate the main uncertainties – which, for a BIP, are much larger than for a normal project. The taskforce is set up to be the first iteration of the new company to be created, not just a concept phase study group.

The Iteration Zero taskforce starts by clarifying aims, ambitions, and scoping, including targets for features, cost and time to market. It then takes initial steps to flesh out the four-pillar framework as outlined above. It articulates the gap between the current status and capabilities and the desired target, and also identifies the main uncertainties and how they will be progressively reduced. Based on the results of this work, the leadership can then gain a much more realistic picture of the business goals of the BIP, the necessary resources, and the funding, especially for the resource-intensive delivery phase and the best organization and governance to ensure success. (See also Box 4.)

INSIGHTS FOR THE EXECUTIVE – COMBINING STRENGTH AND AGILIT Y

Breakthrough innovation is inherently more challenging for the complex product and system industry than it is for other industries. To succeed, players need to focus on the interface between the BIP and the parent organization, carefully combining the agility of the BIP with the strength of the corporation. This means focusing on practices such as:

-

Setting up a multidisciplinary Iteration Zero taskforce to identify and mitigate the main uncertainties at the outset and define the actions to mitigate them

-

Achieving early precision on the target offer requirements

-

Designing the product architecture to minimize interface complexity and enable agile working on individual modules

-

Adopting a careful Make/Use/Buy strategy that balances the need to leverage corporate assets with flexibility to engage the external innovation ecosystem

-

Considering brand and market access at an early stage to minimize the likelihood of failure at the scale-up phase

-

Using resourcing tactics that provide a dedicated core team while leveraging corporate specialist expertise in a concentrated way to enable agile approaches

-

Setting up the right governance and funding model to suit the nature of the new business, with the highest-possible level of sponsorship within the parent organization

Despite the challenges, some players in the A&D sectors have been very successful using these practices, for example, Airbus DS with its OneWeb satellites joint venture, and General Dynamics Electric Boat with its state-of-the-art Virginia-class submarine, which is the US Navy’s latest submarine. Ultimately, there is no reason any big corporate, even in a highly regulated sector, cannot combine strength with agility to deliver world-beating breakthroughs.

Notes

- For example, “The Breakthrough Incubator – How to create and rapidly launch new step-out businesses,” Prism S2 2018, and “Organizing for breakthrough Innovation,” Prism S1 2015

- A common rule-of-thumb is that breakthrough means at least 30 percent improvement in product performance and/or cost

- “Build to Print” means manufacture by a supplier according to a fully detailed customer design. “Build to Spec” means manufacture according to a customer specification, allowing for supplier design inputs