DOWNLOAD

DATE

Contact

The European fiber to the home (FTTH) market is experiencing significant growth, with a projected 18% CAGR, but FTTH players face challenges in securing funding for projects. This Viewpoint delves into refinancing dynamics, focusing on factors for obtaining timely, low-cost financing. It categorizes FTTH players into large standalone platforms, regional platforms, joint ventures with minimum guarantee, and utility-backed platforms — and examines success factors for each.

“There are further opportunities in the private sector, but this also comes with its own quirks. Of course, large providers will fund projects with their balance sheet in mind and will want to see evidence of a strong business case…. The opportunities are out there, it’s just a question of accessing them.”

— Outvise, February 2022

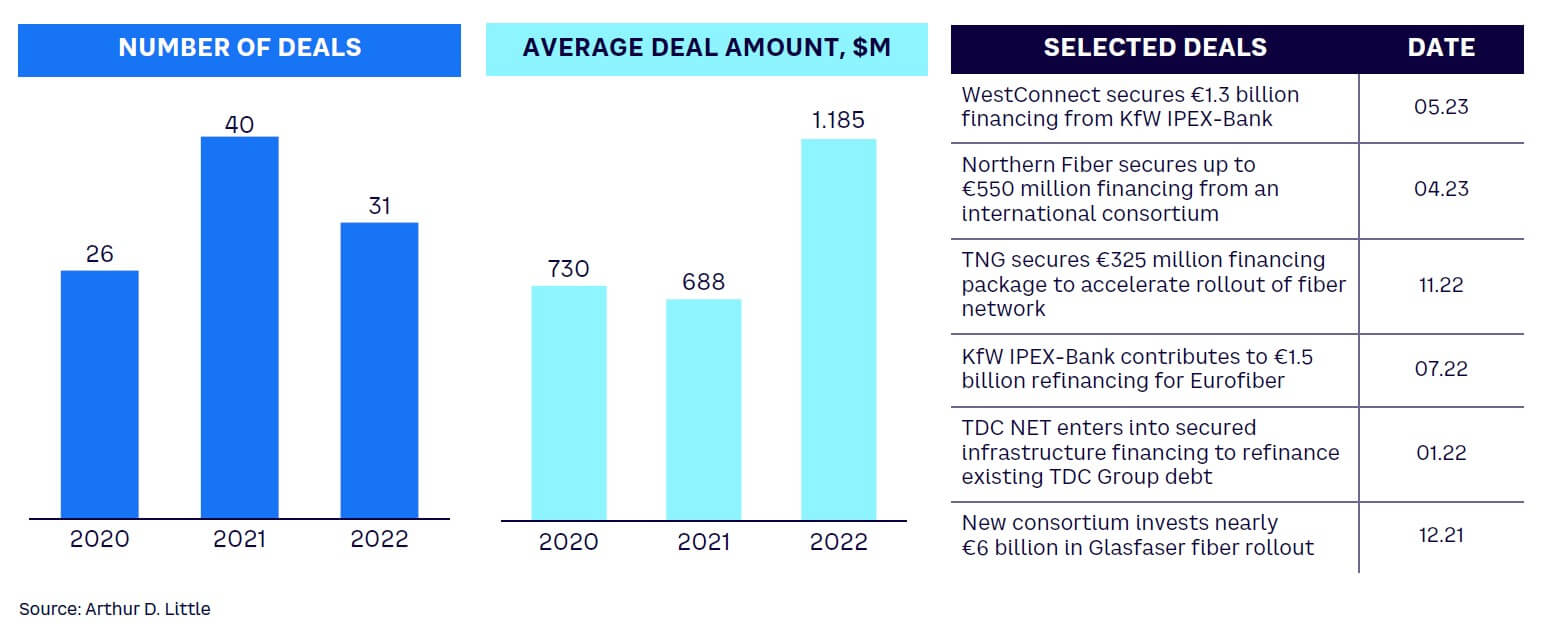

The EU has set its sights on gigabit connectivity in all member states by 2030, according to the European Commission. FTTH Council Europe says FTTH is the main thrust of this plan and forecasts FTTH growth at 18% CAGR until 2026, almost doubling in 2026 compared to 2022. The average fiber project deal size in 2022 saw a substantial increase of more than 170% (this may be attributable to the delayed effects of pandemic-related slowdowns and high multiples observed in carve-out deals).

Despite optimistic projections, the European fiber industry is experiencing refinancing difficulties as operators try to leverage their fiber assets and attractive growth prospects to secure favorable financing terms to support their expansion plans. Our analysis of 100 fiber project refinancing deals in Europe from 2020 to 2023 shows a transaction peak in 2021 (40 deals), followed by a 25% drop in 2022 (see Figure 1).

JPMorgan and other investors are raising concerns about financing in the telco industry. One reason is inflation, which skyrocketed in 2022 and 2023, reaching double digits in some countries. Based on multiple interviews with top telco executives, 30%+ of OPEX and 70%+ of CAPEX are inflation linked, including wages, leases, and energy. There is also a serious construction worker shortage in Europe exacerbated by the ongoing conflict in Ukraine. We predict workforce demand in the EU27 will peak in 2023/2024, with Germany and the UK potentially facing shortages until 2026.

By 2027, the labor shortage should stabilize as the fiber rollout slows down. In the past five years, total expected spending for the sector increased by 25%, mainly due to established players building fiber networks. However, industry CAPEX may have finally peaked. Current industry CAPEX/sales at ~19% marks a record high, so investment-level moderation and slower cash-flow growth is expected.

All of this calls the sustainability of FTTH business models into question. For example, at the beginning of 2023, German FTTH operator Glasfaser-Direkt filed for bankruptcy due to the withdrawal of a key investor, while helloFiber, which is backed by Liberty Global, exited Germany in 2023 due to cost pressures and limited access to capital.

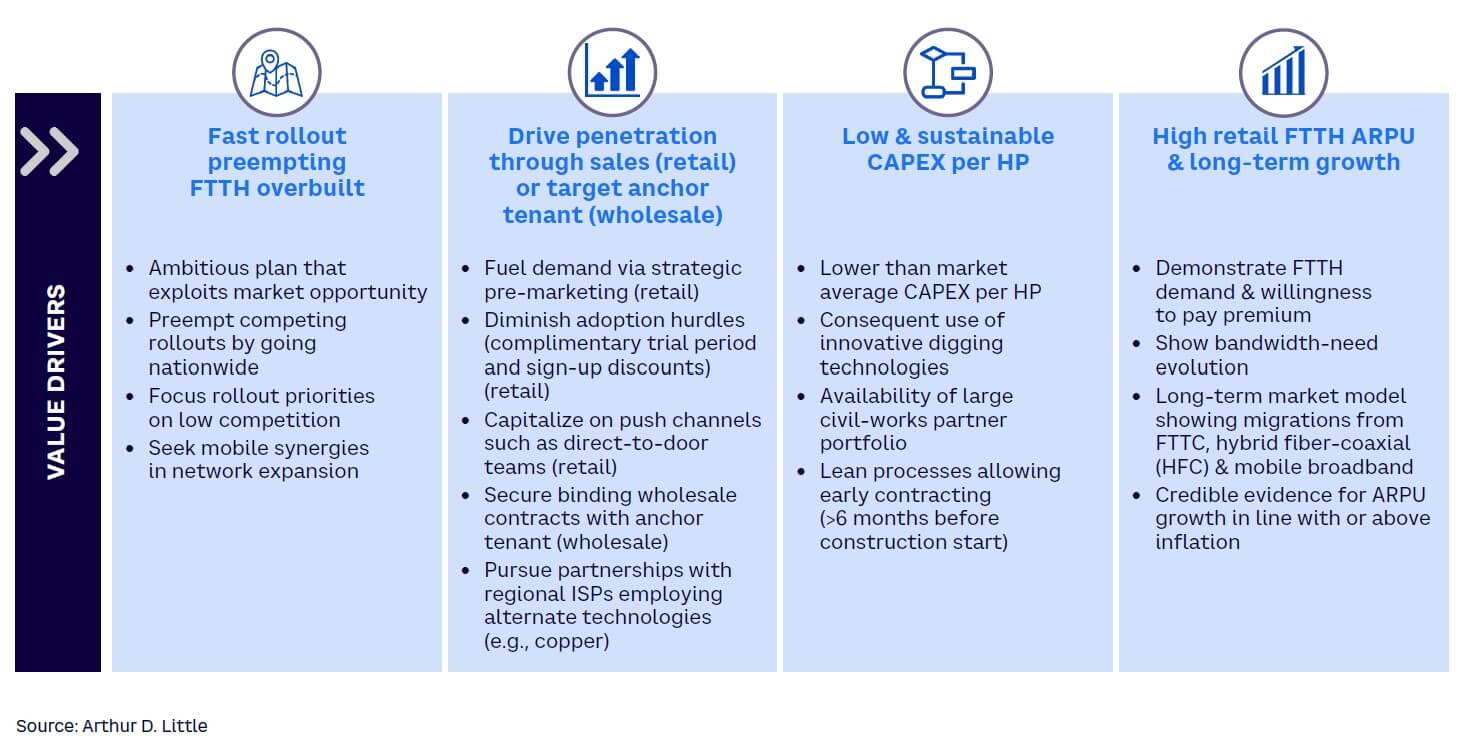

To successfully deliver on their business plans, operators must focus on a fast rollout to preempt competition, achieve high penetration rates, sustain high average revenue per user (ARPU), and maintain low CAPEX per home passed (HP) (see Figure 2).

Our analysis shows fiber refinancing issues are present in other markets, as demonstrated by the downgraded fiber-build targets of major telco players. In the US, Frontier Communications lowered its targets from 1.6 million to 1.3 million, and Altice USA reduced its plans from 1.6 million passings to 900,000. Lumen Technologies cut its multiyear fiber build target from 12 million to between 8 million and 10 million.

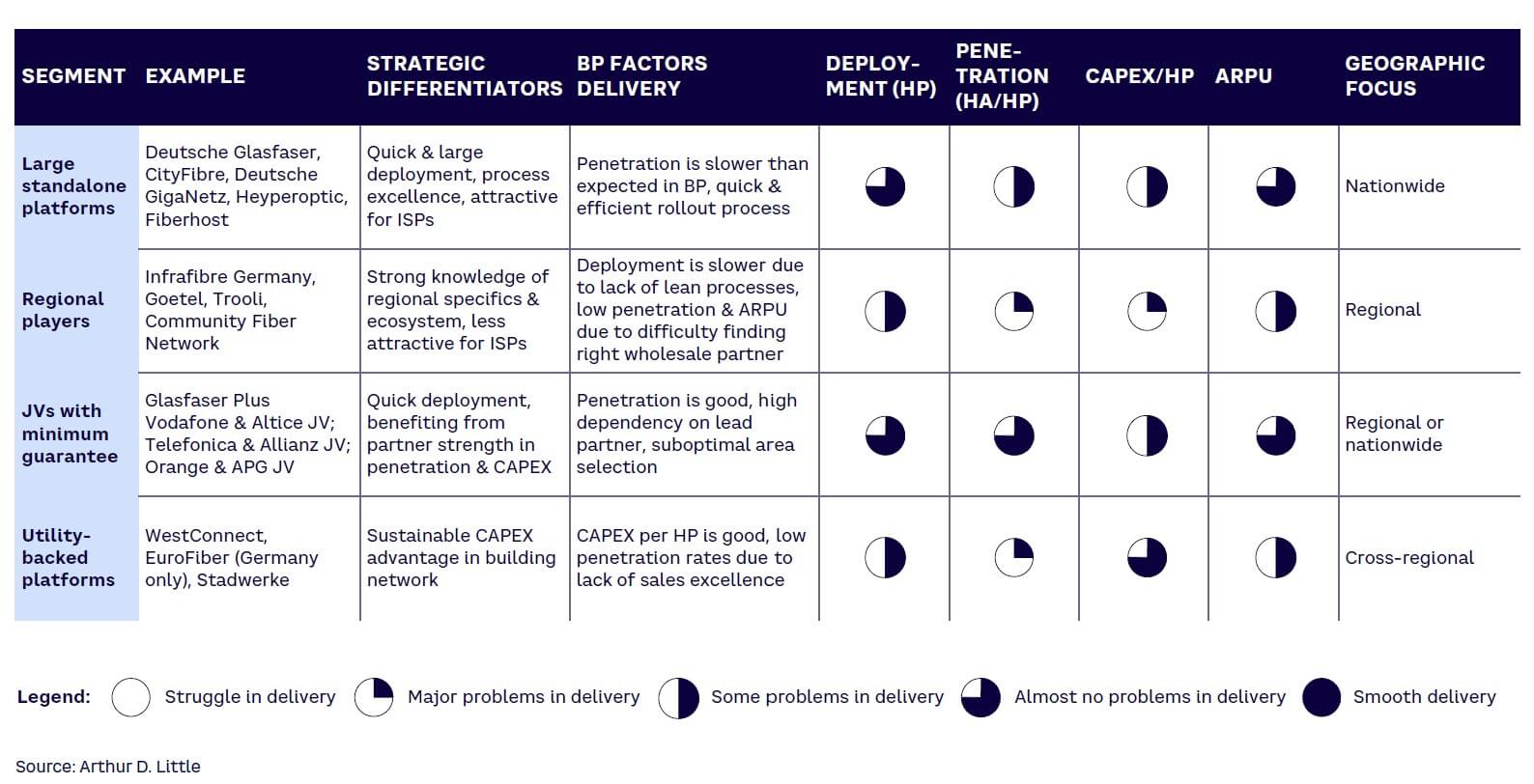

Our analysis began with dividing the market into four categories based on strategic differentiators, business plan delivery factors, and geographic focus. We then evaluated how each segment finances their projects and the factors that shape their financing decisions. This framework allows identification of critical success factors and provides actionable recommendations for FTTH players seeking refinancing.

FTTH SEGMENTS & REFINANCING DYNAMICS

The four segmented groups are: large standalone platforms, regional players, joint ventures (JVs) with minimum guarantee, and utility-backed platforms (see Table 1). Segmentation is based on strategic differentiators, strategic focus, the ability of a segment to deliver key business plan (BP) data, and geographic focus. Note that these evaluations primarily serve as scoring archetypes, since individual circumstances result in significant variance.

Large standalone platforms are under a great deal of pressure from private investors and use various de-risking strategies to ensure sustainable ROI. For example, Deutsche Glasfaser’s retail-focused strategy is supported by agreements with municipal authorities and relies on effective marketing campaigns ahead of build-out. Deutsche Glasfaser managed to secure a record financing deal of €5.75 billion (~US $6.4 billion) in December 2021. CityFibre’s wholesale-focused strategy is to secure binding contracts with an anchor tenant, creating partnerships rather than rivalries. This strategy allowed CityFibre to raise £4.9 billion pounds (~US $6.4 billion) in debt in May 2022, in addition to the £1.125 billion pounds (~US $1.5 billion) it had raised just a few months earlier, according to Dgtl Infra.

Regional players are characterized by excellent knowledge of their local ecosystem. This, together with targeting less competitive rural areas, enables strong cash flow. This is attractive to infrastructure equity investors and provides stable returns for financial institutions. South Germany’s Infrafibre Germany secured up to €550 million (~US $612 million) in financing from a global banking consortium for its digital infrastructure expansion, according to Legal Tribune Online. In August 2021, Trooli, a rapidly growing regional UK ISP, announced it had secured £67.5 million pounds (~US $87 million) from the Connecting Europe Broadband Fund and a consortium of commercial lenders to roll out full fiber broadband to 400,000 premises in 300 towns and villages within two years, reaching 1 million premises by 2024. However, smaller size (compared to large standalone platforms) and lack of robust processes often lead to complications for regional players seeking refinancing.

JVs with minimum guarantee are usually structured as JV partnership agreements between private equity funds and an existing player in the country. This structure benefits from risk sharing between owners, easier access to capital, and operational efficiencies from the incumbent’s broad resources. JVs can also immediately transfer the anchor tenant’s existing customers to the new network for a quick profit.

GlasfaserPlus, a 50/50 joint venture between Deutsche Telekom (DT) and IFM, is planning to build out 4 million FTTH lines in rural and development areas in 2028. These plans are underpinned by a US $2.3 billion project financing led by 20 banks, which closed at the end of May 2022, according to Proximo. Vodafone and Altice’s 50/50 joint venture is planning a potentially record-breaking rollout to 7 million homes by 2028; it plans to invest up to €7 billion (~US $7.8 billion) over the course of the rollout, 70% of which is debt. Asterix, a partnership between Bouygues Telecom and Vauban Infrastructure, aims to establish 2 million FTTH connections across medium-density regions in France through a €1.4 billion (~US $1.6 billion) commitment over five years, supported by a €104.5 million (~US $116 million) long-term loan from KfW IPEX-Bank, according to the bank.

Utility-backed platforms refer to fiber companies that are backed by utility players. These FiberCos leverage the infrastructure and established connections of their utility parents to build their networks. For instance, KfW IPEX-Bank orchestrated a syndicated €1.3 billion (~US $1.5 billion) financing deal for WestConnect’s fiber expansion, bolstering digital infrastructure and broadband connectivity for more than 1.5 million households in Western Germany, according to the bank. To avoid competing with larger players, these platforms tend to focus on rural areas. They can build networks quickly and at a lower unitary CAPEX by leveraging utility infrastructure. However, it’s important to note these advantages may not be unique or regulatory-proof across all markets. In certain regions, other market players may have access to the same infrastructure.

Moreover, the monopoly status of utility companies and potential market distortions may attract regulatory scrutiny. Therefore, it’s prudent to realize that such advantages may be neither exclusive nor universally compliant with competition laws.

Interestingly, ING Deutschland Managing Director Robert Sunderman told Proximo: “Companies have to show a track record of meeting business plans, as banks are becoming more critical — which is healthy development…. There has been a flood of fiber deals in the European market, banks are becoming pickier and more critical towards loose structures.”

KEY SUCCESS FACTORS & ACTIONS

The ability to secure funding is closely tied to the successful delivery of a robust business plan that can weather even the most unfavorable market conditions. Companies must demonstrate proficiency in planning, performance, and operations management to bolster the credibility of their business plans. We have observed that FiberCos with overly aggressive sales projections tend to struggle in the face of negative market scenarios.

Macroeconomic conditions are beyond the control of operators, so it’s important to focus on creating efficient, lean operations and carefully structuring and managing partnerships. Motivated teams with clearly defined roles and adequate incentive systems are also important (see “Efficient partner management” below).

Efficient operations

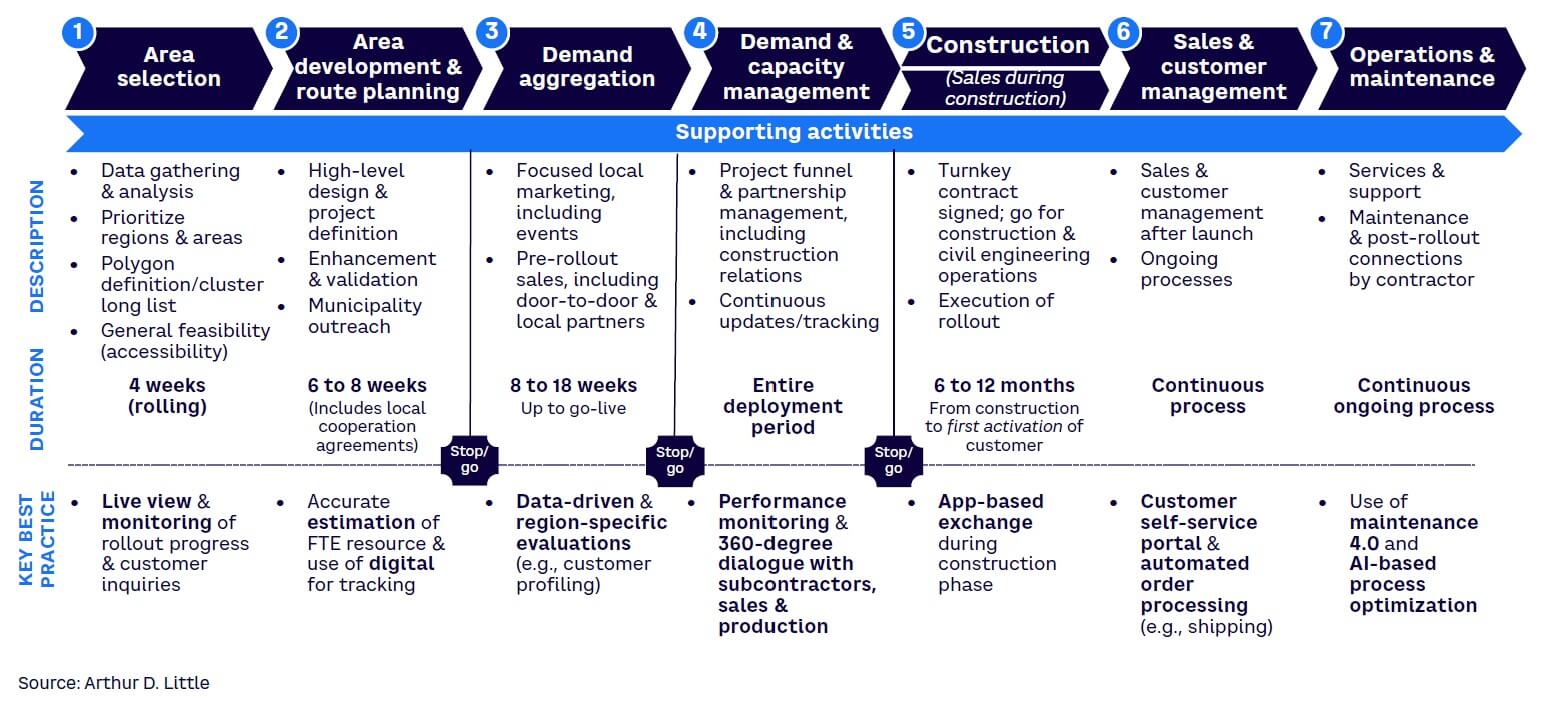

A typical fiber value chain focuses on six key activities (not including operations). Figure 3 shows best-practice examples for each step in optimizing efficiency and time:

-

During the area selection phase, the analytics department should support cluster preselection based on relevant data, GIS, and rule-based analysis and planning. High-level, real-time data management leads to faster, more cost-effective rollouts.

-

A well-maintained database results in more efficient, more accurate route planning during the area development and route-planning phase. Through strong, data-driven planning, innovative players can accurately estimate FTEs and optimize their CAPEX planning.

-

Reliable data collection and higher paybacks through efficient communication with sales should be the focus of the demand aggregation phase. Existing regional structures can be used to specify data aggregation. The most innovative players go beyond attracting local stakeholders to execute data-driven profiling of target groups and marketing via social media platforms.

-

During the demand and capacity management phase, fiber players should focus on faster expansion and better subcontractor management through far-sighted planning of available capacities. Best practices include stepping into long-term subcontractor partnerships and executing transparent demand planning against capacity bottlenecks (see “Efficient partner management” below).

-

During the construction phase, FiberCos should increase the use of digital tools for real-time communications and planning. In certain geographies, the importance of securing a partner proficient in backhaul delivery is paramount, owing to diverse challenges and requisite skills (e.g., intricate negotiations with multiple administrative bodies, varied technical competencies, and aerial network management).

-

During the sales and customer management phase, customer interaction and retention can be increased via end-to-end customer self-service. The focus should be on regional and customized sales with automated customer interfaces.

Efficient partner management

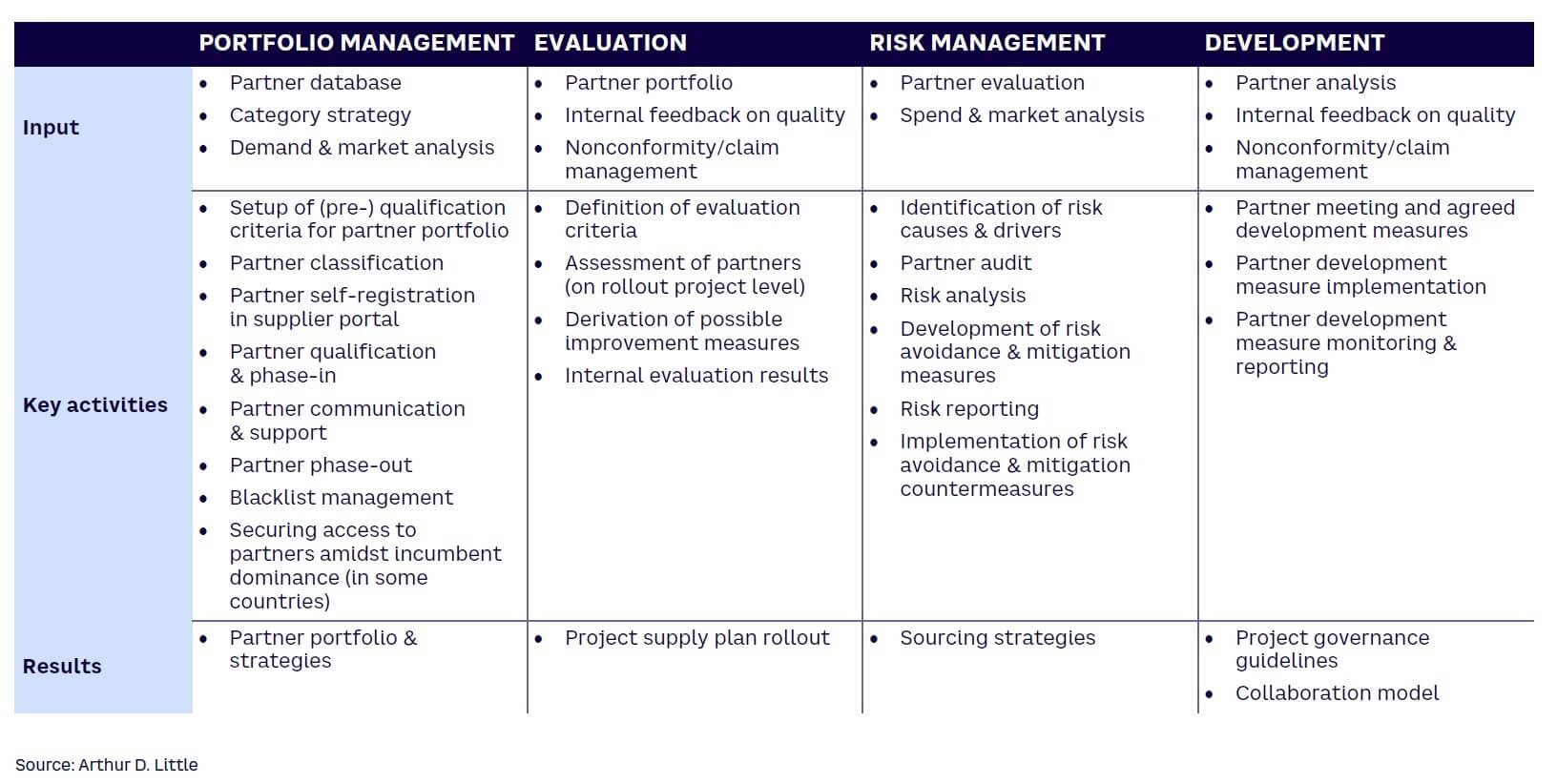

A structured partner-to-performance process allows fiber players to evaluate, monitor, and steer both sales and construction partners. Our framework highlights the four pillars of partner management: portfolio management, evaluation, risk management, and development (see Table 2). Each pillar has its own inputs, key activities, and results. Our process helps fiber players build a comprehensive partner portfolio and develop effective strategies while creating a well-defined project supply plan, identifying appropriate sourcing strategies, and providing project-governance guidelines that ensure efficient stakeholder collaboration. Here are several key topics to consider:

-

Service-level agreements (SLAs). Establish clear, detailed SLAs with construction and sales partners.

-

Performance monitoring. Implement regular monitoring and evaluation of partner performance using automated monitoring tools or onsite inspections.

-

Communication. Establish clear lines of communication and initiate regular status updates.

-

Training and support. Provide training and support to partners, including training on the product portfolio and support for marketing and sales efforts.

-

Incentives and rewards. Use incentives and rewards to motivate partners and encourage them to meet their performance targets (e.g., offer bonuses for hitting sales targets).

RECOMMENDATIONS

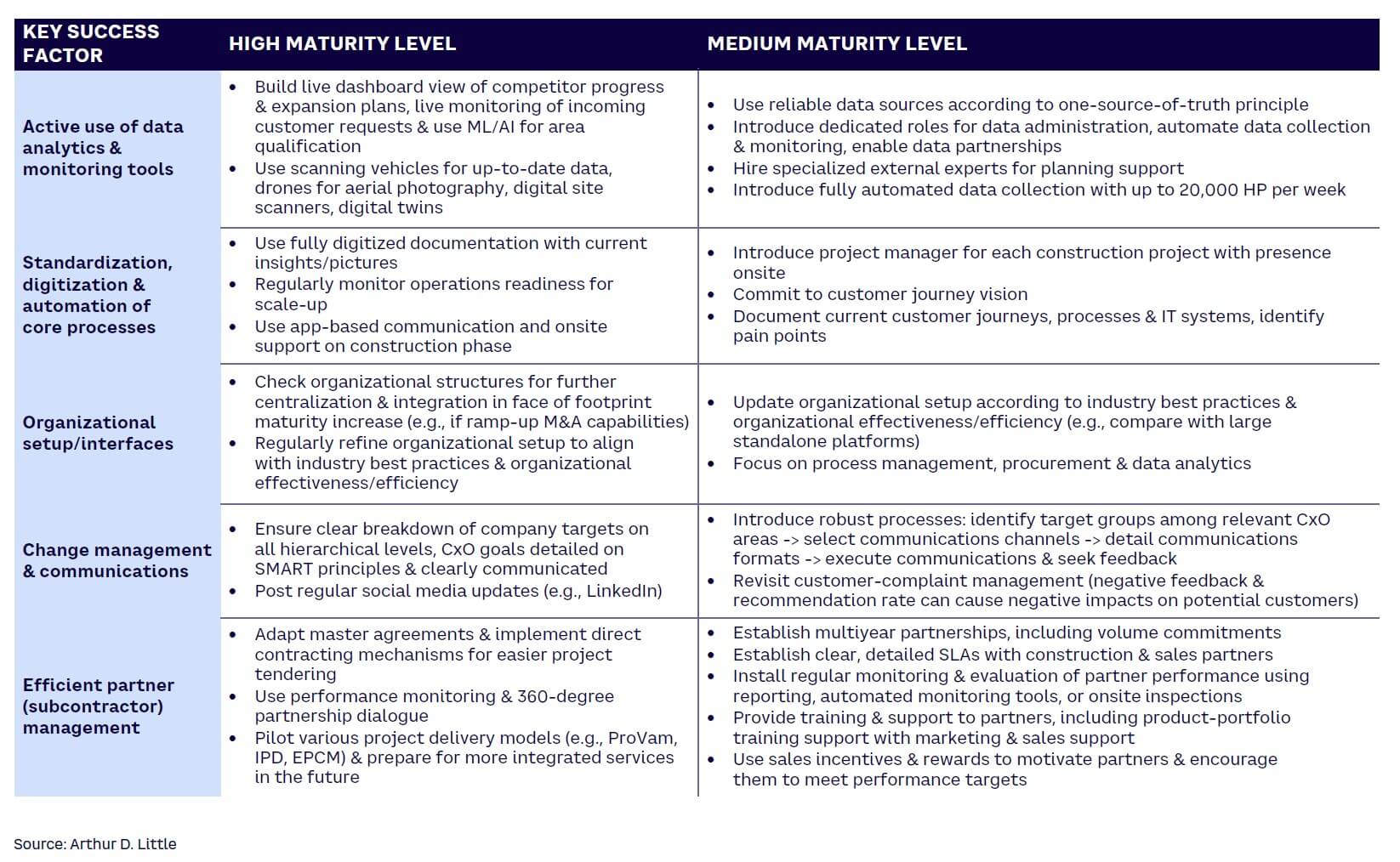

The recommendations in Table 3 apply to each of the segment categories in Table 1, but we have tailored the best practices to each segment’s maturity level. Generally, large standalone platforms and JVs with minimum guarantee are considered mature players while regional players and utility-backed platforms are less mature. However, this is not a rigid categorization; each segment can include both more mature and less mature players.

Conclusion

Solutions for delivering on business plans in a turbulent time

Amid accelerating investments in Europe’s FTTH market, understanding the dynamic landscape is critical. This means exploring various operator financing strategies, understanding the factors influencing investors’ decisions, and identifying key success factors relevant to each maturity stage.

To help stakeholders better understand the landscape, our framework looks at four main groups (large standalone platforms, regional players, joint ventures with minimum guarantee, and utility-backed platforms) and examines how each segment finances their projects and the factors that shape their financing decisions. We also identify key success factors based on the maturity level of the organization, including analytics, digitization, organizational structure, communications, and partner management.