Every day more countries alarm the world with new COVID-19 cases. As a result, many countries are closing their borders and imposing social-distancing measures on their people. Naturally, global and local companies are affected as their workforces and supply chains are cut off. The first weeks of the COVID-19 outbreak showed organizations’ ability to pull out well-prepared contingency plans to respond and adapt to the new reality quickly. However, standard concepts such as “supply-chain continuity management” and “supply-chain resilience” often lack strategic guidance. They hardly address the question of how to steer dynamic supply chains mid-way through the crisis, or even use the current situation as a catalyst for sustainable supply-chain improvement and innovation. Arthur D. Little introduces a holistic framework that helps decision-makers look out for their supply chain organizations beyond the short term and reactive crisis management. We propose specific actions to create supply-chain value based on anticipated macroeconomic developments.

Introduction

The news of more COVID-19 cases seems to show no end. Increasing numbers of infections and imposed countermeasures have led to ever higher levels of supply-chain complexity worldwide. The economic impact is worsening, and governments around the globe are imposing new regulations on supply chains around work safety and cross-border trade. Four symptoms of affected supply chains have become noticeable as COVID-19 has progressed: shortages of labor (e.g., in Chinese production plants), supply (production shutdown and distribution slowdown), suppliers (bankruptcy), and customers (shrinking purchasing power due to fear and lay-offs).

However, these disruptions are not fundamentally new, and most supply-chain managers came across some of these symptoms prior to the current crisis. Organizations have wisely and pro-actively built up supply-chain resilience mechanisms, such as risk and crisis management.

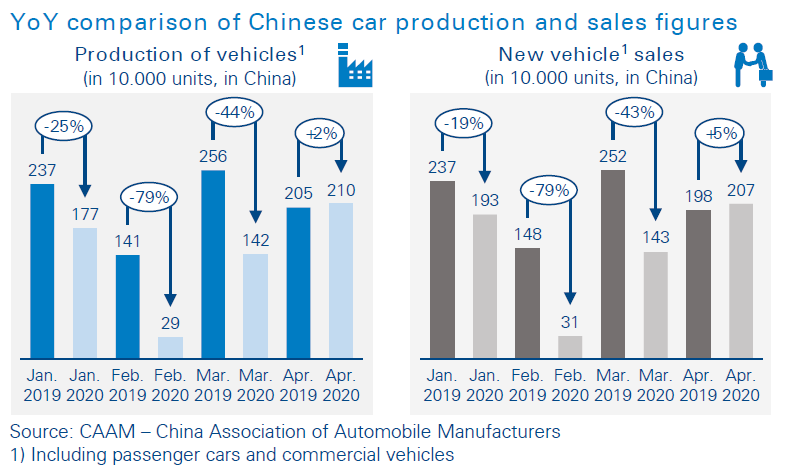

Supply-chain managers are facing an unprecedented crisis with all of these symptoms appearing at once. This will not be a normal short-term disruption. In China, for example, where the crisis hit supply chains approximately six weeks earlier than in Europe, first developments are showing decreases of up to 80 percent in production and demand. This scenario is most likely to be mirrored in the European and US economies. Such impact cannot be compensated in the short run. Long-term strategic plans need to be included in crisis management to overcome this disruption and ensure fast recovery and future growth.

The impact is enormous, and the longevity of the crisis is unknown. But despite the remaining uncertainty over whether the crisis will meet an abrupt end soon, organizations do not need to panic. Now, it is of utmost importance to act fast and plan ahead. Managers need to think in potential future scenarios. Business leaders need to locate their companies within their supply chains and those scenarios; this will be key to deriving effective measures.

Macroeconomic scenarios

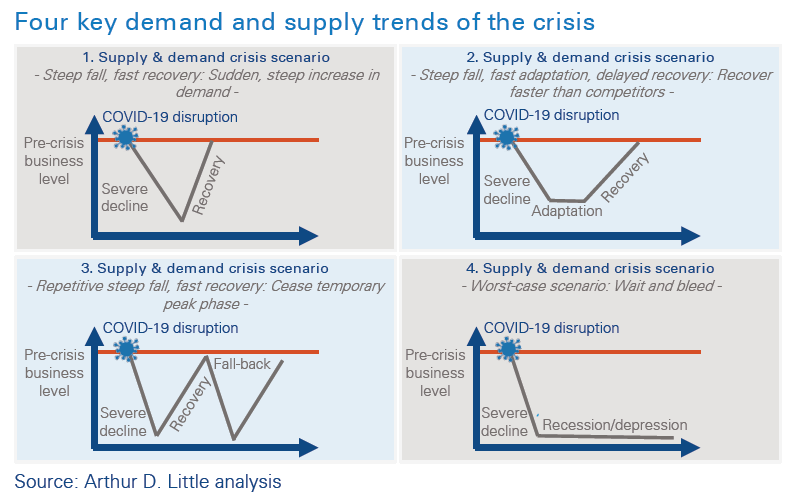

Starting with the first signs of recession, economists around the world have narrowed the cycle of the COVID-19 crisis down to four main macroeconomic scenarios. Scenario building improves the crisis strategy development process by making organizations more aware of risks and constraints, and thus helping them prepare for these situations.

In the current crisis, all scenarios begin with the current situation of a steep economic fall. Due to health and safety measures such as social distancing, many companies experience steep drops in supply and demand. They either fail to procure, produce, or supply goods and services, or simply find that their customers start to consume less, as the figure below illustrates.

The main questions for supply chain managers involve how this falling curve will develop in the short-, medium-, and long run; what each scenario means to the individual supply chain; where an organization should be positioned and how it can effectively handle each stage of each scenario.

- Scenario 1: Steep fall – fast recovery.

- Scenario 2: Steep fall – short stabilization – slow recovery.

- Scenario 3: Steep fall – fast recovery – fallback.

- Scenario 4: Steep fall – long-term recession/depression.

Within scenario 1, the collapse or removal of supplier and customer segments due to non-fulfillment during the crisis may lead to short-sighted reactions. These will not be able to cope with the sharp incline in demand after a sudden end to the crisis, and therefore delay a recovery significantly. Hence, strategic thinking must be the imperative.

Scenario 2 describes a short-term stabilization phase before demand and supply steadily increase back to normal. The phase might result from governmental subsidies stabilizing supply, production, and customer demand. However, a slow recovery is anticipated due to severe damages to supply, production, and purchase powers because of, for example, job losses or bankruptcies. The biggest risk for companies is to miss the optimum point of recovery due to lack of early adaptation and anticipation. The supply chain will become more competitive if a company manages to enter the recovery phase ahead of the market trend curve growing again.

Scenario 3 describes a relapse after the first crisis cycle and a (short) period of recovery. A possible comeback of the COVID-19 crisis leads to another steep fall in demand and supply after the recovery. As the first decline will lead to a severe reduction in free cash, supply chains need to generate more value during the first recovery phase in order to build up cash reserves for the upcoming decline.

Scenario 4 represents the worst case. If supply chains just wait for the recovery, they will bleed and be left defenseless for the collapse. Because the crisis will run into a long-term recession/ depression, more and more parts of the supply chain will fail. It is up to the whole supply chain to initiate preventative measures in order to fight the trend of the macroeconomic fall.

As a result of supply and demand failure in all scenarios, we anticipate several long-term effects that supply chain actors must consider while fighting off today’s challenges. Four key trends will need to be given strategic consideration regardless of the scenario:

- Strict audits of cross-border supply and distribution processes due to cross-border restriction and control.

- Narrowed markets with focus on national and regional markets, bundled critical infrastructure and capabilities.

- A shift from single sourcing to multi-sourcing strategies.

- Consolidation of supply chains: an increase in supplier integration and M&A activities.

What has been the impact on your supply chain this far?

The Augmented Decision Support tool is able to assess the spread of the virus based on publicly available live data.

With the indication of increasing risks per region, the tool will tell you which market is at risk. Drastic changes in supply and demand will identify strategic measures for procurement and supply chains. Create your own dashboard with individual priorities and customized graphs.

The applied 5F Supply Chain War Room

The key questions for crisis management should not only consider the time of the crisis and how to adapt to, or recover from, this situation. The anticipation of a crisis’s end, combined with a fast action strategy, is the key competitive advantage for a company to come out even stronger than before.

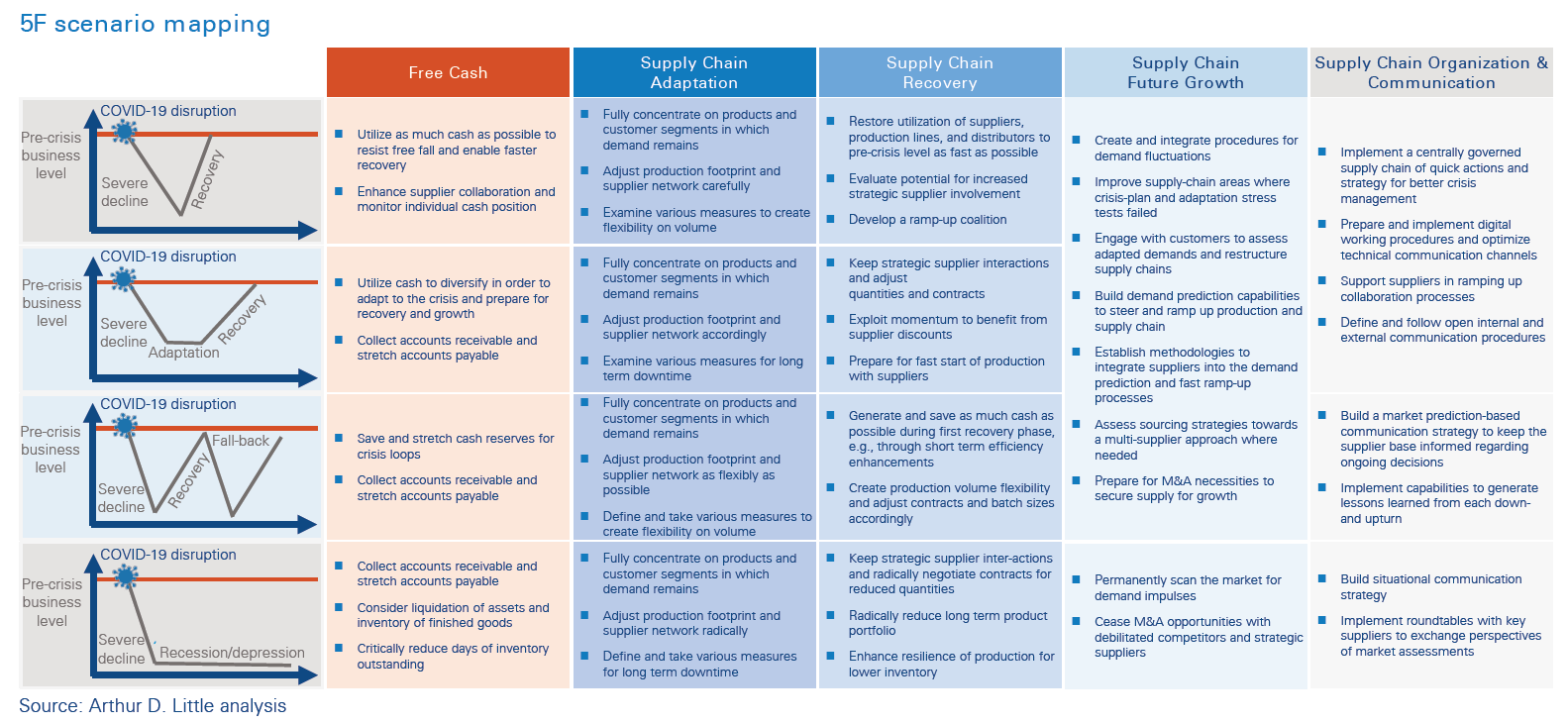

In addition to operational reactiveness, Arthur D. Little’s 5F Supply Chain War Room model focuses on strategic (re)actions. If organizations follow course in five dimensions, supply chains will be able to cope with urgent impact and grow strategically.

- Free Cash is a key enabling requirement to survive, act and invest in all of the subsequent three stages. Several measures help to maintain or free up cash, e.g., collecting and reducing accounts receivable or extending accounts payable.

- Supply Chain Adaptation requires a flexible supply chain and level-headed, bold strategic decisions to serve the right customer segments and remaining demands. It is to evaluate which parts of the supply chain can be adjusted quickly to reach a new optimum and meet the crisis conditions fast.

- For a Supply Chain Recovery to pre-crisis business levels, we recommend keeping turnback efforts to a minimum and having a global economic and political monitoring system in place that identifies the right timing for a fast increase back to maximum utilization of profitable parts of your supply chain.

- In order to lay the foundations for Supply Chain Future Growth, we recommend including growth initiatives in strategic crisis management. Some companies manage to make a virtue of the adaptation phase by transforming ad hoc measures and emergency processes into standard operations. However, fast future growth can also benefit from market monitoring. By observing market dynamics before and during the crisis, companies can exploit emerging opportunities for profitable diversification, new partnerships, or inorganic growth along their supply chains or among competitors. In order to control and stabilize one’s supply chain, we recommend looking out for vertical integration of suppliers and distributors, new partnerships, or even M&A activities.

- Supply Chain Organization and Communication are the ability to steer a supply chain towards future solutions. A centrally governed crisis culture will build trust during all phases of the crisis and lay the foundation for future decision making.

5F action recommendations for each scenario

The two enabling elements of Free Cash and Forward Organization and Communication form the backbone of the 5F Supply Chain War Room model. In addition to scenario allocation, these two elements apply to all three phases of the crisis model.

In contrast to the recovery and growth phase, Supply Chain Adaptation includes several recommended actions that embrace all scenarios. Because we would experience a rapid decline in demand and supply in all scenarios, adaptive measures can be streamlined to initiate a turning point. We recommend taking several initiatives early to escape the macroeconomic drop before competitors do. As the overall demand will initially drop, we suggest concentrating on products and customer segments where demand remains or where new demands are developing. We suggest that companies adjust production footprints and supplier networks. Due to the uncertain future of the crisis, various measures for long-term downtime need not be examined and prepared.

Once the organization has adapted to the situation, it seems easier to recover from the crisis. In the first scenario, it is crucial to restore utilization of suppliers, production lines, and distributors to pre-crisis level as fast as possible. In the second scenario, we recommend working closely with suppliers to prepare and ramp up production rapidly, e.g., via strategic interactions and adjusted contracts with short-term discounts.

In anticipation of a W-shaped future described in scenario 3, it is essential to create as much production and supply-chain flexibility as possible through adjustment of contracts with batch sizes or multi-sourcing operations.

In contrast to the sudden recovery of the first three scenarios, we advise supply-chain managers to radically adjust supply quantities and negotiate prices in a recession scenario to survive.

Finally, supply-chain future growth is built upon early adaptation and fast recovery. By integrating their new ways of creating value into all areas, companies will help traditional supply chains grow.

The crisis will bring many tributes, but also form new winners. The adaptation of the 5F War Room model to supply chains helps companies understand which scenarios could impact supply and demand and how to strategically react, now and in the future. For all scenarios, bold strategies are required to gradually surpass the pre-crisis supply level.

We recommend that companies create and integrate new procedures for demand fluctuations, e.g., engaging with customers to assess adapted demands and restructure supply chains. Building stronger demand-predicting capabilities to steer and ramp up production and supply chains could become as important as early preparation for potential (and lucrative or necessary) M&A activities along the supply chain.

In a recession, demand prediction and M&A activities are seen slightly differently. Demands only emerge as impulses. Every hint needs to be examined for actual sales potential. M&A activities, on the other hand, are seen as opportunities to grow, rather than a necessity to secure supply, and therefore use the difficult situation to create a competitive edge from past crisis operations.

(For further insight into the 5F War Room model see Arthur D. Little’s separate viewpoint https://www.adlittle.com/ insights/viewpoints/5f-war-room).

We have also initiated an international platform for CEOs to exchange crisis management experiences while dealing with COVID-19. Under the motto, “Learning from each other and coping with the crisis together,” the pro bono initiative aims to build a pool of experience and provide companies and public institutions with knowledge on how to deal with the COVID-19 pandemic.

We summarize our global CEO Logbook biweekly to show actions and measures on the agendas of decision makers who are dealing with the effects COVID-19 in their corporations. Please contact us to receive a copy.