24 min read • Energy, Utilities & Resources, Oil, Gas & Other Natural Resources

Decarbonizing Southeast Asia: The green fuels race

Transforming a regional ecosystem to better utilize CO2

FOREWORD

UNLOCKING DECARBONIZATION POTENTIAL ACROSS SEA

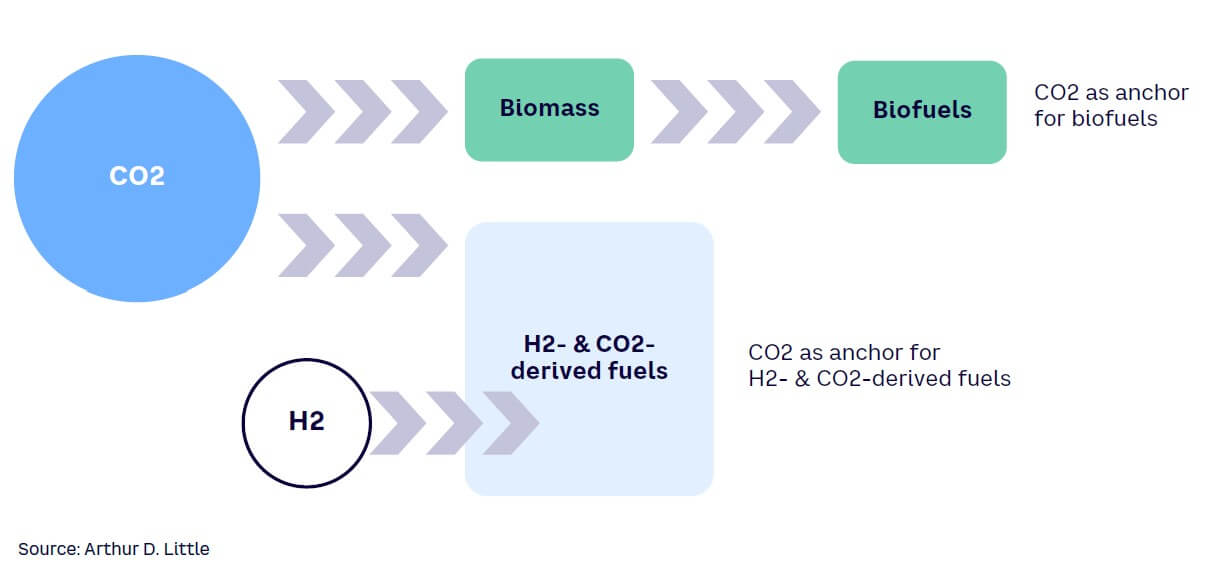

Across the globe, there is currently an enormous, transformative shift away from fossil fuels, driven by the fundamental need to decarbonize to hit net zero targets as well as growing pressure from customers looking to embrace green alternatives. Achieving effective decarbonization requires a profound shift in the entire ecosystem around fuel production, distribution, and usage. As part of this shift, CO2 can anchor new ecosystems, enabling the creation of net zero fuels, whether bio-based or hydrogen (H2)- and CO2-derived products.

This shift provides opportunities for companies, customers, and societies across Southeast Asia (SEA) and will help SEA countries hit their wider decarbonization targets, particularly in crucial, hard-to-decarbonize, high-demand regional sectors, including aviation, shipping, and power generation. It will also help resolve pressing socioeconomic needs, such as reducing waste through reuse and investments in green fuel production and addressing the concerns of younger generations pushing to create a more sustainable world, both as consumers and entrepreneurs building sustainability start-ups.

A move to CO2 can unlock the broader universe of CO2-to-X and carbon capture and utilization (CCU)-to-X products, opening new possibilities for SEA and putting the region at the forefront of the global shift to decarbonization. Technology and processes like carbon capture, utilization, and storage (CCUS) and direct air capture (DAC) are central to this, lowering or eliminating greenhouse gases (GHGs), mitigating hard-to-abate emissions, and providing CO2 as a feedstock for green fuel production, while delivering the monitoring and measurement required for compliance, including through emerging technology like artificial intelligence (AI). Successfully scaling such technologies across SEA is vital to providing the infrastructure for change.

In the words of US Special Presidential Envoy for Climate John Kerry, “The energy transition is the new Industrial Revolution.” Just as earlier industrial revolutions dramatically reshaped industries and cities according to where value was located, so will the energy transition.

This shift makes understanding how to manage CO2 an economic, social, and political imperative for countries within SEA. To realize its potential, governments, regulators, and players across the value chain must act now to address the challenges (especially around cost, certification, and regulation) that are holding back the ecosystem’s growth compared to other regions. The transition requires concerted action on a regional, cross-industry basis that will enable companies to meet the changing needs of customers, preserve competitiveness, and transform regional economies through decarbonization.

Trung Ghi

Partner, Head of Energy & Utilities, Southeast Asia

EXECUTIVE SUMMARY

Against the backdrop of achieving net zero, companies from all industries must transform their strategies to focus on reducing and, over time, eliminating GHG emissions. Collectively, this decarbonization push will help countries achieve their net zero targets.

Decarbonization can be delivered through multiple approaches, such as electrification, adopting advanced materials, replacing industrial equipment with more sustainable alternatives, and asset optimization. One alternative approach is to effectively capture and use CO2 to create new products, such as fuels and chemicals.

With an emphasis on the approach of effectively reusing CO2, this Report focuses on decarbonization from the perspective of shifting the product mix to enable net zero. CO2 can serve as an anchor for a broader ecosystem of green products in the CO2-to-X and CCU-to-X domains. Examples include biofuels (derived from biomass, which absorbs CO2) as well as H2- and CO2-derived products (e.g., e-fuels).

While making greener products will not contribute directly to the producer’s own decarbonization, those products will enable its customers, end users, and the region to eliminate carbon emissions. For example, sustainable aviation fuel (SAF) helps airlines decarbonize their operations and hence supports national-level targets but does not necessarily enable SAF producers to hit their own GHG-reduction objectives.

Looking in-depth at SEA, achieving net zero across the region hinges on effectively managing carbon emissions and using carbon itself as a raw material for the net zero journey, such as by converting it into usable products. These products comprise both fuels and non-fuels (e.g., chemical products and derivatives). However, since fuel is a more urgent and pressing need compared to chemicals, this Report focuses on this area.

Specifically, the Report addresses these five questions:

-

How can CO2 unlock a broader ecosystem of green fuels, and how are companies preparing for the transition to these CO2-derived fuels?

-

What is the state of the ecosystem for biofuels, and what obstacles does SEA face?

-

What is the state of H2- and CO2-derived fuels in SEA, and what challenges does the market face?

-

Where are the opportunities in SEA for CO2-based fuels (both bio-based and H2- and CO2-derived)?

-

How can businesses and governments build an ecosystem in SEA for regional decarbonization?

1

HOW CO2 CAN UNLOCK ECOSYSTEM OF GREEN FUELS & HOW COMPANIES CAN PREPARE

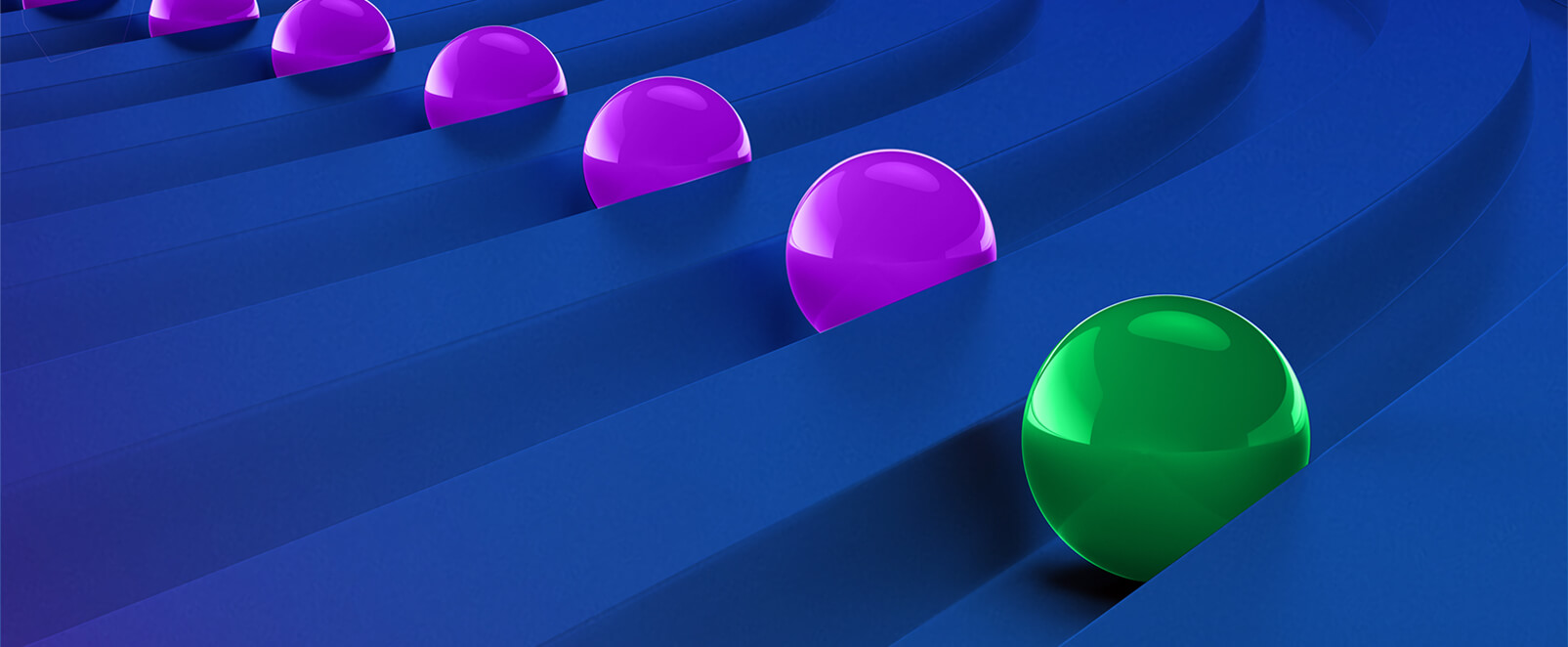

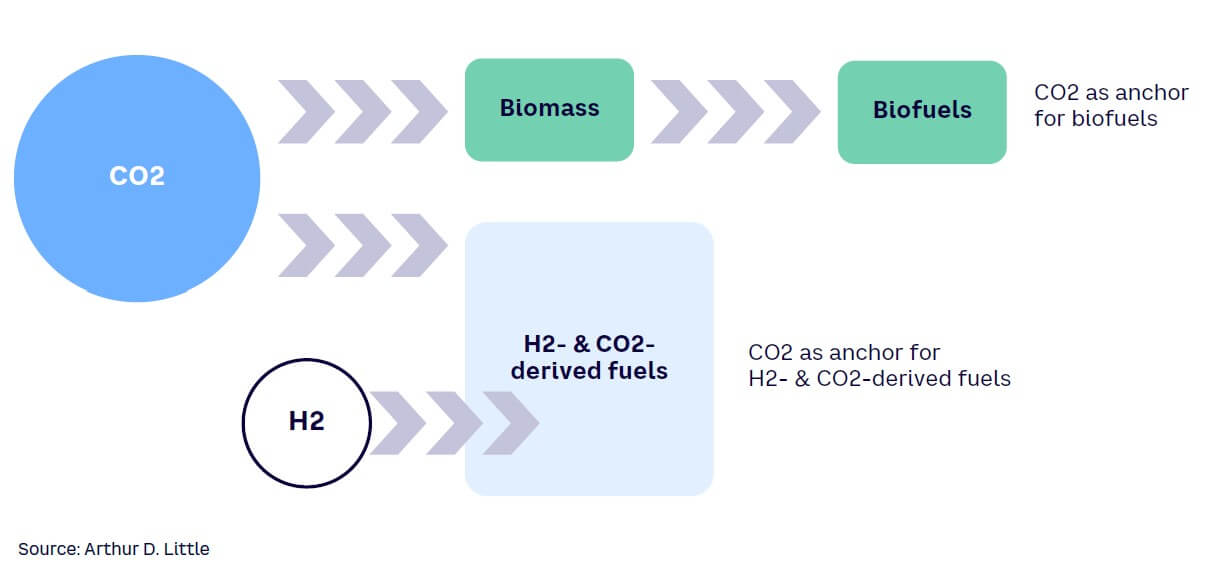

Creating a decarbonized ecosystem across SEA relies on economies moving from fossil fuels to using CO2 as an anchor for new processes that create alternative fuels, using either biomass or H2 as production feedstock (see Figure 1).

Successfully collecting and harnessing CO2 enables producers to unlock a broader universe of products, including:

-

CO2-to-X fuels, namely biofuels (e.g., fatty acid methyl esters [FAME], hydrotreated vegetable oil [HVO], bio-SAF, and 1-3G biofuels)

-

CCU-to-X fuels, such as H2- and CO2-derived fuels

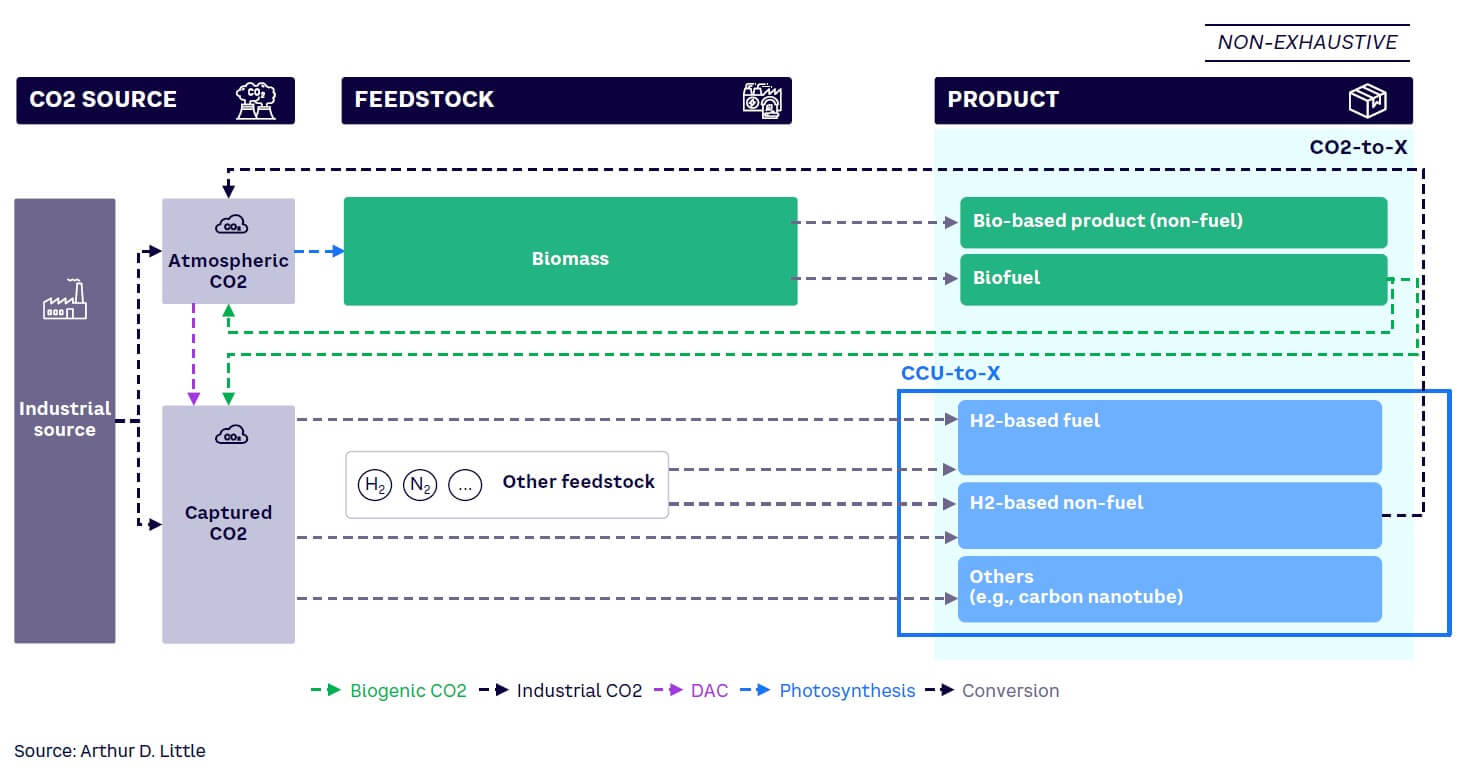

Figure 2 illustrates the differences between CO2-to-X and CCU-to-X products. (Since fourth-generation biofuels remain at an incredibly early stage in development, we do not cover them in this Report.)

2

PREPARING FOR TRANSITION TO CO2-BASED PRODUCTS

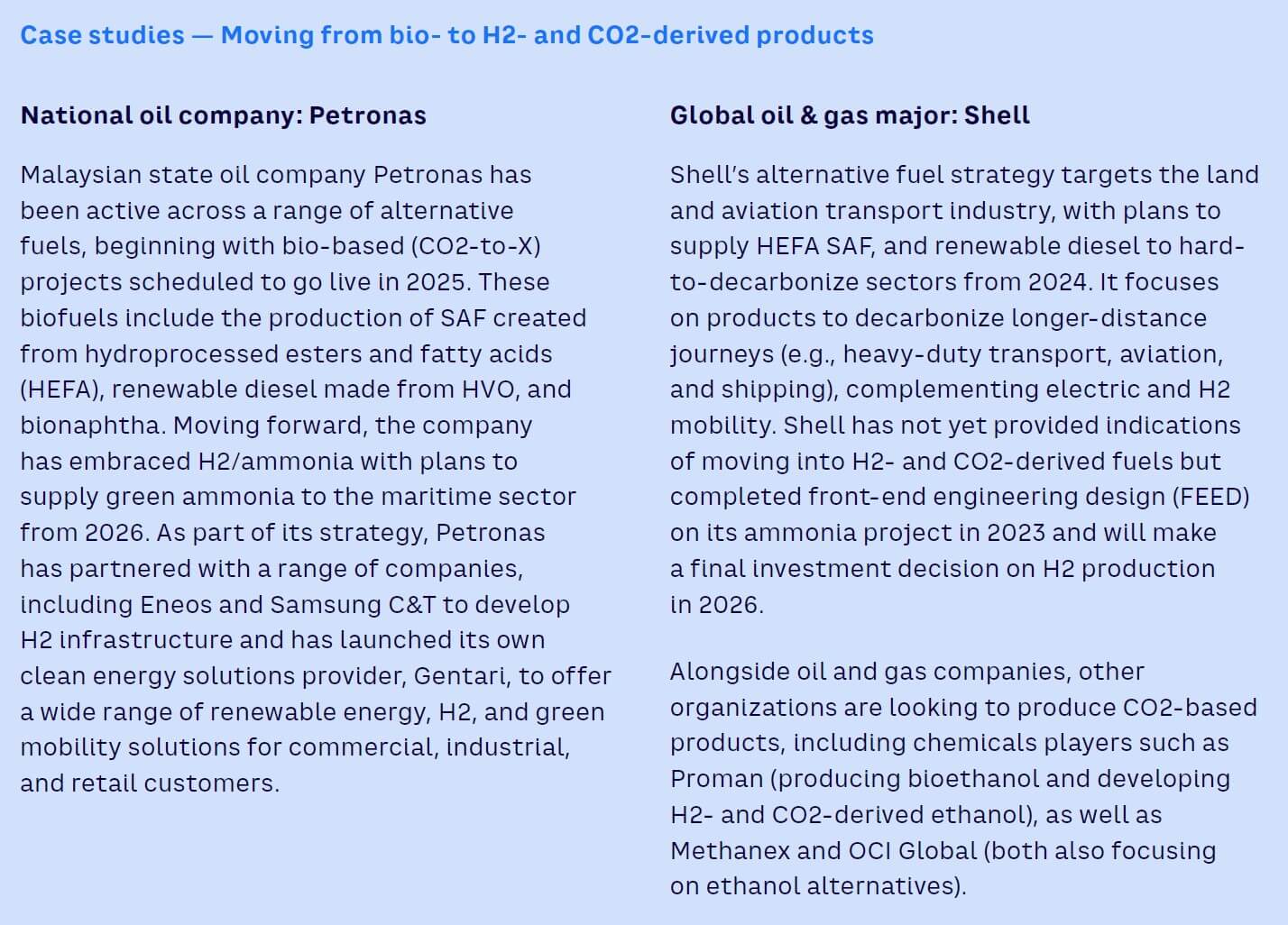

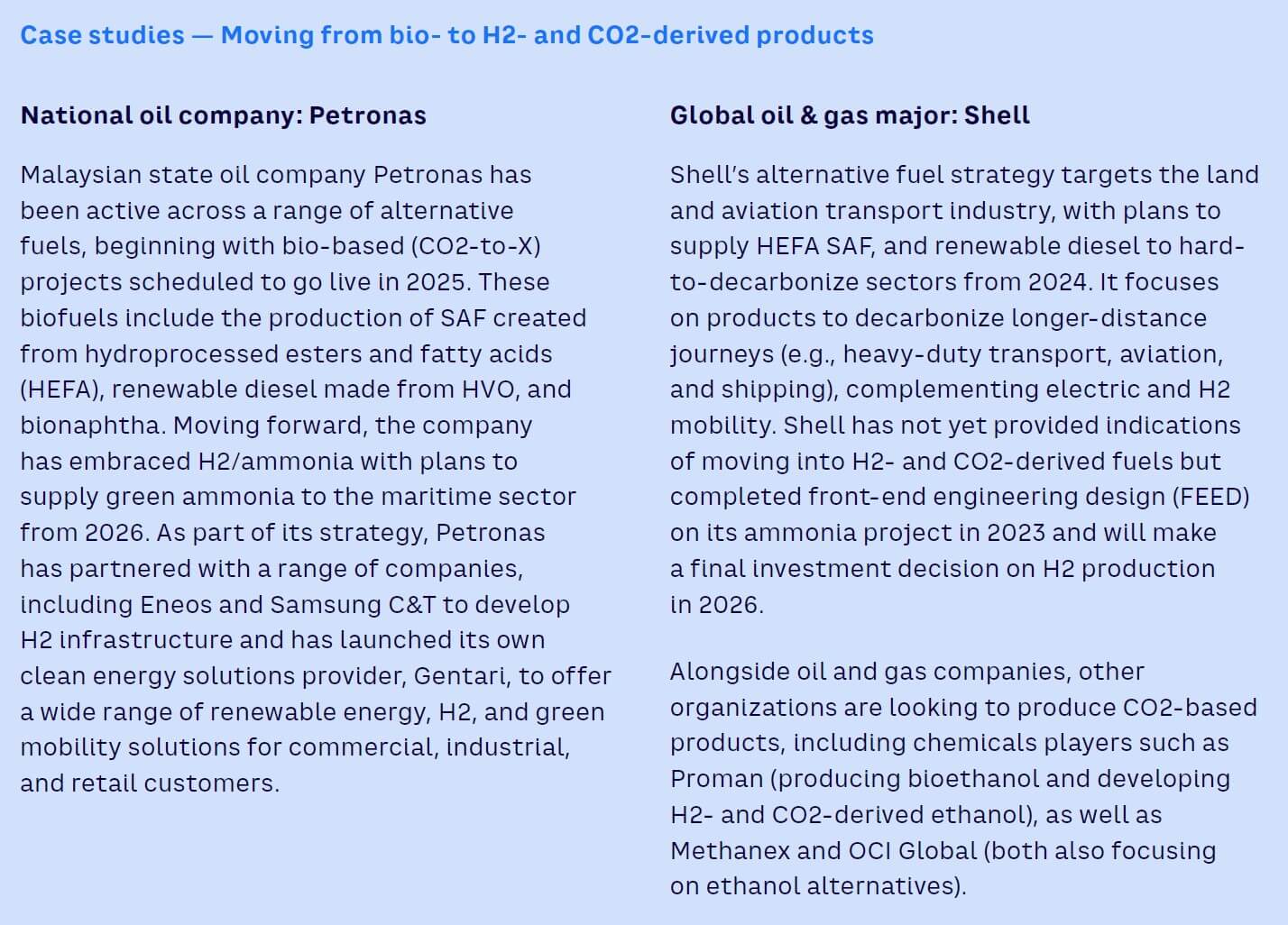

Globally, many companies have begun their transition to providing greener alternatives to fossil-based products. In most cases, they have initially created bio-based products but are now moving toward H2- and CO2-derived fuels.

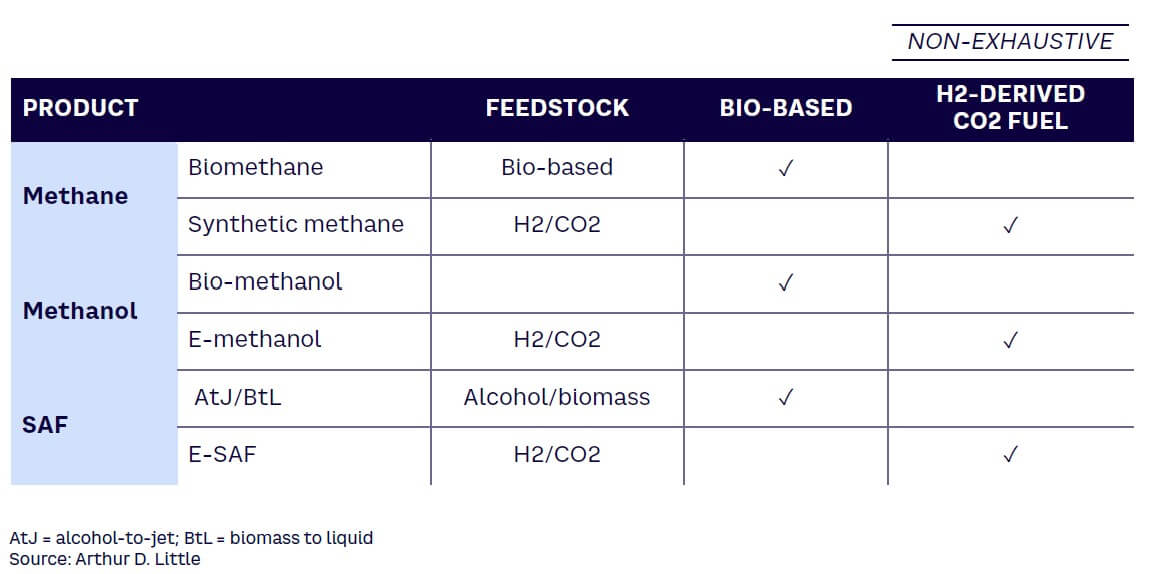

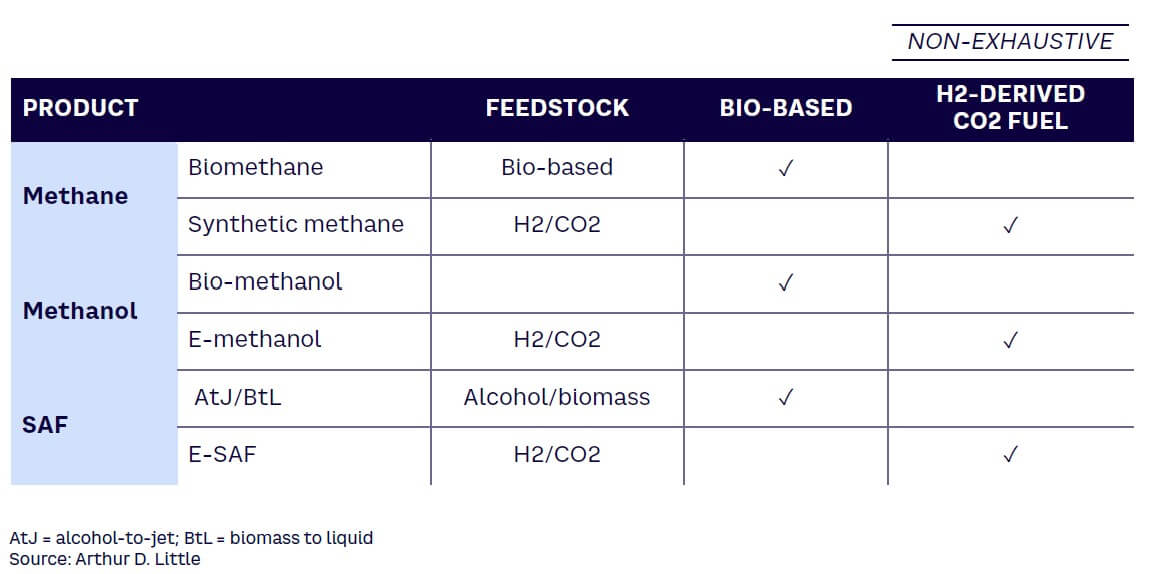

The essential difference between bio-based products and their H2- and CO2-derived equivalents is the feedstock used in their manufacture. That means the same applications can use them, and they do not require a large-scale change to the distribution infrastructure or supply networks. Consequently, many producers are treating bio-based products as a first step on the path to H2- and CO2-derived products, shifting their focus as costs fall and regulatory policies change. Among the universe of alternative fuels, products with both bio- and H2-derived counterparts will enable this transition (see Table 1).

The shift toward H2- and CO2-derived pathways is further enabled by feedstock availability and regulatory mechanisms in the region.

Access to affordable feedstock

Across the region, biomass is readily available, providing a relatively affordable feedstock for bio-based products. This makes these products an ideal first step for producers looking to move away from fossil fuel–based products. In contrast, the cost of renewable energy is currently higher in SEA compared to other regions and supplies of low-cost H2 are also limited. This makes H2- and CO2-derived products more expensive than bio-based equivalents, although using hydropower or geothermal energy can aid cost-competitiveness, in select countries.

Regulatory mechanisms

Legislation (through mandatory uses and subsidies) is key to driving the transition to decarbonized fuels, particularly given their higher cost compared to fossil-based products. While the EU is the driving force behind much of current regulatory activity, it has a major impact on SEA, for two main reasons:

-

EU regulations impact global sectors such as the maritime industry, where SEA is strong (especially given Singapore’s position as a global maritime hub). Ships from the region that sail to EU ports are affected by EU maritime legislation.

-

Other nations/regions often adapt and adopt versions of EU legislation, meaning they can become de facto standards for many parts of the world.

Initially, markets like the EU focused on biofuels, such as through the Renewable Energy Directive (RED I) of 2009. However, regulators are increasingly recognizing the additional sustainability benefits and attributes of H2- and CO2-derived fuels, leading to new legislation that provides the market with confidence when investing in this area. For example:

-

In February 2023, the European Commission adopted the Additionality Delegated Act, which outlines how H2, H2-based fuels, or other synthetic fuels (including those produced with industrial CO2) can be considered as renewable fuels of non-biological origin (RFNBOs).

-

In July 2023, the EU launched the FuelEU Maritime initiative, which includes incentives to support the use of RFNBOs, including H2- and CO2-derived fuels.

3

STATE OF ECOSYSTEM FOR BIOFUELS & OBSTACLES IN SEA

FIRST-GENERATION BIOFUEL ECOSYSTEM

Given that SEA consists largely of countries with significant agricultural sectors, there is an abundance of bio-based feedstock for use in creating biofuels. For example, when it comes to first-generation (1G) biofuels (produced directly from crops), Indonesia and Malaysia are the two largest providers of palm oil in the world, responsible for 84% of global production, while Thailand is a major cassava producer.

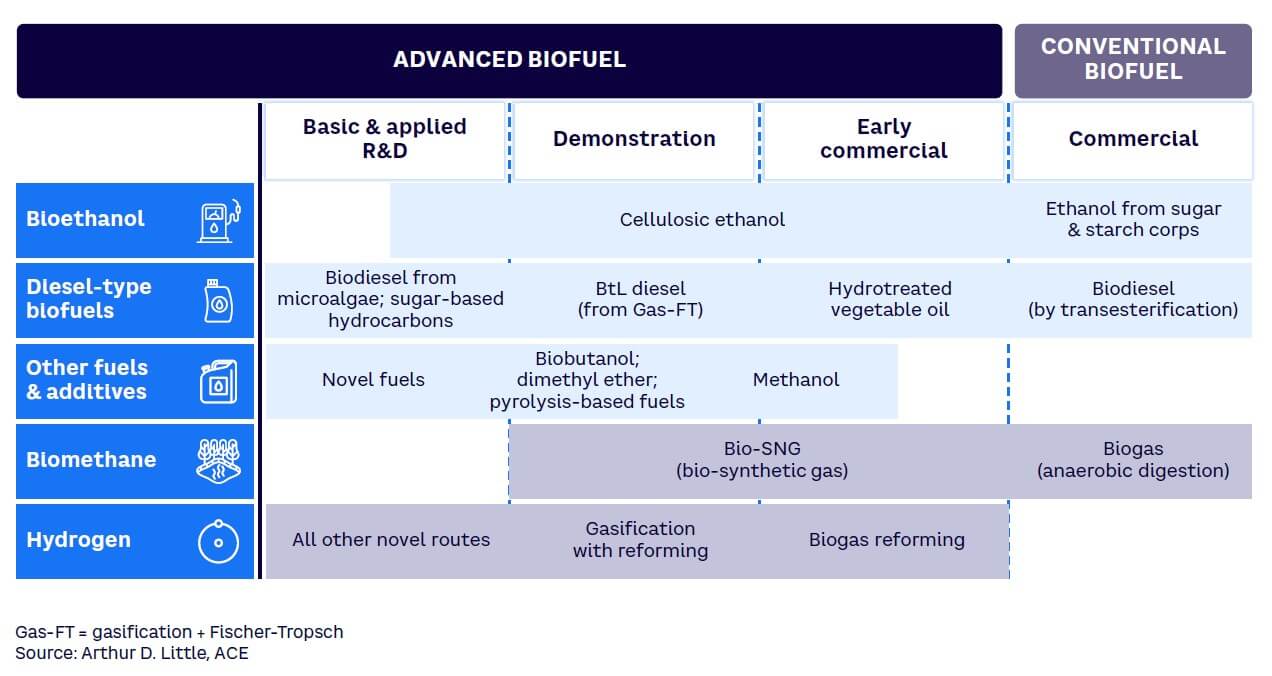

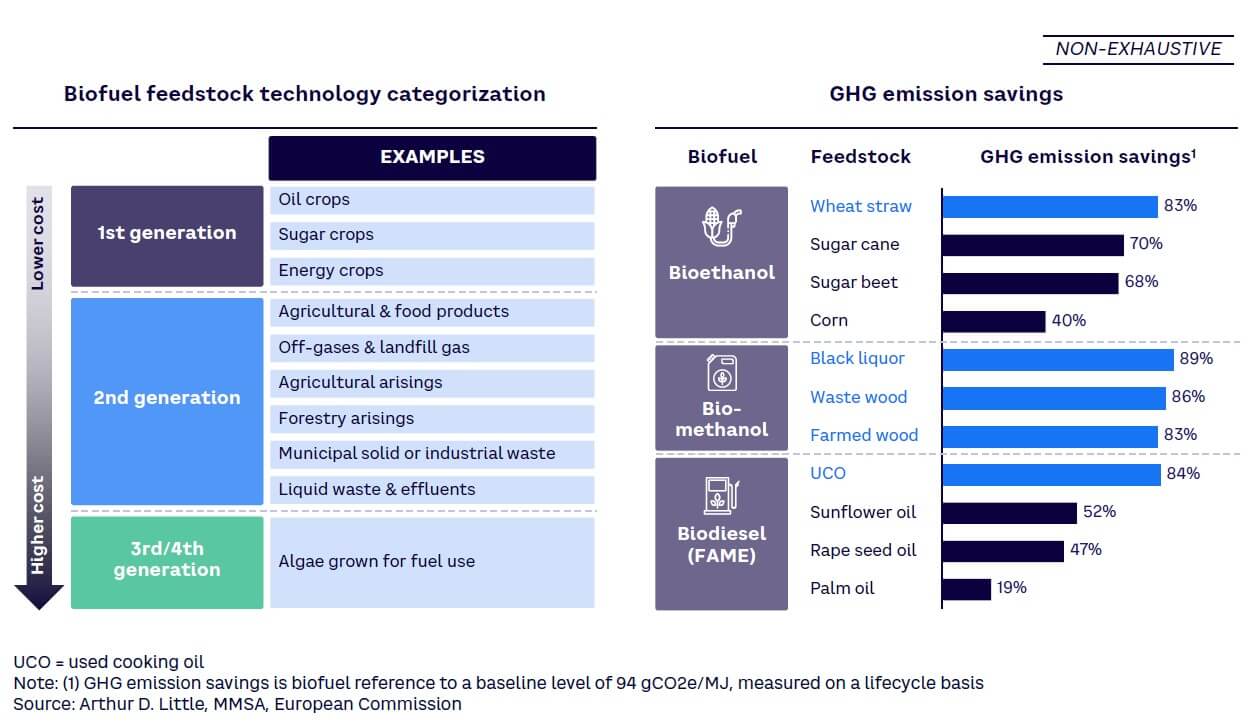

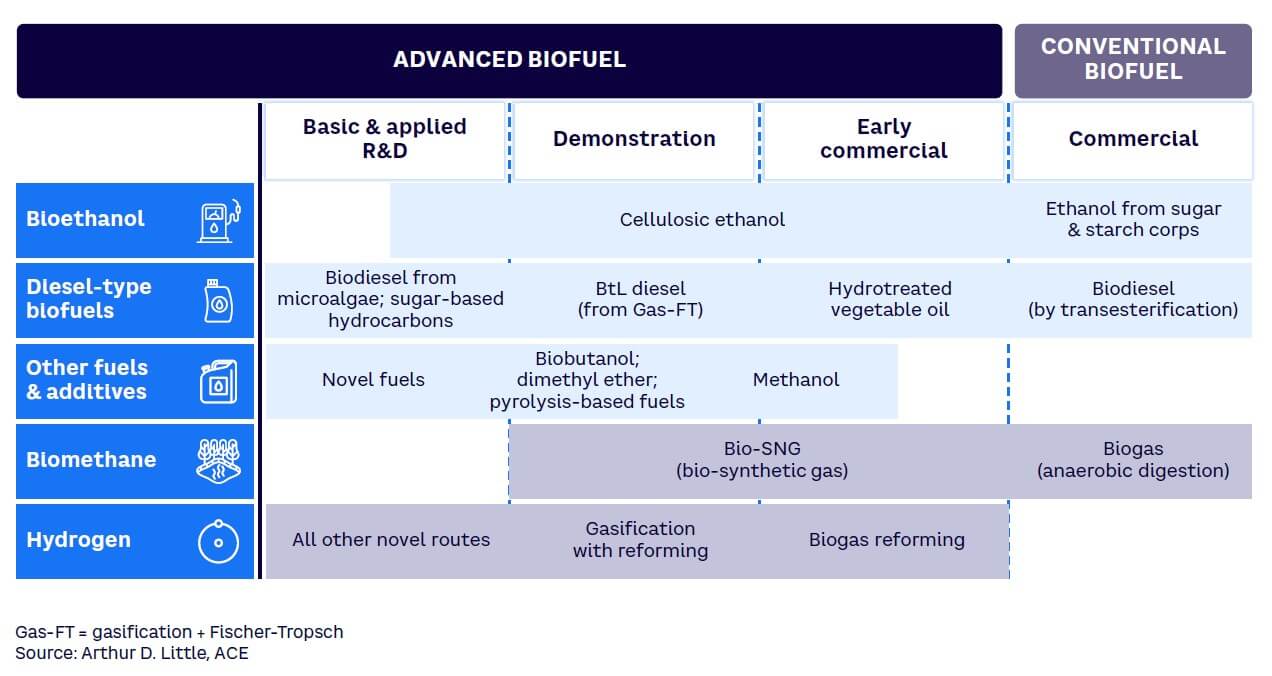

The availability of this biomass has driven the establishment of a conventional biofuel sector across the region, with products including bioethanol (from sugar/starch crops) and biodiesel (from transesterification of oils). Currently, the development of more advanced biofuels is at an earlier stage (see Figure 3).

Given its natural advantages around biomass availability and established conventional biofuel industries, the region is poised to become a prominent producer and exporter; for example, it was responsible for 17% of global biodiesel production in 2022. Key strengths include:

-

Indonesia — 15% of global biodiesel production, supported by available, varied feedstock sources

-

Malaysia — 2% of global biodiesel production, driven by cost advantages

-

Thailand — 2% of global bioethanol production, driven by proximity to large Asian markets

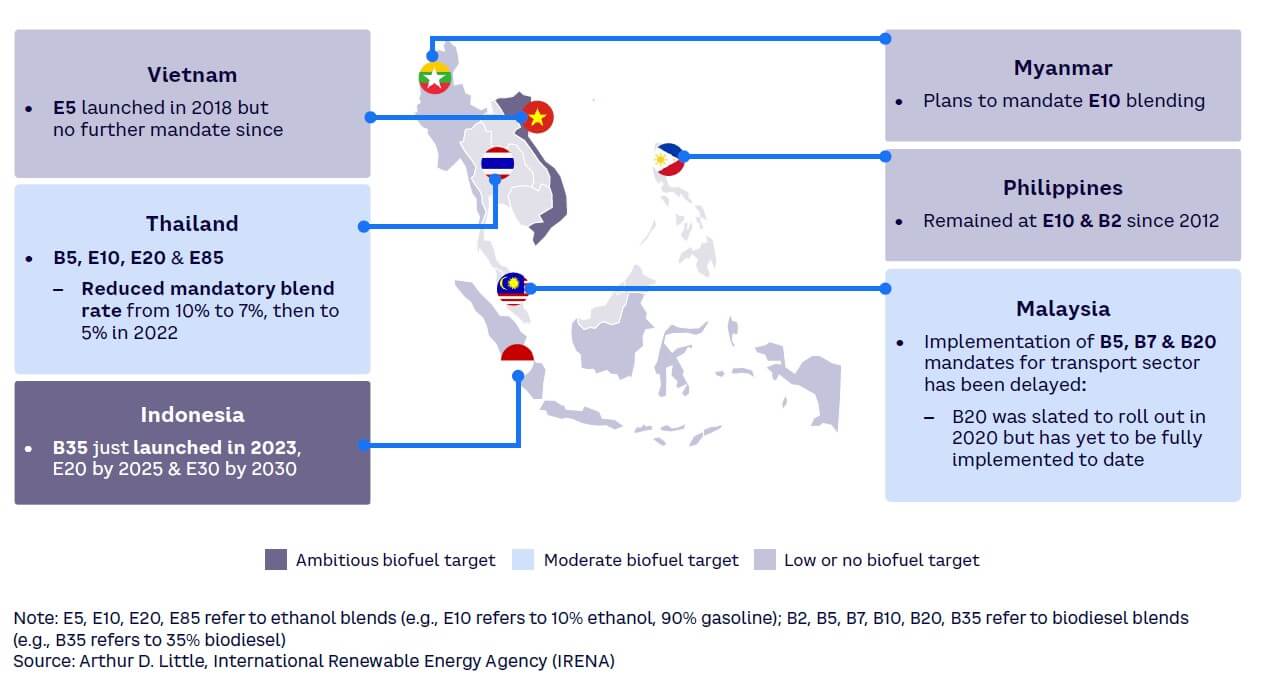

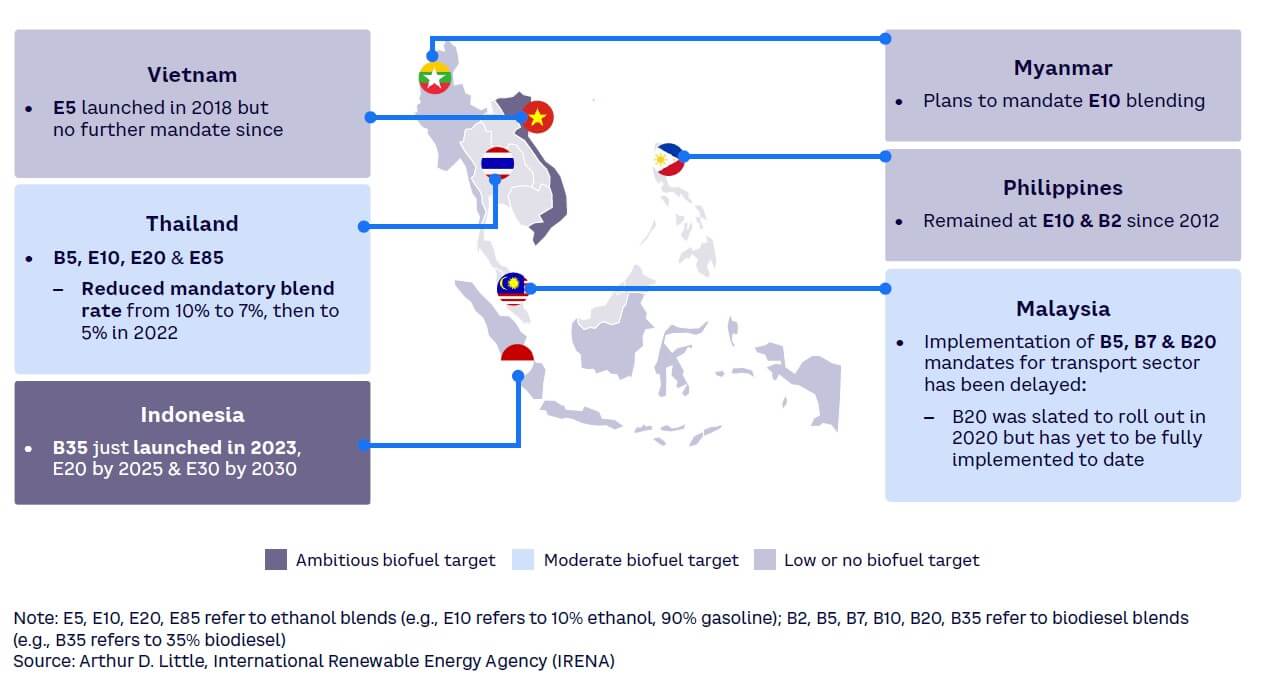

Governments across SEA are driving local consumption and guaranteeing their own energy security by implementing a range of biofuel blending mandates (see Figure 4). Indonesia has set the most ambitious targets, mandating 35% bio-based biodiesel (B35) for road transport since August 2023.

However, there are challenges to 1G biofuels — particularly around certification and concerns over indirect land-use change — when using agricultural land for biofuel crops rather than for growing food. Many producers of bio-based feedstock (e.g., palm oil plantations in Indonesia and Thailand) remain uncertified. This makes it difficult to export products created from this, particularly to the EU, where restrictions exist to protect and promote the growth of the EU’s local industries. As Table 2 overleaf shows, certification is more advanced in Malaysia, where the Malaysia Sustainable Palm Oil (MSPO) mandate covers 88% of total plantation area.

While the EU is moving away from 1G biofuels, other countries are embracing them, meaning there is a pressing need to ensure that production meets sustainability criteria, delivers GHG savings, and has a lower adverse impact on the environment and society. Those efforts will open markets such as:

-

UK — which has committed to recognizing MSPO certification in due diligence guidelines for ensuring commodity sustainability

-

Singapore — where transport ministry is advocating for including palm oil as feedstock for SAF production

Additionally, producers of biodiesel must move beyond existing production, which is based on FAME processes and subject to recommended B5 blending limits (5% FAME and 95% fossil diesel, by volume), which narrows the percentage for use within existing fuels and hence their sustainability impacts. Shifting production to drop-in replacements such as HVO, which is not subject to blending limits, will thus increase biodiesel consumption and reduce GHG emissions. Production of HVO therefore must be developed and scaled up in the region, while producers should look to meet growing needs for 1G biofuels in areas outside road transport, particularly in the aviation sector.

UNLOCKING POTENTIAL OF 2G BIOFUELS

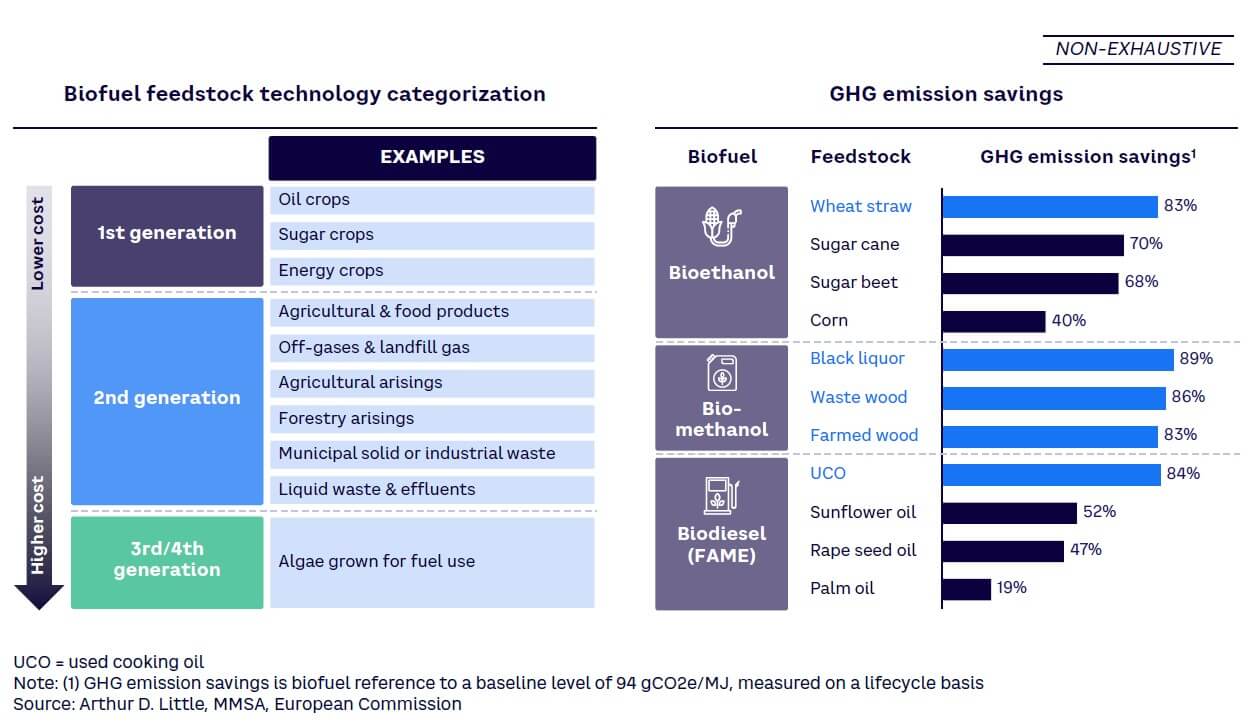

Second-generation (2G) biofuels provide significant advantages over 1G biofuels. They are more sustainable (with higher GHG emission savings) and, as they use waste products rather than crops as feedstock, they do not impact agricultural food production or lead to deforestation (see Figure 5).

The EU is currently the most advanced region when it comes to driving the shift to 2G biofuels. It has initiated policies to:

-

Enhance biofuel sustainability criteria — by increasing GHG emissions savings requirement for fossil fuels to 50%-65%

-

Limit/reduce use of crop-based biofuel — to 7% of energy consumption (or 2020 EU country consumption level plus 1%)

-

Encourage use of non-crop-based biofuels — with mandates around advanced biofuels

-

Phase out use of (some) crop-based biofuels — with an EU-wide ban on palm oil and a proposed blanket ban in Germany

As a major export market for SEA biofuel, EU legislation also will have an impact on producers in the region.

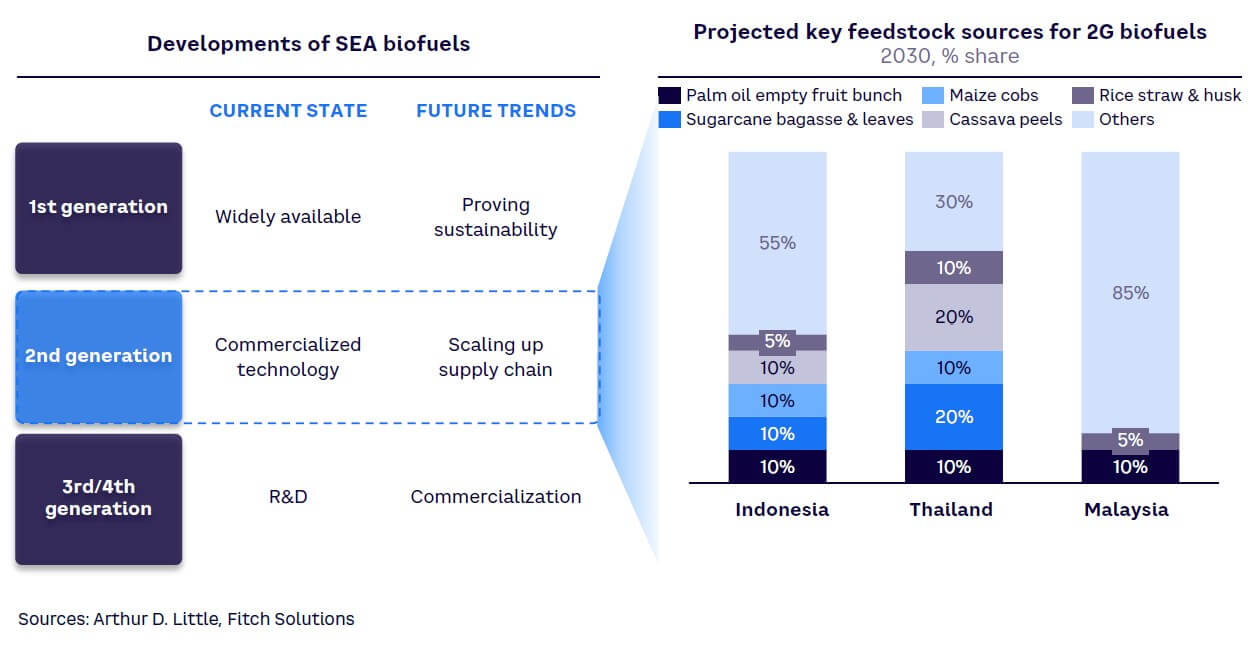

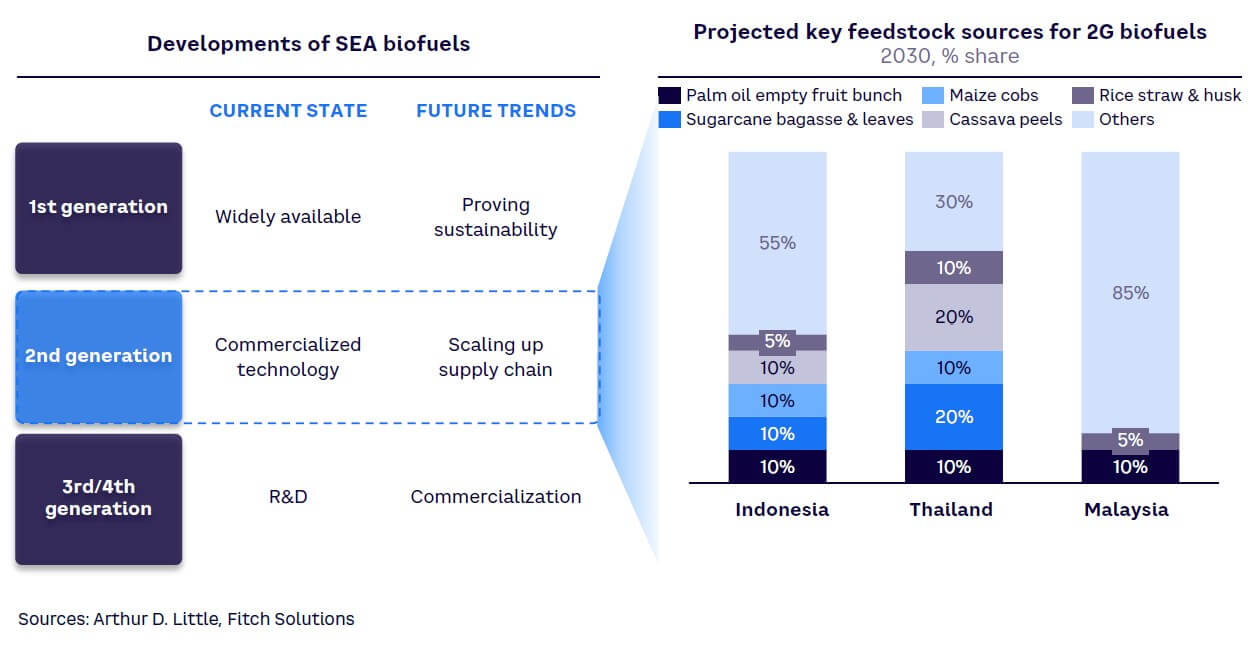

From a feedstock perspective, SEA is well positioned to make the transition to 2G biofuels produced through, for example, pyrolysis or gasification from waste-based feedstock, such as cooking oil or agricultural waste (see Figure 6). However, supply chain bottlenecks, particularly around the aggregation and collection of feedstocks from numerous, widely spread producers, is a key challenge. One way to address the issue is by securing feedstock from B2B partnerships, which provide a more centralized supply compared to distributed municipal solid waste sites. Some players in the region have already formed such partnerships. As an example, METPower is building biogas facilities using pineapple waste from Dole Philippines.

4

STATE OF H2- & CO2-DERIVED FUELS & MARKET CHALLENGES IN SEA

CURRENT H2- & CO2-DERIVED FUELS ECOSYSTEM

Across SEA, there is enormous potential for the use of H2 in fuel production, both in terms of feedstock availability and renewable energy production. Based on the carbon emissions involved in its production, H2 is classified into different colors (other colors, including white, pink, and turquoise, are also used to classify H2, although these are not yet as developed or widely used):

-

Green H2 — uses renewable energy, meaning production does not create any carbon emissions

-

Blue H2 — creates carbon emissions (e.g., by burning fossil fuels) but these are captured and utilized/stored through CCUS to mitigate emissions

-

Grey H2 — produced by using fossil fuels without any capture of emissions

Natural gas is a key feedstock for blue H2 production and is widely available across the region, with Indonesia, Malaysia, and Thailand large-scale natural gas producers. This has led many countries to focus on H2 as a key enabler for decarbonization across mobility, industry, and power generation, particularly when combined with renewable energy from wind, solar, and hydroelectric sources.

COST CHALLENGES

Renewable energy remains expensive in the region compared to the US, the Middle East, and Australia, impeding green H2 production. While countries across SEA possess distinct, economically viable renewable energy sources (e.g., hydropower in Laos and Malaysia and geothermal energy in Indonesia), these are currently underdeveloped, while hydropower is well established and cost competitive.

For example, Rystad predicts that by 2030 the levelized cost of green H2 (LCOH) in key SEA countries will be between US $3.5-$4.3 per kilogram compared to less than $2.5 in the US, the Middle East, and Australia. Reducing costs through new, cheaper renewable energy sources, such as hydropower in Malaysia, would reduce LCOH to around $2.6 per kilogram, according to a report by DNV. However, building a new hydropower plant is a time-consuming project, taking at least a decade to achieve functionality. Alongside renewable energy, the region also lacks other infrastructure, including R&D and production facilities (including electrolyzers and CCUS facilities), although multiple SEA countries have announced electrolyzer projects.

SECURING CO2 FEEDSTOCK

H2- and CO2-derived fuels involve a CO2 capture element. Multiple carbon capture and storage (CCS) projects, a key enabler of blue H2, are under construction in SEA, with facilities at Kasawari (Malaysia) and Panca Amara Utama Central Sulawesi (Indonesia) scheduled to become operational in 2025, and Arthit (Thailand) going live in 2026. CO2 is available in large volumes across the region, generally from industrial processes. The availability of biogenic CO2 (created by living organisms) is more limited, with development of DAC technologies focused outside the region, in Europe and the US. However, local companies have invested in DAC players, such as Singapore sovereign wealth fund GIC in Swiss-based Climeworks AG.

OVERCOMING TECHNOLOGY, REGULATORY & DEMAND CHALLENGES

Globally, the adoption of alternative fuels faces significant obstacles due to the need for innovative technologies and infrastructure to accelerate scaling. SEA lags other regions in developing production infrastructure for decarbonization, with insufficient CCUS technology penetration, for example, or a connected renewable power grid needed for large-scale production of blue and green H2 fuel.

Developing an alternative fuel ecosystem requires significant up-front investment. To justify it, producers must secure offtake contracts or guarantees from customers to mitigate their risks. However, the SEA region lacks relevant incentives and scale to encourage demand and the uptake of H2- and CO2-derived fuels, which are vital given the current higher cost of alternative fuels compared to fossil equivalents. For example, in the SEA region, only select countries have established H2 strategies; examples include Singapore, which has a national H2 strategy in place, and Malaysia, which recently announced the launch of the Hydrogen Economy & Technology Roadmap (HETR). Other countries have not yet published national H2 strategies or established clear frameworks or mechanisms, which reduces regulatory certainty for businesses and investors and thus discourages investment in H2 products.

This lack of regulatory support is particularly noticeable in three areas:

-

Targets, mandates, and incentives. Local countries lag behind the likes of the EU in terms of regulatory and financial incentives to drive demand. For example, in the EU and the US, subsidies such as the EU Innovation Fund and the US Inflation Reduction Act (IRA) incentivize development, making these regions global hubs for alternative fuel production.

-

Certification. Producers must be able to prove the decarbonization credentials of their alternative fuels if they are to be adopted en masse. However, SEA currently lacks sustainability standards for H2- and CO2-derived fuels, hindering local sales and exports to regions with existing standards like the EU’s RED II and California’s Low Carbon Fuel Standard (LCFS).

-

Knowledge. Many producers of sustainable/alternative fuels in SEA are not price-aware, which hinders the development of transparent price indexes that drive customer confidence.

5

SEA OPPORTUNITIES FOR CO2-BASED FUELS

As the energy transition continues, producers and their customers must understand where the biggest opportunities lie for bio- and H2-derived green fuels in order to properly focus their efforts and investments. In SEA, opportunities exist in alternative fuels due to three primary factors:

-

The presence of large-scale demand hubs in the region

-

The impact of the global regulatory/industry push around alternative fuels

-

Growing demand-side infrastructure readiness, especially in hubs like Singapore

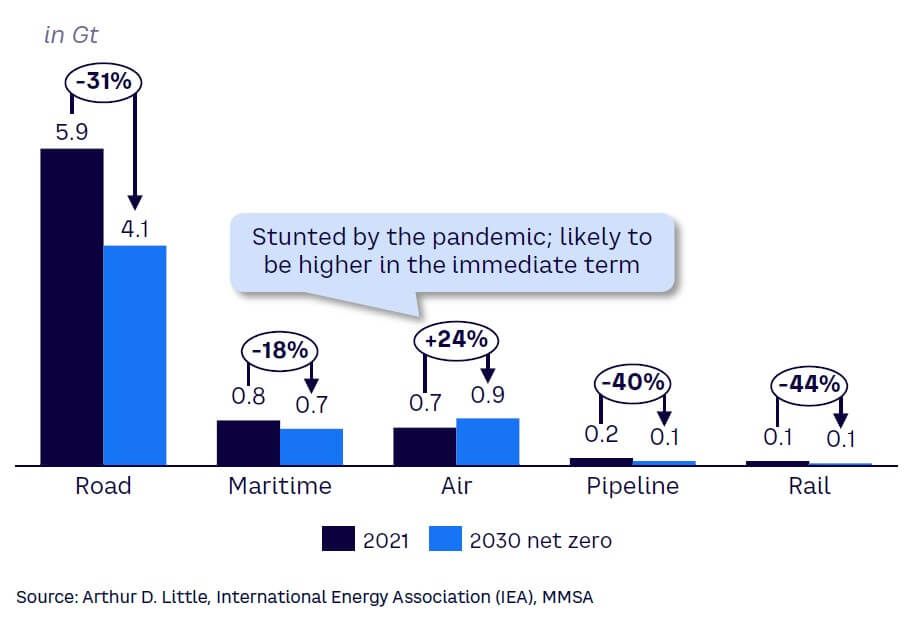

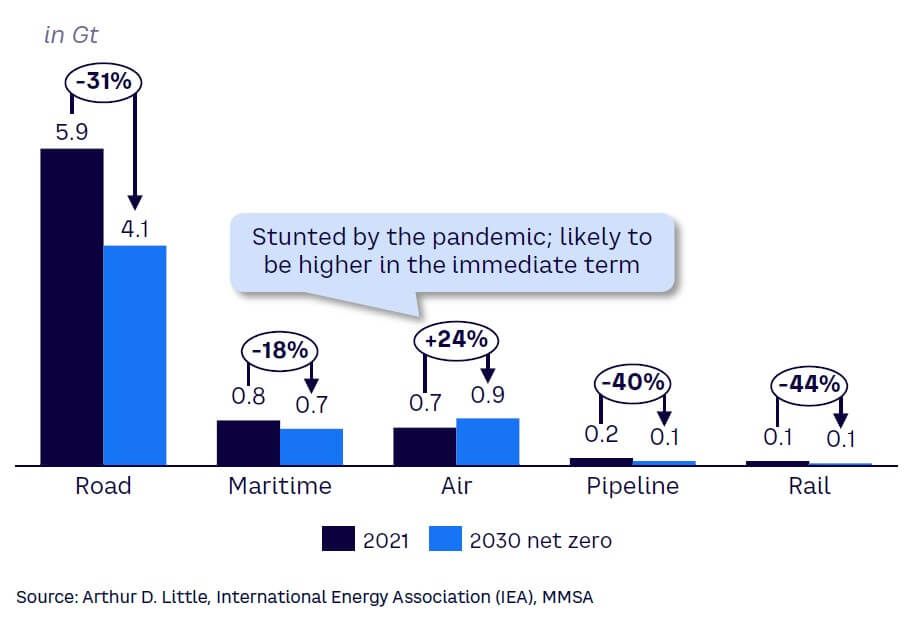

For alternative fuels, transport offers the largest immediate target market due to its pressing need to decarbonize, responsibility for an estimated 20% of SEA emissions, and emissions growth of an estimated 2.2% per year. According to the IEA, to deliver net zero emissions by 2050, transport CO2 emissions must fall by more than 3% per year to 2030.

Within the sector, road transport is the largest CO2 emitter (see Figure 7). Here, alternative fuels (e.g., biofuels such as bioethanol and biodiesel) are expected to act as a complementary component to electrification in road transportation, particularly in heavy-duty applications, until the achievement of total electrification.

By contrast, electrification is not a viable option for the maritime and air transport sectors due to journey distances and weight constraints. This means that adopting biofuels and H2- and CO2-derived fuels is crucial for successfully decarbonizing these industries, leading to strong demand. Apart from transport, power generation also offers a potential opportunity for alternative fuels technologies within SEA.

OPPORTUNITIES IN THE MARITIME SECTOR

Responsible for 2.2% of global CO2 emissions, the maritime industry currently provides the largest and most urgent opportunity for alternative fuels (notably bio- and e-methanol), driven by significant potential demand, growing regulation, and infrastructure availability. Within the region, Singapore is taking a leading role in marine decarbonization, providing clear opportunities for the supply and take-up of alternative fuels.

Demand

Major maritime trade routes run across the region. In particular, Singapore is a key port for global shipping and is the largest bunkering (refueling) port in the world, with a volume of nearly 50 million tons in 2022, according to the Maritime and Port Authority (MPA) of Singapore. Demand is increasing as shippers respond to pressure from customers and set their own decarbonization targets. For example, Maersk has pledged to reach net zero emissions by 2040, and MSC has committed to the same by 2050. Demonstrating this, Ship & Bunker reports that 62% of new vessels ordered in H1 2023 are powered by methanol, compared to just 8% that will use traditional fuel oil.

Regulation/government action

Maritime operators must meet increasingly stringent rules developed at a global, industry, and local level. The International Maritime Organization (IMO) has set targets for the maritime industry to reach net zero by or around 2050 and reduce GHG emissions intensity by 20-30% by 2030 and 70-80% by 2040. These targets will rely on a smooth transition to alternative low/zero-carbon fuels. At a local level, Singapore’s MPA is promoting and supporting the use of renewable fuels as part of the country’s national strategy to reduce emissions, including through pilot programs and cross-ecosystem work on safety standards.

Infrastructure readiness

Alongside the growth in methanol-powered shipping, port infrastructure is already in place to enable the use of alternative fuels. For example, Singapore has already completed more than 70 methanol loading and discharging operations for industrial use since 2022, and local firms have ordered methanol-bunkering tankers.

OPPORTUNITIES IN THE AVIATION SECTOR

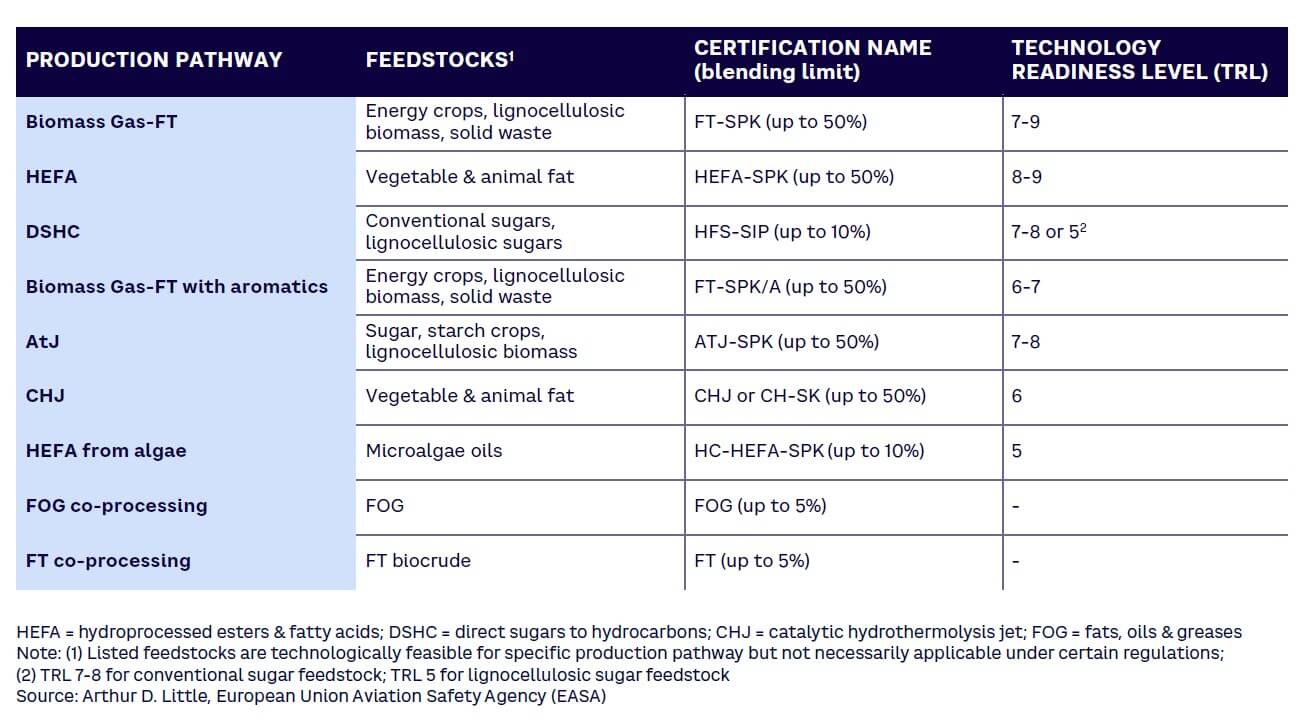

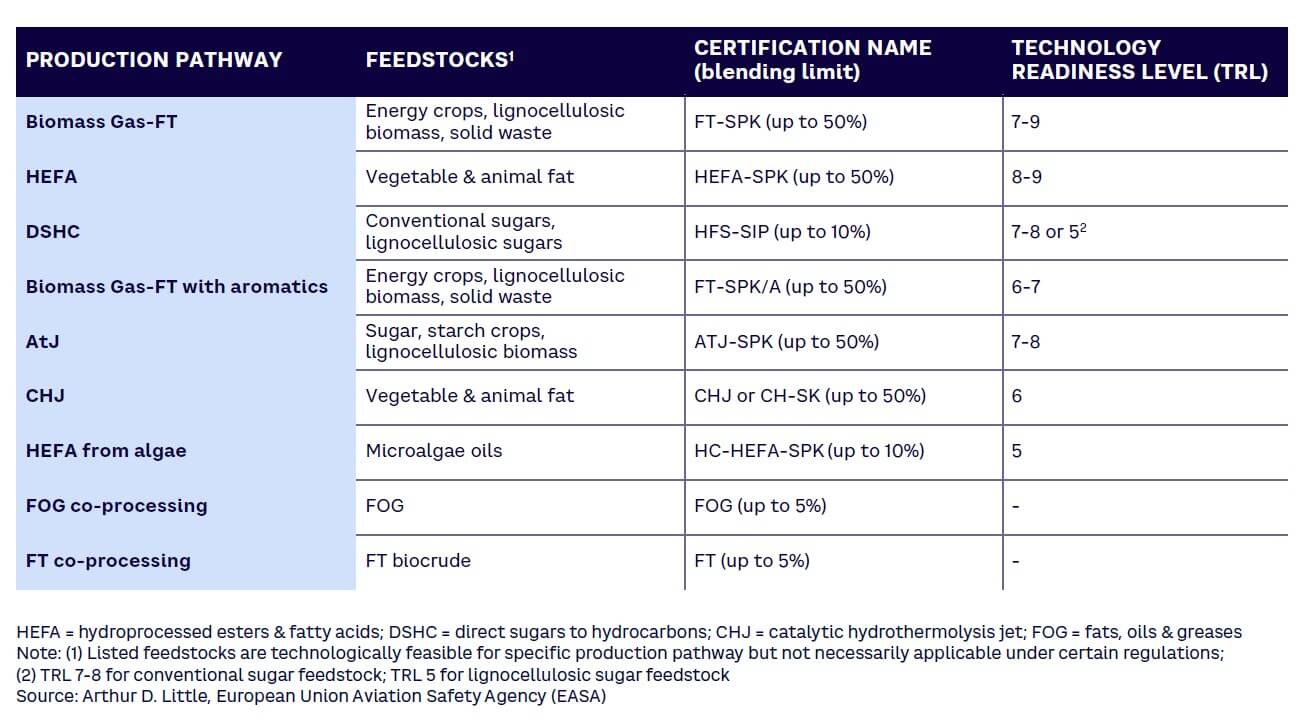

Aviation generates a similar level of emissions to the maritime sector, according to the IEA, with the entire industry focusing on achieving net zero, notably by the rollout of SAFs produced through bio- and H2- and CO2-derived pathways. SAFs are renewable liquid or gaseous fuels of non-biological origin produced by mixing green H2 with CO2, which can be captured directly from the air, from biogenic origin, or from industrial processes. They cover a wide range of feedstocks and processes, as shown in Table 3.

Demand

According to TheGlobalEconomy.com, Singapore, Thailand, Malaysia, and the Philippines are all in the top 30 of global aviation fuel users, signifying significant potential demand for green alternatives within the region. Singapore is the largest SEA user of jet fuel, ranking among the top 10 in the world by volume.

Regulation/government action

As with the maritime sector, aviation industry bodies are setting targets for decarbonization. The International Air Transport Association (IATA) aims to reduce emissions to net zero by 2050, with 65% of this reduction a result of using SAFs. On the government side, the region currently lags others, notably the EU, which has set mandated targets for usage through the RefuelEU regulation. However, there is growing interest from SEA governments in this area, again led by Singapore, which in May 2023 said it was studying rules to oblige airlines to use SAF on flights departing from the state.

Infrastructure readiness

For use within aircraft as drop-in replacements for fossil-based fuels, different SAF production pathways must fulfill strict certification requirements that prove that they match the physical and chemical characteristics of the fuels they are replacing and can therefore use the same infrastructure. As of January 2022, seven SAF production processes have been approved. In addition, two pathways for the coprocessing of renewable feedstocks in petroleum refineries are approved with a blending limit of 5% (refer back to Table 3). Notably, as estimated by IATA, overall SAF production reached more than 600 million liters in 2023. Given regulatory imperatives and growing demand, production is expected to grow rapidly, both globally and in SEA.

OPPORTUNITIES IN THE POWER SECTOR

Outside transport, power generation also offers opportunities for the use of bio- and H2- and CO2-derived fuels within the region. Given the size of its current emissions volume (over 40% of the global total, according to the IEA), and the fact that emissions are increasing, there is a pressing need to decarbonize the sector across the value chain. This can be achieved upstream — by using renewables (including landfill gas and biomethane), gas-to-power, co-firing (e.g., ammonia co-firing in coal power plants), CCUS, bioenergy CCS, and DAC — and midstream through H2/biomethane injection.

Longer-term decarbonization can be through H2 and carbon capture, while renewables, including bio- and e-methane, provide interim solutions. Demonstrating their versatility, these can be used on their own as an alternative to natural gas (methane) for power generation or processed into further derivatives that provide both fuels and chemical applications via the gas-to-liquids pathway.

Presently, most activity is concentrated in biomethane because it is cheaper to produce than e-methane, although there is some variation among markets. In SEA, countries such as Singapore (distribution) and Malaysia (production) are looking at becoming green methane hubs, supplying internal needs and external markets through existing infrastructure.

6

BUILDING AN ECOSYSTEM FOR REGIONAL DECARBONIZATION

Although it has made some advances toward creating a regional decarbonization ecosystem, SEA remains behind other markets such as Europe and the US. By learning from their successes and best practices, the region can accelerate its progress, focusing on four key areas.

1. STRENGTHEN REGULATORY & POLICY SUPPORT

Governments in other regions have actively provided direct regulatory support for decarbonization through a combination of subsidies, tax breaks/investments, and penalties. For example:

-

The EU’s Innovation Fund and the US’s IRA provide subsidies to relevant building blocks and pillars, incentivizing economic, supply chain, and technological development to deliver indirect and direct impacts on the energy transition.

-

Governments in countries such as Australia and Germany have launched programs to fund the commercial gap between the current cost of H2 production and market price. Australia has assigned around $1.3 billion in funding from its Hydrogen Headstart program, while the German government has committed approximately $986 million over 10 years to compensate providers that take part in auctions of green H2 and its derivatives organized by the H2Global Foundation.

-

In the EU as well as countries such as Singapore and Japan, the implementation of carbon taxes and emissions trading systems serve as a driving force for organizations to reduce their emissions through various strategies, including the adoption of cleaner fuels, in order to avoid penalties.

SEA countries are beginning to introduce regulatory support in areas such as H2 and biofuels. For example:

-

Singapore has released a national H2 strategy and is looking to develop biofuels, especially for the maritime and aviation sectors. The Civil Aviation Authority of Singapore (CAAS) is developing a Sustainable Air Hub blueprint. Scheduled to be published by the end of 2023, it will provide a decarbonization roadmap for aviation in Singapore, with both 2030 and 2050 targets.

-

Malaysia includes a focus on H2 within its National Energy Policy. It provides a long-term roadmap to optimize production pathways for green, blue, and grey H2 and aims to create a local H2 ecosystem supported by R&D and commercialization capabilities across the value chain through regulations, collaborations, and pilot/market entry programs. The country has also recently announced a National Energy Council to facilitate the implementation of its National Energy Transition Roadmap, along with a renewable energy exchange to trade renewable energy.

Next steps

Countries across SEA must accelerate their regulatory support, incorporating lessons from other nations and regions and introducing direct and tangible incentives, targets, and penalties. Producers and customers should push for this greater support by highlighting growing demand and signal their commitment to decarbonization, sharing knowledge with regulators and governments.

2. COLLABORATE REGIONALLY ACROSS ECOSYSTEM & VALUE CHAIN

Across SEA, several national/industry-level partnerships dedicated to decarbonization have already been created, including:

-

The Global Center for Maritime Decarbonization (GCMD) in Singapore, created to support the sector in meeting or exceeding the IMO decarbonization goals.

-

The Asian Clean Fuels Association (ACFA), dedicated to the promotion and advancement of cleaner transport fuels.

-

Vietnam and Indonesia’s participation in Just Energy Transition Partnerships (JETPs), which fund pathways away from dependence on coal-based power generation.

-

The ASEAN Centre for Energy (ACE), an intergovernmental organization within the Association of Southeast Asian Nations (ASEAN) structure, has recently completed a research and development roadmap for biofuels.

-

Showing collaboration across the broader Asian region, 280 Japanese companies (including Toyota and Sumitomo Mitsui Financial Group) that make up the Hydrogen Value Chain Promotion Council have launched a multi-billion-yen investment fund to boost the development of the H2 industry.

However, opportunities remain for increased cross-geography partnerships that span the region, modeled on existing examples such as:

-

The German/Dutch collaboration involving the HyNetherlands and NortH2 projects, which aims to create a large-scale, integrated H2 ecosystem for alternative fuels (green methanol/green ammonia). This includes pipelines, an electrolyzer, green power generation, and transport hubs.

-

The Zero-Emission Shipping Mission, a cross-country collaboration that is co-led by the US, Norway, and Denmark. It aims to demonstrate commercially viable zero-emission ships by 2030.

-

The European Clean Hydrogen Alliance, which aims to facilitate customer demand (e.g., by publishing a list of 840 H2 projects), technology transfer (through an electrolyzer partnership), and knowledge sharing through roundtables to promote H2 development and address adoption issues and barriers.

Next steps

Governments and industry together need to build wider ecosystems and partnerships, focused on bringing together producers and customers across SEA. This could be reinforced through technology-transfer agreements or through offtake arrangements.

3. DEVELOP ROBUST CERTIFICATION MEASURES

One area where Europe and the US are far ahead of SEA is around certification, with specific standards already in place. These include:

-

The EU’s RED II, Emissions Trading System (EU ETS), and FuelEU Maritime initiative

-

The CertifHy consortium, which has developed high-quality H2 certification schemes addressing consumer disclosure (from well to gate) to advance the European H2 economy

-

California’s LCFS

Robust regulation and certification would provide the required guarantees for both producers and customers to unlock investment and to commit to alternative fuels, justifying the price premiums required. In SEA, these would enable the development of cross-border supply chains and trade, stimulate demand for alternative fuels in the region, enable local producers to target export markets, and contribute to local and global decarbonization.

Next steps

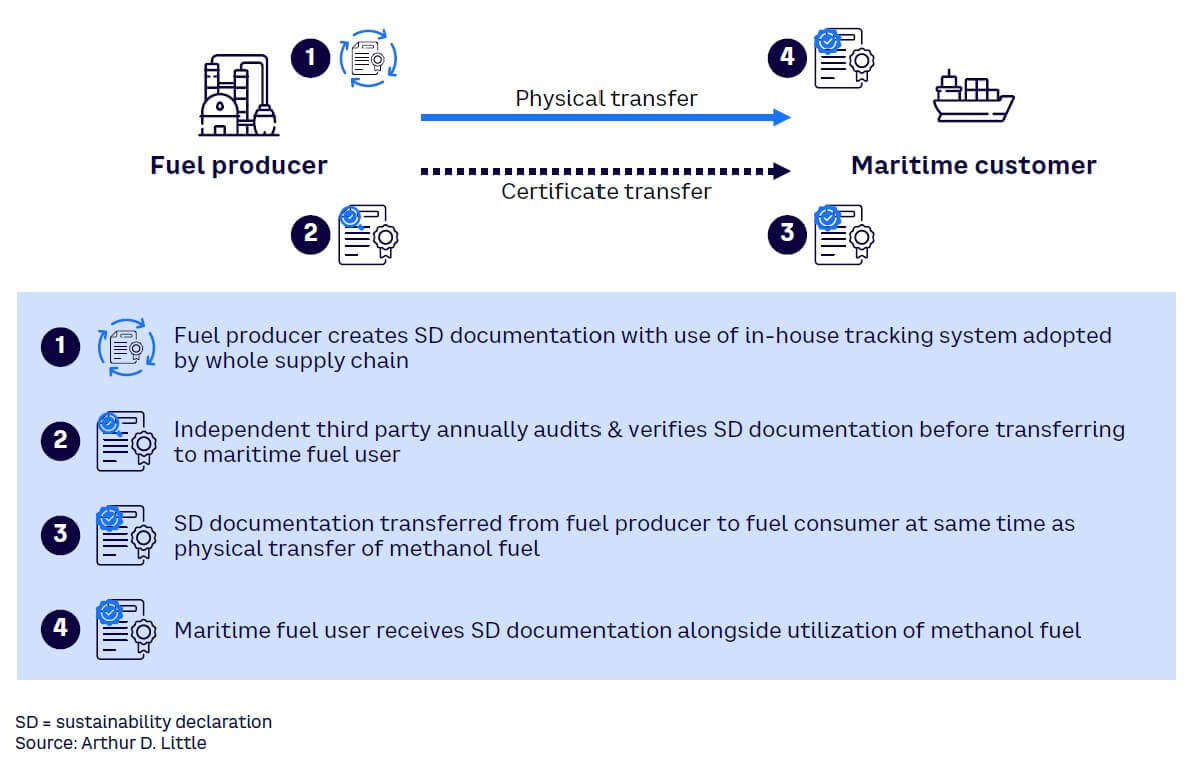

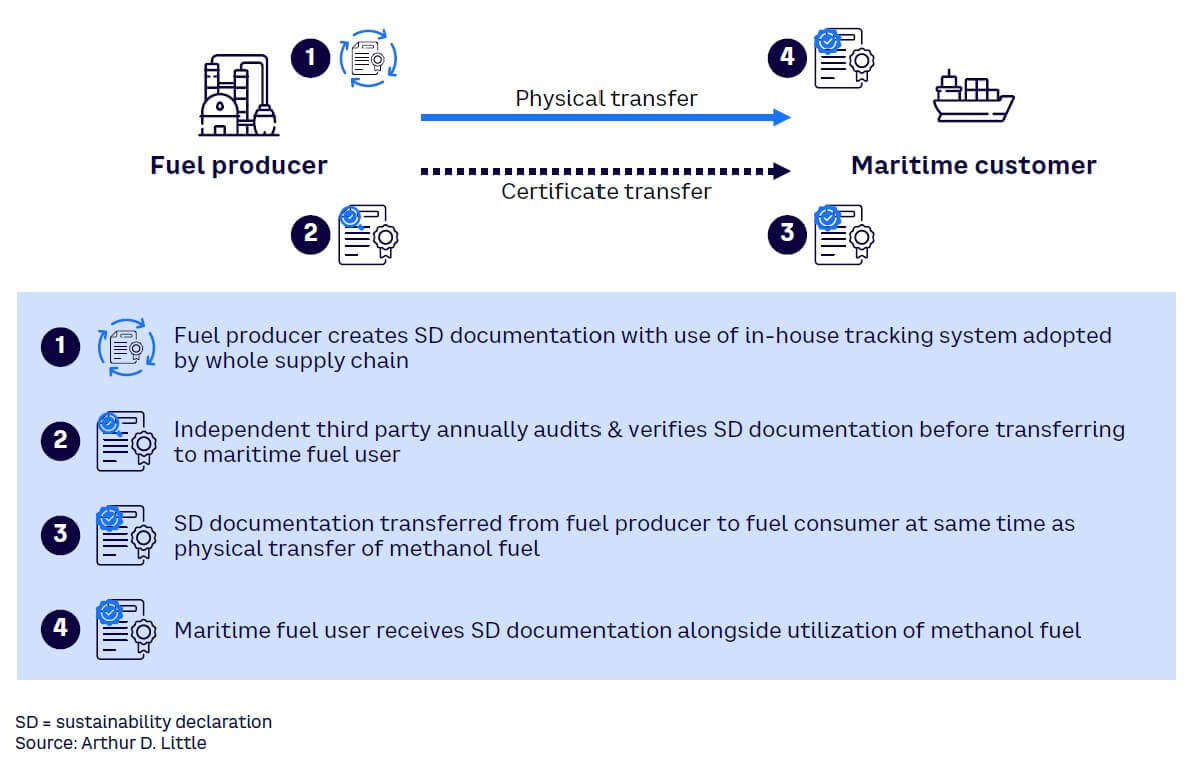

SEA countries could consider developing standards such as a guarantee of origin (GO) scheme, which would show customers that a unit of energy aligns with a scheme’s criteria. However, since certification schemes take time to develop and implement, producers and customers can navigate around current challenges in the interim by taking one of two options:

-

Identify available certification schemes based on customer requirements and supplement shortfalls with self-declared documentation (e.g., internal lifecycle assessments to obtain fuel carbon footprints), audited by an independent third party.

-

Where adopting a certification scheme is not possible, develop an in-house tracking system and leverage data analytics and smart lifecycle assessment processes to generate a delivery documentation system that facilitates end-to-end communication across the supply chain, as shown in Figure 8.

4. EMBRACE DISRUPTIVE TECHNOLOGIES: AI

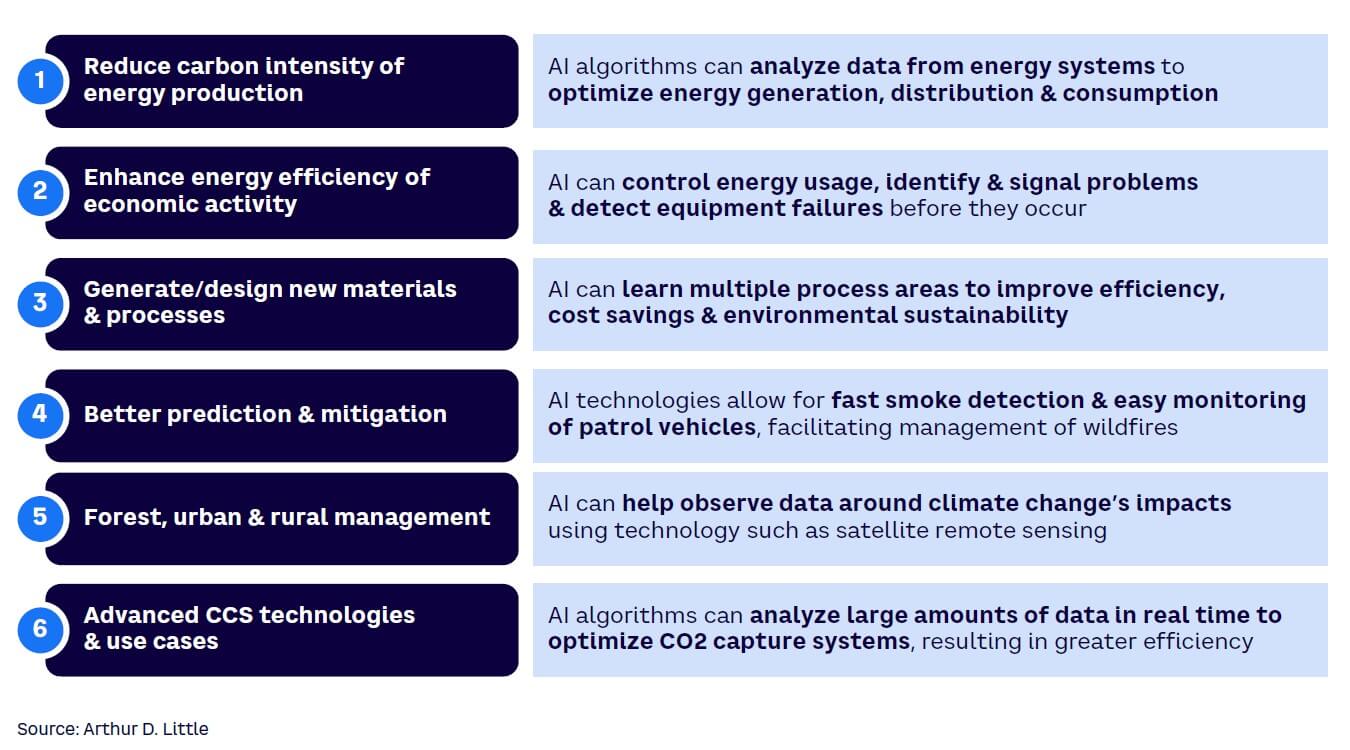

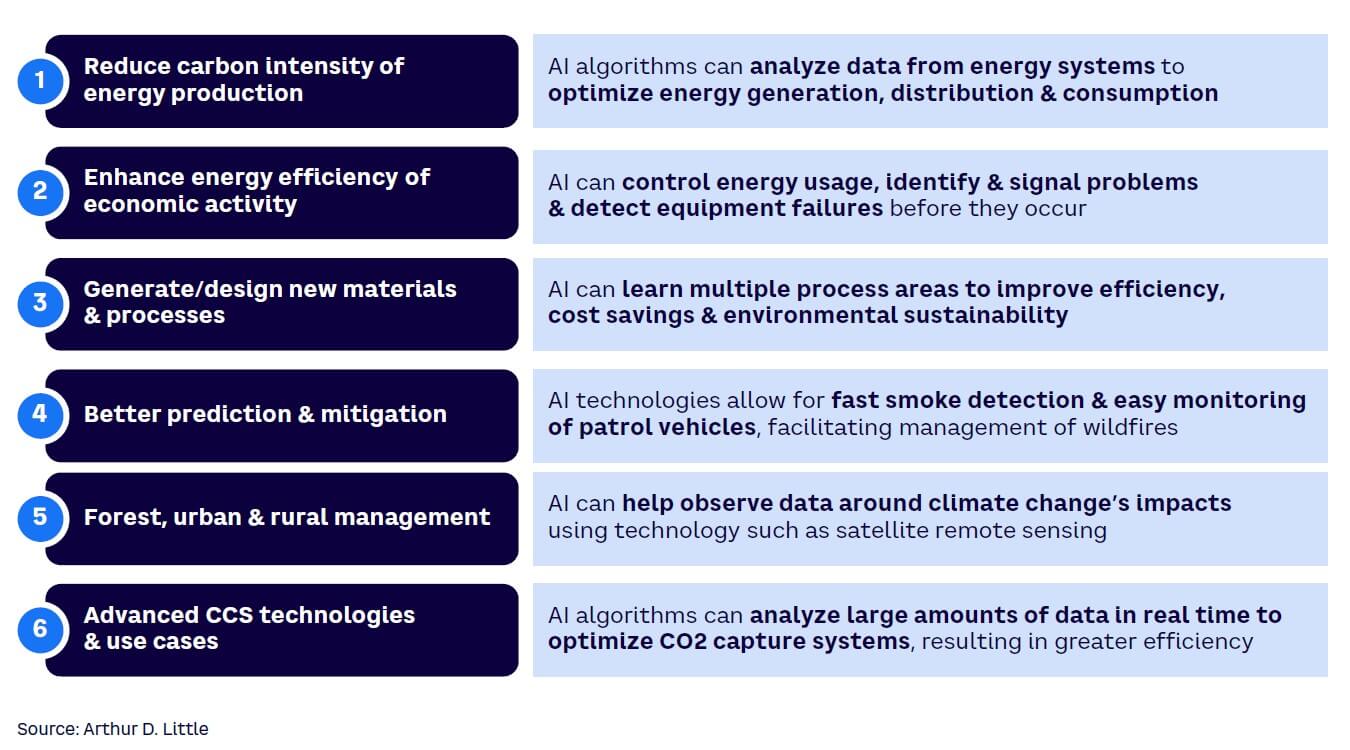

Decarbonization relies on new, emerging technologies and processes such as CCUS and DAC. At the same time, AI can assist in the transformation toward decarbonization (see Figure 9). AI has the potential to boost decarbonization substantially in terms of both reducing emissions and boosting carbon absorption by radically reducing the carbon intensity of energy production, enhancing energy efficiency, better predicting/mitigating carbon emissions from natural sources, enabling new policies for forest and ocean management, and enabling advanced CCU-to-X technologies.

Next steps

Multiple examples exist of global and SEA start-ups and larger organizations using AI to enable decarbonization across the value chain. SEA companies must first understand which of the dimensions impact them, then partner with relevant technology players and begin to pilot solutions. With the right mix of investments, policies, incentives, and prioritization, the SEA region can play a significant role globally in the new and exciting space of AI for decarbonization.

CONCLUSION

DELIVERING DECARBONIZATION IN SEA

The pressing need to decarbonize is an opportunity for transformation, providing countries and companies across SEA with the chance to innovate, leverage existing resources (e.g., bio-feedstock), and develop the infrastructure to meet changing demand needs. SEA can play a pivotal role in the development and adoption of green fuels, but policymakers must seize the opportunities across the region.

Returning to the questions asked at the beginning of this Report, we draw the following conclusions:

-

How can CO2 unlock a broader ecosystem of green fuels, and how are companies preparing for the transition to CO2-derived fuels? Access to feedstock is driving the growth of bio-based products, providing a pathway to CO2-derived fuels. Legislation and subsidies are key to encouraging uptake.

-

What is the state of the ecosystem for biofuels, and what obstacles does SEA face? The region is already a substantial producer of 1G biofuels and is well positioned to transition to 2G biofuels. Achieving this shift requires overcoming supply chain bottlenecks around feedstock.

-

What is the state of H2- and CO2-derived fuels in SEA, and what challenges does the market face? While there is enormous potential for the use of H2 in fuel production, to enable success the market must address current high renewable energy costs and a lack of regulatory support.

-

Where are the opportunities in SEA for CO2-based fuels? The combination of pressing needs and substantial regional demand hubs in shipping and aviation provides significant opportunities for CO2-based fuels, helped by growing government action.

-

How can businesses and governments build an ecosystem in SEA for regional decarbonization? Unlocking the region’s potential relies on increasing and accelerating regulatory support, deepening regional collaboration, introducing stronger certification, and harnessing new technologies like AI across both carbon emissions and absorption.

DOWNLOAD THE FULL REPORT

24 min read • Energy, Utilities & Resources, Oil, Gas & Other Natural Resources

Decarbonizing Southeast Asia: The green fuels race

Transforming a regional ecosystem to better utilize CO2

DATE

FOREWORD

UNLOCKING DECARBONIZATION POTENTIAL ACROSS SEA

Across the globe, there is currently an enormous, transformative shift away from fossil fuels, driven by the fundamental need to decarbonize to hit net zero targets as well as growing pressure from customers looking to embrace green alternatives. Achieving effective decarbonization requires a profound shift in the entire ecosystem around fuel production, distribution, and usage. As part of this shift, CO2 can anchor new ecosystems, enabling the creation of net zero fuels, whether bio-based or hydrogen (H2)- and CO2-derived products.

This shift provides opportunities for companies, customers, and societies across Southeast Asia (SEA) and will help SEA countries hit their wider decarbonization targets, particularly in crucial, hard-to-decarbonize, high-demand regional sectors, including aviation, shipping, and power generation. It will also help resolve pressing socioeconomic needs, such as reducing waste through reuse and investments in green fuel production and addressing the concerns of younger generations pushing to create a more sustainable world, both as consumers and entrepreneurs building sustainability start-ups.

A move to CO2 can unlock the broader universe of CO2-to-X and carbon capture and utilization (CCU)-to-X products, opening new possibilities for SEA and putting the region at the forefront of the global shift to decarbonization. Technology and processes like carbon capture, utilization, and storage (CCUS) and direct air capture (DAC) are central to this, lowering or eliminating greenhouse gases (GHGs), mitigating hard-to-abate emissions, and providing CO2 as a feedstock for green fuel production, while delivering the monitoring and measurement required for compliance, including through emerging technology like artificial intelligence (AI). Successfully scaling such technologies across SEA is vital to providing the infrastructure for change.

In the words of US Special Presidential Envoy for Climate John Kerry, “The energy transition is the new Industrial Revolution.” Just as earlier industrial revolutions dramatically reshaped industries and cities according to where value was located, so will the energy transition.

This shift makes understanding how to manage CO2 an economic, social, and political imperative for countries within SEA. To realize its potential, governments, regulators, and players across the value chain must act now to address the challenges (especially around cost, certification, and regulation) that are holding back the ecosystem’s growth compared to other regions. The transition requires concerted action on a regional, cross-industry basis that will enable companies to meet the changing needs of customers, preserve competitiveness, and transform regional economies through decarbonization.

Trung Ghi

Partner, Head of Energy & Utilities, Southeast Asia

EXECUTIVE SUMMARY

Against the backdrop of achieving net zero, companies from all industries must transform their strategies to focus on reducing and, over time, eliminating GHG emissions. Collectively, this decarbonization push will help countries achieve their net zero targets.

Decarbonization can be delivered through multiple approaches, such as electrification, adopting advanced materials, replacing industrial equipment with more sustainable alternatives, and asset optimization. One alternative approach is to effectively capture and use CO2 to create new products, such as fuels and chemicals.

With an emphasis on the approach of effectively reusing CO2, this Report focuses on decarbonization from the perspective of shifting the product mix to enable net zero. CO2 can serve as an anchor for a broader ecosystem of green products in the CO2-to-X and CCU-to-X domains. Examples include biofuels (derived from biomass, which absorbs CO2) as well as H2- and CO2-derived products (e.g., e-fuels).

While making greener products will not contribute directly to the producer’s own decarbonization, those products will enable its customers, end users, and the region to eliminate carbon emissions. For example, sustainable aviation fuel (SAF) helps airlines decarbonize their operations and hence supports national-level targets but does not necessarily enable SAF producers to hit their own GHG-reduction objectives.

Looking in-depth at SEA, achieving net zero across the region hinges on effectively managing carbon emissions and using carbon itself as a raw material for the net zero journey, such as by converting it into usable products. These products comprise both fuels and non-fuels (e.g., chemical products and derivatives). However, since fuel is a more urgent and pressing need compared to chemicals, this Report focuses on this area.

Specifically, the Report addresses these five questions:

-

How can CO2 unlock a broader ecosystem of green fuels, and how are companies preparing for the transition to these CO2-derived fuels?

-

What is the state of the ecosystem for biofuels, and what obstacles does SEA face?

-

What is the state of H2- and CO2-derived fuels in SEA, and what challenges does the market face?

-

Where are the opportunities in SEA for CO2-based fuels (both bio-based and H2- and CO2-derived)?

-

How can businesses and governments build an ecosystem in SEA for regional decarbonization?

1

HOW CO2 CAN UNLOCK ECOSYSTEM OF GREEN FUELS & HOW COMPANIES CAN PREPARE

Creating a decarbonized ecosystem across SEA relies on economies moving from fossil fuels to using CO2 as an anchor for new processes that create alternative fuels, using either biomass or H2 as production feedstock (see Figure 1).

Successfully collecting and harnessing CO2 enables producers to unlock a broader universe of products, including:

-

CO2-to-X fuels, namely biofuels (e.g., fatty acid methyl esters [FAME], hydrotreated vegetable oil [HVO], bio-SAF, and 1-3G biofuels)

-

CCU-to-X fuels, such as H2- and CO2-derived fuels

Figure 2 illustrates the differences between CO2-to-X and CCU-to-X products. (Since fourth-generation biofuels remain at an incredibly early stage in development, we do not cover them in this Report.)

2

PREPARING FOR TRANSITION TO CO2-BASED PRODUCTS

Globally, many companies have begun their transition to providing greener alternatives to fossil-based products. In most cases, they have initially created bio-based products but are now moving toward H2- and CO2-derived fuels.

The essential difference between bio-based products and their H2- and CO2-derived equivalents is the feedstock used in their manufacture. That means the same applications can use them, and they do not require a large-scale change to the distribution infrastructure or supply networks. Consequently, many producers are treating bio-based products as a first step on the path to H2- and CO2-derived products, shifting their focus as costs fall and regulatory policies change. Among the universe of alternative fuels, products with both bio- and H2-derived counterparts will enable this transition (see Table 1).

The shift toward H2- and CO2-derived pathways is further enabled by feedstock availability and regulatory mechanisms in the region.

Access to affordable feedstock

Across the region, biomass is readily available, providing a relatively affordable feedstock for bio-based products. This makes these products an ideal first step for producers looking to move away from fossil fuel–based products. In contrast, the cost of renewable energy is currently higher in SEA compared to other regions and supplies of low-cost H2 are also limited. This makes H2- and CO2-derived products more expensive than bio-based equivalents, although using hydropower or geothermal energy can aid cost-competitiveness, in select countries.

Regulatory mechanisms

Legislation (through mandatory uses and subsidies) is key to driving the transition to decarbonized fuels, particularly given their higher cost compared to fossil-based products. While the EU is the driving force behind much of current regulatory activity, it has a major impact on SEA, for two main reasons:

-

EU regulations impact global sectors such as the maritime industry, where SEA is strong (especially given Singapore’s position as a global maritime hub). Ships from the region that sail to EU ports are affected by EU maritime legislation.

-

Other nations/regions often adapt and adopt versions of EU legislation, meaning they can become de facto standards for many parts of the world.

Initially, markets like the EU focused on biofuels, such as through the Renewable Energy Directive (RED I) of 2009. However, regulators are increasingly recognizing the additional sustainability benefits and attributes of H2- and CO2-derived fuels, leading to new legislation that provides the market with confidence when investing in this area. For example:

-

In February 2023, the European Commission adopted the Additionality Delegated Act, which outlines how H2, H2-based fuels, or other synthetic fuels (including those produced with industrial CO2) can be considered as renewable fuels of non-biological origin (RFNBOs).

-

In July 2023, the EU launched the FuelEU Maritime initiative, which includes incentives to support the use of RFNBOs, including H2- and CO2-derived fuels.

3

STATE OF ECOSYSTEM FOR BIOFUELS & OBSTACLES IN SEA

FIRST-GENERATION BIOFUEL ECOSYSTEM

Given that SEA consists largely of countries with significant agricultural sectors, there is an abundance of bio-based feedstock for use in creating biofuels. For example, when it comes to first-generation (1G) biofuels (produced directly from crops), Indonesia and Malaysia are the two largest providers of palm oil in the world, responsible for 84% of global production, while Thailand is a major cassava producer.

The availability of this biomass has driven the establishment of a conventional biofuel sector across the region, with products including bioethanol (from sugar/starch crops) and biodiesel (from transesterification of oils). Currently, the development of more advanced biofuels is at an earlier stage (see Figure 3).

Given its natural advantages around biomass availability and established conventional biofuel industries, the region is poised to become a prominent producer and exporter; for example, it was responsible for 17% of global biodiesel production in 2022. Key strengths include:

-

Indonesia — 15% of global biodiesel production, supported by available, varied feedstock sources

-

Malaysia — 2% of global biodiesel production, driven by cost advantages

-

Thailand — 2% of global bioethanol production, driven by proximity to large Asian markets

Governments across SEA are driving local consumption and guaranteeing their own energy security by implementing a range of biofuel blending mandates (see Figure 4). Indonesia has set the most ambitious targets, mandating 35% bio-based biodiesel (B35) for road transport since August 2023.

However, there are challenges to 1G biofuels — particularly around certification and concerns over indirect land-use change — when using agricultural land for biofuel crops rather than for growing food. Many producers of bio-based feedstock (e.g., palm oil plantations in Indonesia and Thailand) remain uncertified. This makes it difficult to export products created from this, particularly to the EU, where restrictions exist to protect and promote the growth of the EU’s local industries. As Table 2 overleaf shows, certification is more advanced in Malaysia, where the Malaysia Sustainable Palm Oil (MSPO) mandate covers 88% of total plantation area.

While the EU is moving away from 1G biofuels, other countries are embracing them, meaning there is a pressing need to ensure that production meets sustainability criteria, delivers GHG savings, and has a lower adverse impact on the environment and society. Those efforts will open markets such as:

-

UK — which has committed to recognizing MSPO certification in due diligence guidelines for ensuring commodity sustainability

-

Singapore — where transport ministry is advocating for including palm oil as feedstock for SAF production

Additionally, producers of biodiesel must move beyond existing production, which is based on FAME processes and subject to recommended B5 blending limits (5% FAME and 95% fossil diesel, by volume), which narrows the percentage for use within existing fuels and hence their sustainability impacts. Shifting production to drop-in replacements such as HVO, which is not subject to blending limits, will thus increase biodiesel consumption and reduce GHG emissions. Production of HVO therefore must be developed and scaled up in the region, while producers should look to meet growing needs for 1G biofuels in areas outside road transport, particularly in the aviation sector.

UNLOCKING POTENTIAL OF 2G BIOFUELS

Second-generation (2G) biofuels provide significant advantages over 1G biofuels. They are more sustainable (with higher GHG emission savings) and, as they use waste products rather than crops as feedstock, they do not impact agricultural food production or lead to deforestation (see Figure 5).

The EU is currently the most advanced region when it comes to driving the shift to 2G biofuels. It has initiated policies to:

-

Enhance biofuel sustainability criteria — by increasing GHG emissions savings requirement for fossil fuels to 50%-65%

-

Limit/reduce use of crop-based biofuel — to 7% of energy consumption (or 2020 EU country consumption level plus 1%)

-

Encourage use of non-crop-based biofuels — with mandates around advanced biofuels

-

Phase out use of (some) crop-based biofuels — with an EU-wide ban on palm oil and a proposed blanket ban in Germany

As a major export market for SEA biofuel, EU legislation also will have an impact on producers in the region.

From a feedstock perspective, SEA is well positioned to make the transition to 2G biofuels produced through, for example, pyrolysis or gasification from waste-based feedstock, such as cooking oil or agricultural waste (see Figure 6). However, supply chain bottlenecks, particularly around the aggregation and collection of feedstocks from numerous, widely spread producers, is a key challenge. One way to address the issue is by securing feedstock from B2B partnerships, which provide a more centralized supply compared to distributed municipal solid waste sites. Some players in the region have already formed such partnerships. As an example, METPower is building biogas facilities using pineapple waste from Dole Philippines.

4

STATE OF H2- & CO2-DERIVED FUELS & MARKET CHALLENGES IN SEA

CURRENT H2- & CO2-DERIVED FUELS ECOSYSTEM

Across SEA, there is enormous potential for the use of H2 in fuel production, both in terms of feedstock availability and renewable energy production. Based on the carbon emissions involved in its production, H2 is classified into different colors (other colors, including white, pink, and turquoise, are also used to classify H2, although these are not yet as developed or widely used):

-

Green H2 — uses renewable energy, meaning production does not create any carbon emissions

-

Blue H2 — creates carbon emissions (e.g., by burning fossil fuels) but these are captured and utilized/stored through CCUS to mitigate emissions

-

Grey H2 — produced by using fossil fuels without any capture of emissions

Natural gas is a key feedstock for blue H2 production and is widely available across the region, with Indonesia, Malaysia, and Thailand large-scale natural gas producers. This has led many countries to focus on H2 as a key enabler for decarbonization across mobility, industry, and power generation, particularly when combined with renewable energy from wind, solar, and hydroelectric sources.

COST CHALLENGES

Renewable energy remains expensive in the region compared to the US, the Middle East, and Australia, impeding green H2 production. While countries across SEA possess distinct, economically viable renewable energy sources (e.g., hydropower in Laos and Malaysia and geothermal energy in Indonesia), these are currently underdeveloped, while hydropower is well established and cost competitive.

For example, Rystad predicts that by 2030 the levelized cost of green H2 (LCOH) in key SEA countries will be between US $3.5-$4.3 per kilogram compared to less than $2.5 in the US, the Middle East, and Australia. Reducing costs through new, cheaper renewable energy sources, such as hydropower in Malaysia, would reduce LCOH to around $2.6 per kilogram, according to a report by DNV. However, building a new hydropower plant is a time-consuming project, taking at least a decade to achieve functionality. Alongside renewable energy, the region also lacks other infrastructure, including R&D and production facilities (including electrolyzers and CCUS facilities), although multiple SEA countries have announced electrolyzer projects.

SECURING CO2 FEEDSTOCK

H2- and CO2-derived fuels involve a CO2 capture element. Multiple carbon capture and storage (CCS) projects, a key enabler of blue H2, are under construction in SEA, with facilities at Kasawari (Malaysia) and Panca Amara Utama Central Sulawesi (Indonesia) scheduled to become operational in 2025, and Arthit (Thailand) going live in 2026. CO2 is available in large volumes across the region, generally from industrial processes. The availability of biogenic CO2 (created by living organisms) is more limited, with development of DAC technologies focused outside the region, in Europe and the US. However, local companies have invested in DAC players, such as Singapore sovereign wealth fund GIC in Swiss-based Climeworks AG.

OVERCOMING TECHNOLOGY, REGULATORY & DEMAND CHALLENGES

Globally, the adoption of alternative fuels faces significant obstacles due to the need for innovative technologies and infrastructure to accelerate scaling. SEA lags other regions in developing production infrastructure for decarbonization, with insufficient CCUS technology penetration, for example, or a connected renewable power grid needed for large-scale production of blue and green H2 fuel.

Developing an alternative fuel ecosystem requires significant up-front investment. To justify it, producers must secure offtake contracts or guarantees from customers to mitigate their risks. However, the SEA region lacks relevant incentives and scale to encourage demand and the uptake of H2- and CO2-derived fuels, which are vital given the current higher cost of alternative fuels compared to fossil equivalents. For example, in the SEA region, only select countries have established H2 strategies; examples include Singapore, which has a national H2 strategy in place, and Malaysia, which recently announced the launch of the Hydrogen Economy & Technology Roadmap (HETR). Other countries have not yet published national H2 strategies or established clear frameworks or mechanisms, which reduces regulatory certainty for businesses and investors and thus discourages investment in H2 products.

This lack of regulatory support is particularly noticeable in three areas:

-

Targets, mandates, and incentives. Local countries lag behind the likes of the EU in terms of regulatory and financial incentives to drive demand. For example, in the EU and the US, subsidies such as the EU Innovation Fund and the US Inflation Reduction Act (IRA) incentivize development, making these regions global hubs for alternative fuel production.

-

Certification. Producers must be able to prove the decarbonization credentials of their alternative fuels if they are to be adopted en masse. However, SEA currently lacks sustainability standards for H2- and CO2-derived fuels, hindering local sales and exports to regions with existing standards like the EU’s RED II and California’s Low Carbon Fuel Standard (LCFS).

-

Knowledge. Many producers of sustainable/alternative fuels in SEA are not price-aware, which hinders the development of transparent price indexes that drive customer confidence.

5

SEA OPPORTUNITIES FOR CO2-BASED FUELS

As the energy transition continues, producers and their customers must understand where the biggest opportunities lie for bio- and H2-derived green fuels in order to properly focus their efforts and investments. In SEA, opportunities exist in alternative fuels due to three primary factors:

-

The presence of large-scale demand hubs in the region

-

The impact of the global regulatory/industry push around alternative fuels

-

Growing demand-side infrastructure readiness, especially in hubs like Singapore

For alternative fuels, transport offers the largest immediate target market due to its pressing need to decarbonize, responsibility for an estimated 20% of SEA emissions, and emissions growth of an estimated 2.2% per year. According to the IEA, to deliver net zero emissions by 2050, transport CO2 emissions must fall by more than 3% per year to 2030.

Within the sector, road transport is the largest CO2 emitter (see Figure 7). Here, alternative fuels (e.g., biofuels such as bioethanol and biodiesel) are expected to act as a complementary component to electrification in road transportation, particularly in heavy-duty applications, until the achievement of total electrification.

By contrast, electrification is not a viable option for the maritime and air transport sectors due to journey distances and weight constraints. This means that adopting biofuels and H2- and CO2-derived fuels is crucial for successfully decarbonizing these industries, leading to strong demand. Apart from transport, power generation also offers a potential opportunity for alternative fuels technologies within SEA.

OPPORTUNITIES IN THE MARITIME SECTOR

Responsible for 2.2% of global CO2 emissions, the maritime industry currently provides the largest and most urgent opportunity for alternative fuels (notably bio- and e-methanol), driven by significant potential demand, growing regulation, and infrastructure availability. Within the region, Singapore is taking a leading role in marine decarbonization, providing clear opportunities for the supply and take-up of alternative fuels.

Demand

Major maritime trade routes run across the region. In particular, Singapore is a key port for global shipping and is the largest bunkering (refueling) port in the world, with a volume of nearly 50 million tons in 2022, according to the Maritime and Port Authority (MPA) of Singapore. Demand is increasing as shippers respond to pressure from customers and set their own decarbonization targets. For example, Maersk has pledged to reach net zero emissions by 2040, and MSC has committed to the same by 2050. Demonstrating this, Ship & Bunker reports that 62% of new vessels ordered in H1 2023 are powered by methanol, compared to just 8% that will use traditional fuel oil.

Regulation/government action

Maritime operators must meet increasingly stringent rules developed at a global, industry, and local level. The International Maritime Organization (IMO) has set targets for the maritime industry to reach net zero by or around 2050 and reduce GHG emissions intensity by 20-30% by 2030 and 70-80% by 2040. These targets will rely on a smooth transition to alternative low/zero-carbon fuels. At a local level, Singapore’s MPA is promoting and supporting the use of renewable fuels as part of the country’s national strategy to reduce emissions, including through pilot programs and cross-ecosystem work on safety standards.

Infrastructure readiness

Alongside the growth in methanol-powered shipping, port infrastructure is already in place to enable the use of alternative fuels. For example, Singapore has already completed more than 70 methanol loading and discharging operations for industrial use since 2022, and local firms have ordered methanol-bunkering tankers.

OPPORTUNITIES IN THE AVIATION SECTOR

Aviation generates a similar level of emissions to the maritime sector, according to the IEA, with the entire industry focusing on achieving net zero, notably by the rollout of SAFs produced through bio- and H2- and CO2-derived pathways. SAFs are renewable liquid or gaseous fuels of non-biological origin produced by mixing green H2 with CO2, which can be captured directly from the air, from biogenic origin, or from industrial processes. They cover a wide range of feedstocks and processes, as shown in Table 3.

Demand

According to TheGlobalEconomy.com, Singapore, Thailand, Malaysia, and the Philippines are all in the top 30 of global aviation fuel users, signifying significant potential demand for green alternatives within the region. Singapore is the largest SEA user of jet fuel, ranking among the top 10 in the world by volume.

Regulation/government action

As with the maritime sector, aviation industry bodies are setting targets for decarbonization. The International Air Transport Association (IATA) aims to reduce emissions to net zero by 2050, with 65% of this reduction a result of using SAFs. On the government side, the region currently lags others, notably the EU, which has set mandated targets for usage through the RefuelEU regulation. However, there is growing interest from SEA governments in this area, again led by Singapore, which in May 2023 said it was studying rules to oblige airlines to use SAF on flights departing from the state.

Infrastructure readiness

For use within aircraft as drop-in replacements for fossil-based fuels, different SAF production pathways must fulfill strict certification requirements that prove that they match the physical and chemical characteristics of the fuels they are replacing and can therefore use the same infrastructure. As of January 2022, seven SAF production processes have been approved. In addition, two pathways for the coprocessing of renewable feedstocks in petroleum refineries are approved with a blending limit of 5% (refer back to Table 3). Notably, as estimated by IATA, overall SAF production reached more than 600 million liters in 2023. Given regulatory imperatives and growing demand, production is expected to grow rapidly, both globally and in SEA.

OPPORTUNITIES IN THE POWER SECTOR

Outside transport, power generation also offers opportunities for the use of bio- and H2- and CO2-derived fuels within the region. Given the size of its current emissions volume (over 40% of the global total, according to the IEA), and the fact that emissions are increasing, there is a pressing need to decarbonize the sector across the value chain. This can be achieved upstream — by using renewables (including landfill gas and biomethane), gas-to-power, co-firing (e.g., ammonia co-firing in coal power plants), CCUS, bioenergy CCS, and DAC — and midstream through H2/biomethane injection.

Longer-term decarbonization can be through H2 and carbon capture, while renewables, including bio- and e-methane, provide interim solutions. Demonstrating their versatility, these can be used on their own as an alternative to natural gas (methane) for power generation or processed into further derivatives that provide both fuels and chemical applications via the gas-to-liquids pathway.

Presently, most activity is concentrated in biomethane because it is cheaper to produce than e-methane, although there is some variation among markets. In SEA, countries such as Singapore (distribution) and Malaysia (production) are looking at becoming green methane hubs, supplying internal needs and external markets through existing infrastructure.

6

BUILDING AN ECOSYSTEM FOR REGIONAL DECARBONIZATION

Although it has made some advances toward creating a regional decarbonization ecosystem, SEA remains behind other markets such as Europe and the US. By learning from their successes and best practices, the region can accelerate its progress, focusing on four key areas.

1. STRENGTHEN REGULATORY & POLICY SUPPORT

Governments in other regions have actively provided direct regulatory support for decarbonization through a combination of subsidies, tax breaks/investments, and penalties. For example:

-

The EU’s Innovation Fund and the US’s IRA provide subsidies to relevant building blocks and pillars, incentivizing economic, supply chain, and technological development to deliver indirect and direct impacts on the energy transition.

-

Governments in countries such as Australia and Germany have launched programs to fund the commercial gap between the current cost of H2 production and market price. Australia has assigned around $1.3 billion in funding from its Hydrogen Headstart program, while the German government has committed approximately $986 million over 10 years to compensate providers that take part in auctions of green H2 and its derivatives organized by the H2Global Foundation.

-

In the EU as well as countries such as Singapore and Japan, the implementation of carbon taxes and emissions trading systems serve as a driving force for organizations to reduce their emissions through various strategies, including the adoption of cleaner fuels, in order to avoid penalties.

SEA countries are beginning to introduce regulatory support in areas such as H2 and biofuels. For example:

-

Singapore has released a national H2 strategy and is looking to develop biofuels, especially for the maritime and aviation sectors. The Civil Aviation Authority of Singapore (CAAS) is developing a Sustainable Air Hub blueprint. Scheduled to be published by the end of 2023, it will provide a decarbonization roadmap for aviation in Singapore, with both 2030 and 2050 targets.

-

Malaysia includes a focus on H2 within its National Energy Policy. It provides a long-term roadmap to optimize production pathways for green, blue, and grey H2 and aims to create a local H2 ecosystem supported by R&D and commercialization capabilities across the value chain through regulations, collaborations, and pilot/market entry programs. The country has also recently announced a National Energy Council to facilitate the implementation of its National Energy Transition Roadmap, along with a renewable energy exchange to trade renewable energy.

Next steps

Countries across SEA must accelerate their regulatory support, incorporating lessons from other nations and regions and introducing direct and tangible incentives, targets, and penalties. Producers and customers should push for this greater support by highlighting growing demand and signal their commitment to decarbonization, sharing knowledge with regulators and governments.

2. COLLABORATE REGIONALLY ACROSS ECOSYSTEM & VALUE CHAIN

Across SEA, several national/industry-level partnerships dedicated to decarbonization have already been created, including:

-

The Global Center for Maritime Decarbonization (GCMD) in Singapore, created to support the sector in meeting or exceeding the IMO decarbonization goals.

-

The Asian Clean Fuels Association (ACFA), dedicated to the promotion and advancement of cleaner transport fuels.

-

Vietnam and Indonesia’s participation in Just Energy Transition Partnerships (JETPs), which fund pathways away from dependence on coal-based power generation.

-

The ASEAN Centre for Energy (ACE), an intergovernmental organization within the Association of Southeast Asian Nations (ASEAN) structure, has recently completed a research and development roadmap for biofuels.

-

Showing collaboration across the broader Asian region, 280 Japanese companies (including Toyota and Sumitomo Mitsui Financial Group) that make up the Hydrogen Value Chain Promotion Council have launched a multi-billion-yen investment fund to boost the development of the H2 industry.

However, opportunities remain for increased cross-geography partnerships that span the region, modeled on existing examples such as:

-

The German/Dutch collaboration involving the HyNetherlands and NortH2 projects, which aims to create a large-scale, integrated H2 ecosystem for alternative fuels (green methanol/green ammonia). This includes pipelines, an electrolyzer, green power generation, and transport hubs.

-

The Zero-Emission Shipping Mission, a cross-country collaboration that is co-led by the US, Norway, and Denmark. It aims to demonstrate commercially viable zero-emission ships by 2030.

-

The European Clean Hydrogen Alliance, which aims to facilitate customer demand (e.g., by publishing a list of 840 H2 projects), technology transfer (through an electrolyzer partnership), and knowledge sharing through roundtables to promote H2 development and address adoption issues and barriers.

Next steps

Governments and industry together need to build wider ecosystems and partnerships, focused on bringing together producers and customers across SEA. This could be reinforced through technology-transfer agreements or through offtake arrangements.

3. DEVELOP ROBUST CERTIFICATION MEASURES

One area where Europe and the US are far ahead of SEA is around certification, with specific standards already in place. These include:

-

The EU’s RED II, Emissions Trading System (EU ETS), and FuelEU Maritime initiative

-

The CertifHy consortium, which has developed high-quality H2 certification schemes addressing consumer disclosure (from well to gate) to advance the European H2 economy

-

California’s LCFS

Robust regulation and certification would provide the required guarantees for both producers and customers to unlock investment and to commit to alternative fuels, justifying the price premiums required. In SEA, these would enable the development of cross-border supply chains and trade, stimulate demand for alternative fuels in the region, enable local producers to target export markets, and contribute to local and global decarbonization.

Next steps

SEA countries could consider developing standards such as a guarantee of origin (GO) scheme, which would show customers that a unit of energy aligns with a scheme’s criteria. However, since certification schemes take time to develop and implement, producers and customers can navigate around current challenges in the interim by taking one of two options:

-

Identify available certification schemes based on customer requirements and supplement shortfalls with self-declared documentation (e.g., internal lifecycle assessments to obtain fuel carbon footprints), audited by an independent third party.

-

Where adopting a certification scheme is not possible, develop an in-house tracking system and leverage data analytics and smart lifecycle assessment processes to generate a delivery documentation system that facilitates end-to-end communication across the supply chain, as shown in Figure 8.

4. EMBRACE DISRUPTIVE TECHNOLOGIES: AI

Decarbonization relies on new, emerging technologies and processes such as CCUS and DAC. At the same time, AI can assist in the transformation toward decarbonization (see Figure 9). AI has the potential to boost decarbonization substantially in terms of both reducing emissions and boosting carbon absorption by radically reducing the carbon intensity of energy production, enhancing energy efficiency, better predicting/mitigating carbon emissions from natural sources, enabling new policies for forest and ocean management, and enabling advanced CCU-to-X technologies.

Next steps

Multiple examples exist of global and SEA start-ups and larger organizations using AI to enable decarbonization across the value chain. SEA companies must first understand which of the dimensions impact them, then partner with relevant technology players and begin to pilot solutions. With the right mix of investments, policies, incentives, and prioritization, the SEA region can play a significant role globally in the new and exciting space of AI for decarbonization.

CONCLUSION

DELIVERING DECARBONIZATION IN SEA

The pressing need to decarbonize is an opportunity for transformation, providing countries and companies across SEA with the chance to innovate, leverage existing resources (e.g., bio-feedstock), and develop the infrastructure to meet changing demand needs. SEA can play a pivotal role in the development and adoption of green fuels, but policymakers must seize the opportunities across the region.

Returning to the questions asked at the beginning of this Report, we draw the following conclusions:

-

How can CO2 unlock a broader ecosystem of green fuels, and how are companies preparing for the transition to CO2-derived fuels? Access to feedstock is driving the growth of bio-based products, providing a pathway to CO2-derived fuels. Legislation and subsidies are key to encouraging uptake.

-

What is the state of the ecosystem for biofuels, and what obstacles does SEA face? The region is already a substantial producer of 1G biofuels and is well positioned to transition to 2G biofuels. Achieving this shift requires overcoming supply chain bottlenecks around feedstock.

-

What is the state of H2- and CO2-derived fuels in SEA, and what challenges does the market face? While there is enormous potential for the use of H2 in fuel production, to enable success the market must address current high renewable energy costs and a lack of regulatory support.

-

Where are the opportunities in SEA for CO2-based fuels? The combination of pressing needs and substantial regional demand hubs in shipping and aviation provides significant opportunities for CO2-based fuels, helped by growing government action.

-

How can businesses and governments build an ecosystem in SEA for regional decarbonization? Unlocking the region’s potential relies on increasing and accelerating regulatory support, deepening regional collaboration, introducing stronger certification, and harnessing new technologies like AI across both carbon emissions and absorption.

DOWNLOAD THE FULL REPORT