11 min read • Organization & transformation, Strategy, Technology & innovation management

How to build a unicorn in the post-pandemic inflationary world

The global boom in start-up valuations has abruptly stopped. What felt like never-ending growth in venture capital and private equity investments that created a conveyor belt of new tech disruptors has been replaced by a landscape of failed initial public offerings (IPOs), dramatically lower valuations, and job cuts. Q3 2022 saw 37 new USD1bn+ valued tech unicorns created – a year earlier, the figure had been 165. Venture funding dropped by over 50 percent year-on-year. High-profile companies such as Paytm in India, Palantir in the US, and Klarna in Europe saw their share prices and valuations slide. Large investors such as Softbank and Tiger have lost billions on their portfolios.

All of this has caused many to write off start-ups as a bubble that has well and truly burst, particularly in the context of the wider “tech winter,” which saw an estimated 150,000 US tech workers lose their jobs in 2022.

What does this mean for today’s start-ups, their investors, and corporates that want to tap into their innovation? At a time when disruptive new ideas are seen as vital to solving global megachallenges, does this spell the end of transformative advances and fresh business models? Are unicorns destined to return to being mythical?

The positive news is that, despite current market valuations, money is still being invested. However, what attracts venture capitalists has changed dramatically – no longer is it about “blitz scaling” to create first-mover advantage, an approach that resulted in significant cash burn and limited or no profits.

Instead, start-ups must focus on the bottom line and profitable unit economics, retain (rather than churn) customers, and look at where they site their operations to maximize efficiency. Based on ADL experience and discussions with venture capitalists and start-up CEOs from across the globe, this article explains the new formula for creating unicorns – and retaining that valuation post-IPO.

DRIVING TOP-LINE GROWTH – THE FOCUS OF THE PREVIOUS DECADE

THE MODEL FOR START-UP SUCCESS

The successful emergence of trillion-dollar tech companies such as Amazon, Google, and Meta created a template for start-ups looking to disrupt the status quo. These pioneers attracted enormous private and public capital to bring about transformative shifts in consumer behavior and challenged the industrial incumbents.

Following this model allowed the likes of Uber, Lyft, Grab, and Deliveroo to build completely new business models in traditional markets. Hungry investors provided capital at gravity-defying revenue multiples (20 to 30x), and saw their shares increase in value as new rounds of funding were raised. In this race to back the next big thing, investors started placing huge bets on promising start-ups, focusing on the disruptive potential of technology, online marketplaces, and platforms. Global venture-capital investments grew from USD78bn in 2010 to USD643bn in 2021.

These investments were made against a backdrop of excess global liquidity and historically low interest rates. Alternative investment classes (such as real estate, commodities, gold, and treasury bills) underperformed, which meant cash-rich investors looking for high returns were willing to stomach extra risk in return for potentially outsized rewards when taking equity in start-ups.

TAPPING INTO THE INVESTOR MIND-SET

In most cases the model for start-up success was seen as focusing solely on the top line or growth. The aim was to build a leadership position through customer acquisition, whatever that cost. As this investor mind-set began to dominate, start-ups focused on building businesses with top-line growth and paid minimal attention to the bottom line, which led to huge cash burn driven by high customer acquisition costs.

Valuations soared between funding rounds, which meant backers saw enormous (paper) gains from their investments.

The increased adoption of digital services due to COVID-19 lockdowns, as well as breakthrough innovations in areas such as healthcare, fintech, and electric vehicles, led to enormous investments, notably through blank-check special purpose acquisition companies (SPACs).

THE SHIFT IN THE INVESTMENT MARKET

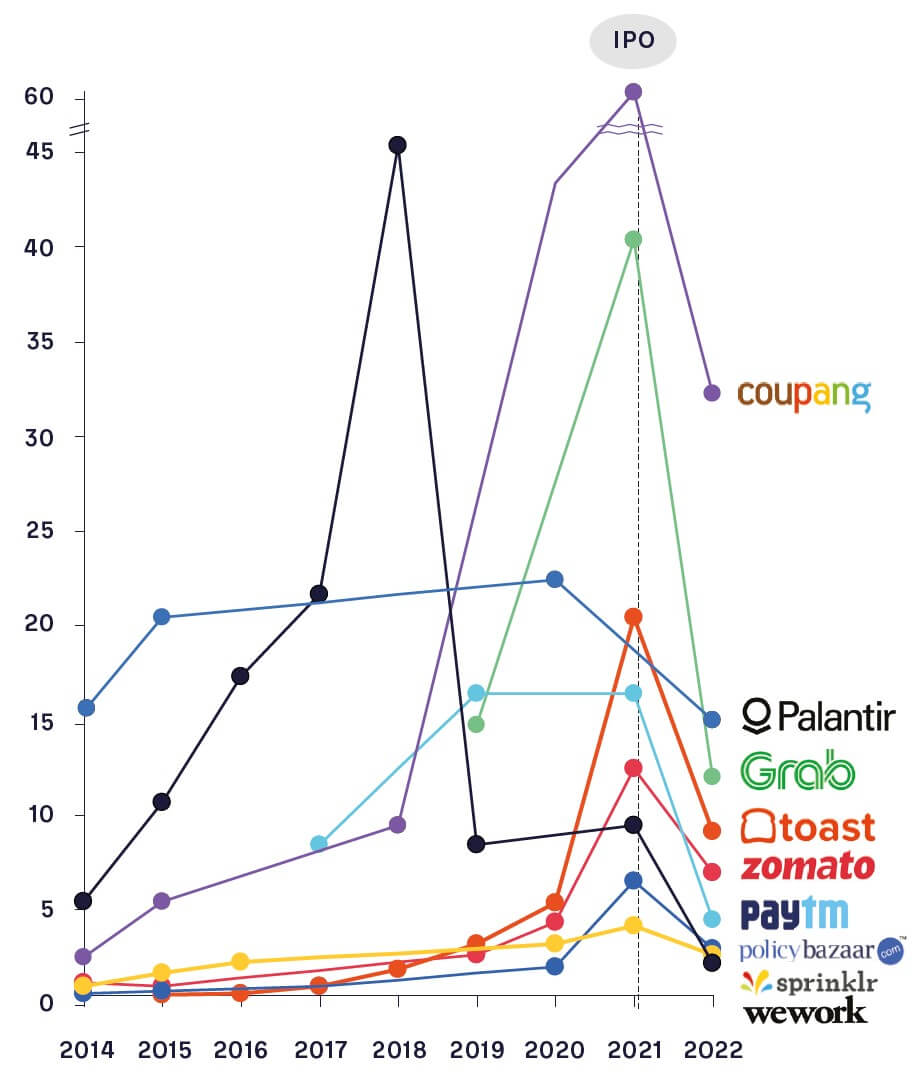

Given the combination of large valuations and perceived market interest, start-up investors across the world saw 2021–22 as the ideal time to get their investments listed and provide an attractive exit option. However, several high-profile failures demonstrated that the valuations they were looking for were not viable for institutional or retail investors. (See Figure 1.)

For example, as of December 2022:

-

Korean e-commerce company Coupang had a pre-IPO valuation of USD60 billion and traded at approximately USD32 billion.

-

Office provider WeWork had a targeted market valuation of USD47 billion in 2019. It had a market capitalization of USD1.9 billion.

-

Mobile payments provider Paytm had a USD16 billion pre-IPO valuation and traded at under USD7 billion.

Other start-ups saw falls in value of between 50 and 70 percent in their first year of being listed. Several start-ups (including Indian e-pharmacy PharmEasy, Canadian e-commerce start-up Hubba, and Australian music streaming company Guvera) have put their plans on the backburner as they could not guarantee high enough valuations. Over 80 percent of the companies that went public through a SPAC between 2020 and 2021 now trade lower than their initial IPO price.

While the IPO market provided early warning signals, the war in Ukraine and subsequent economic disruption deepened the crisis for start-ups and their investors. It has had multiple consequences:

-

Rising interest rates, leading to higher borrowing cost

-

Lower consumer spending in many categories due to high inflation and economic slowdowns

-

A drop in public market valuation that eventually affects private markets. Because of the increased scrutiny of investors, organizations now require stronger financials than before in order to earn the same valuation

-

Increased wariness from risk-averse investors about where they put their money, particularly as traditional investments in fixed income and commodities are delivering higher real returns

This funding winter means start-ups that previously could raise large sums are finding it increasingly difficult to maintain or grow their valuations. For example:

-

The internal valuation of financial services firm Stripe dropped from USD95 billion in 2021 to USD74 billion in November 2022.

-

Supermarket delivery start-up Instacart reduced its internal valuation in March 2022 by 38 percent, from USD39 billion to USD24 billion.

-

Swedish “buy now, pay later” payments start-up Klarna Bank was valued at USD45 billion in June 2021, but in a round of financing in 2022, it secured funding that valued it at USD6.7 billion.

All of these factors mean investors are only willing to place bets on category leaders or start-ups with a highly defensible moat. They expect markets to sustain just a few players, forcing others to exit in the wake of competition and inability to keep up with the rapid change in technology and customer demand.

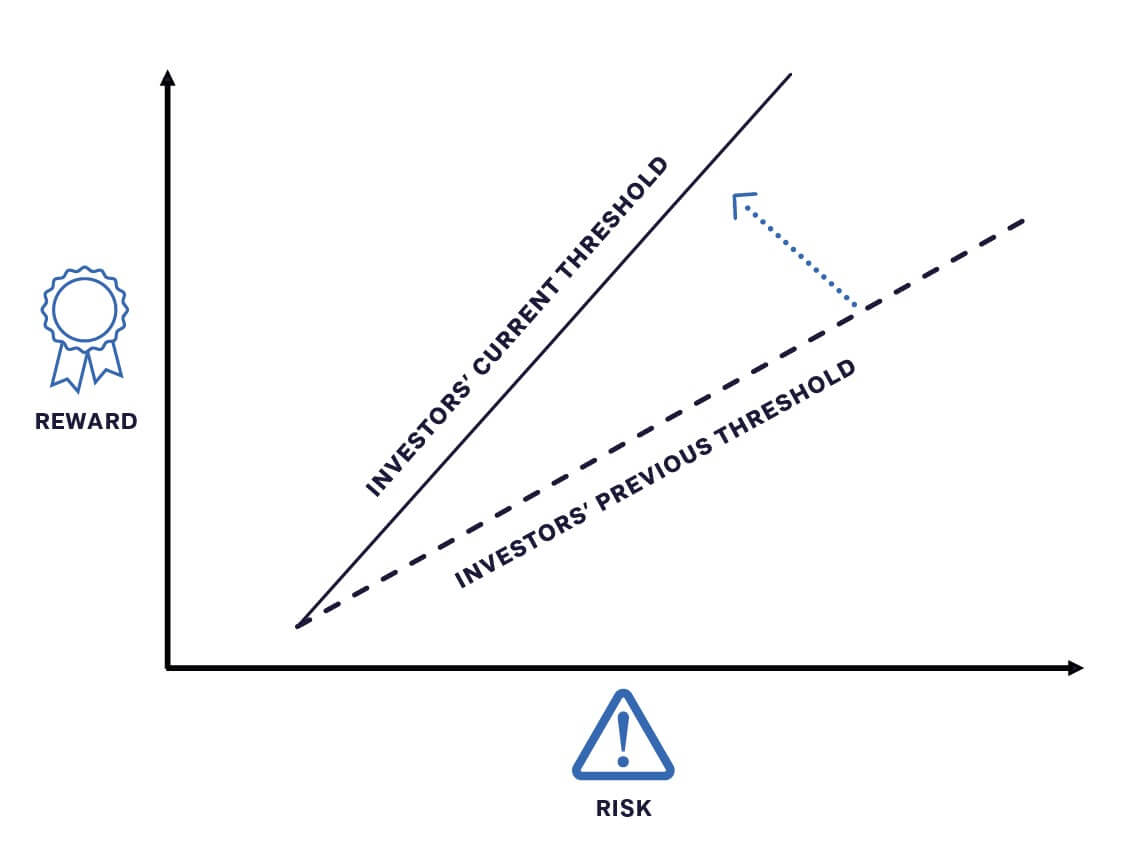

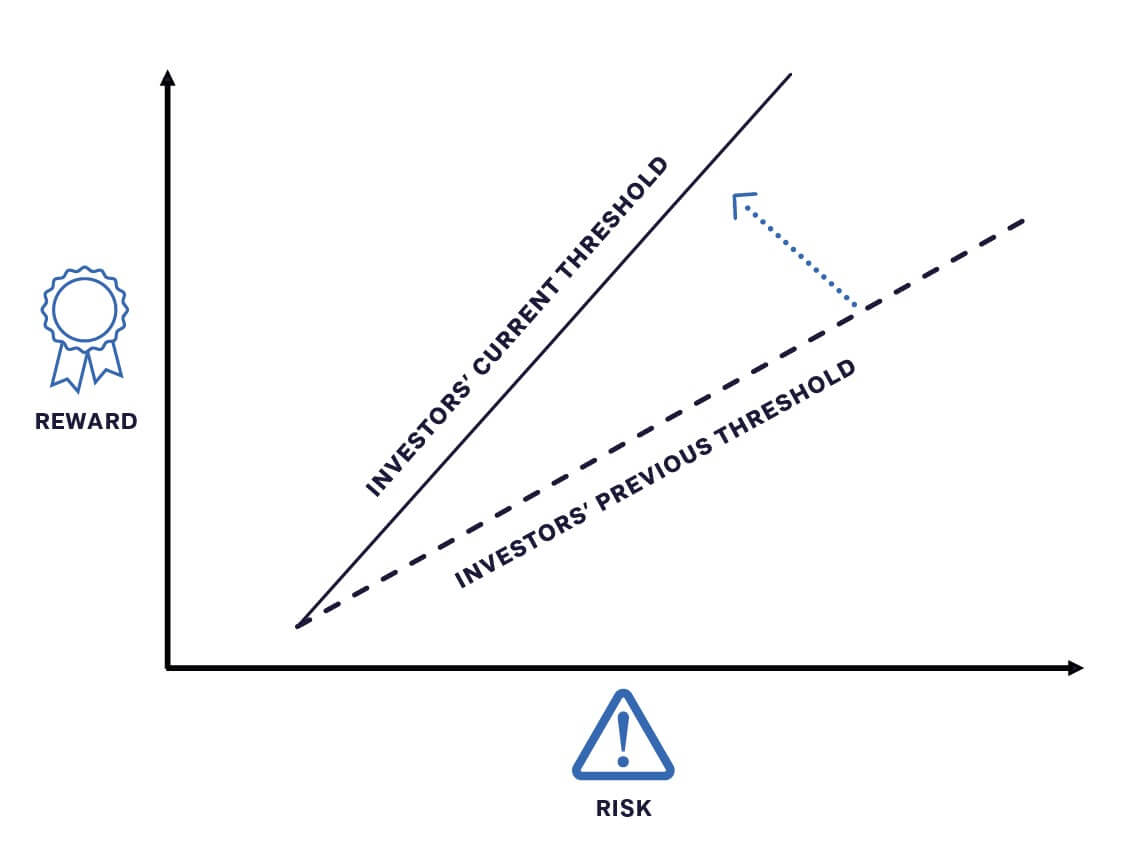

All of this has led to a shift in risk/reward thresholds (see Figure 2) and slowing of larger investments in favor of early-stage start-ups. Venture capital (VC) companies still spent USD81 billion in Q3 2022. However, how they assess start-ups has radically changed. The focus is not just on top-line growth, but also on businesses with a solid bottom line that could pass the IPO test that their peers have spectacularly failed in the recent past.

Start-ups are pivoting to react to these signals. Many have been taking huge steps toward ensuring profitability, such as through mass layoffs, reduction in customer acquisition costs, and shifting to venture debt funding to sustain the business.

INSIGHTS FOR THE EXECUTIVE – HOW TO BUILD UNICORNS IN THE NEW WORLD

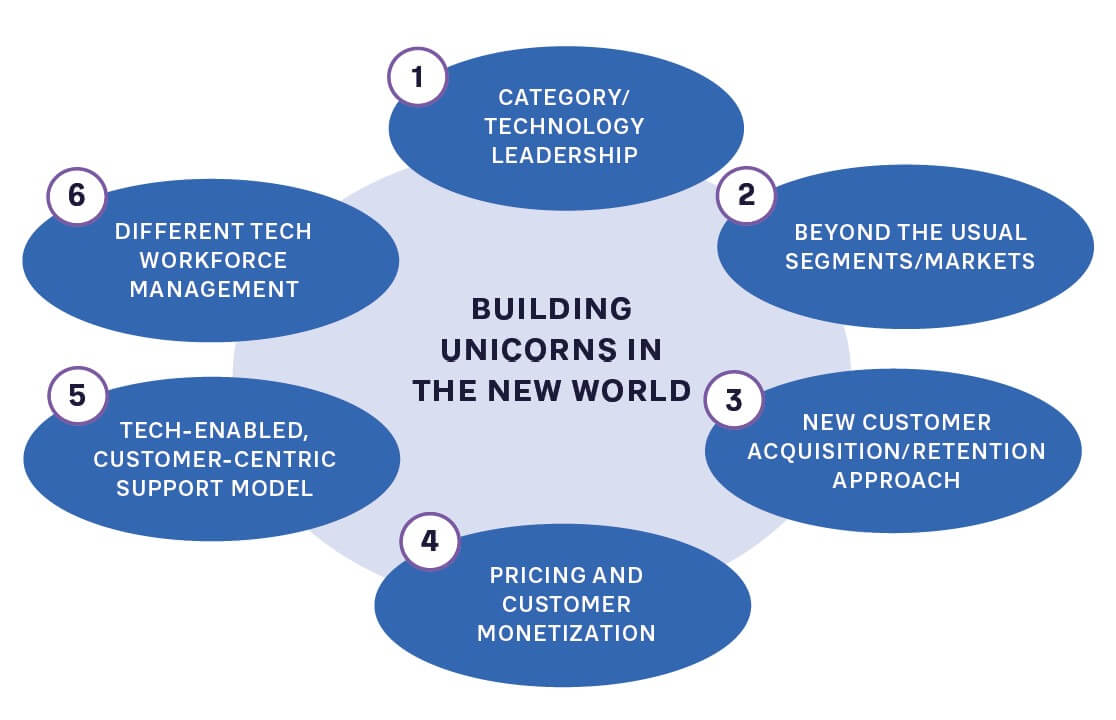

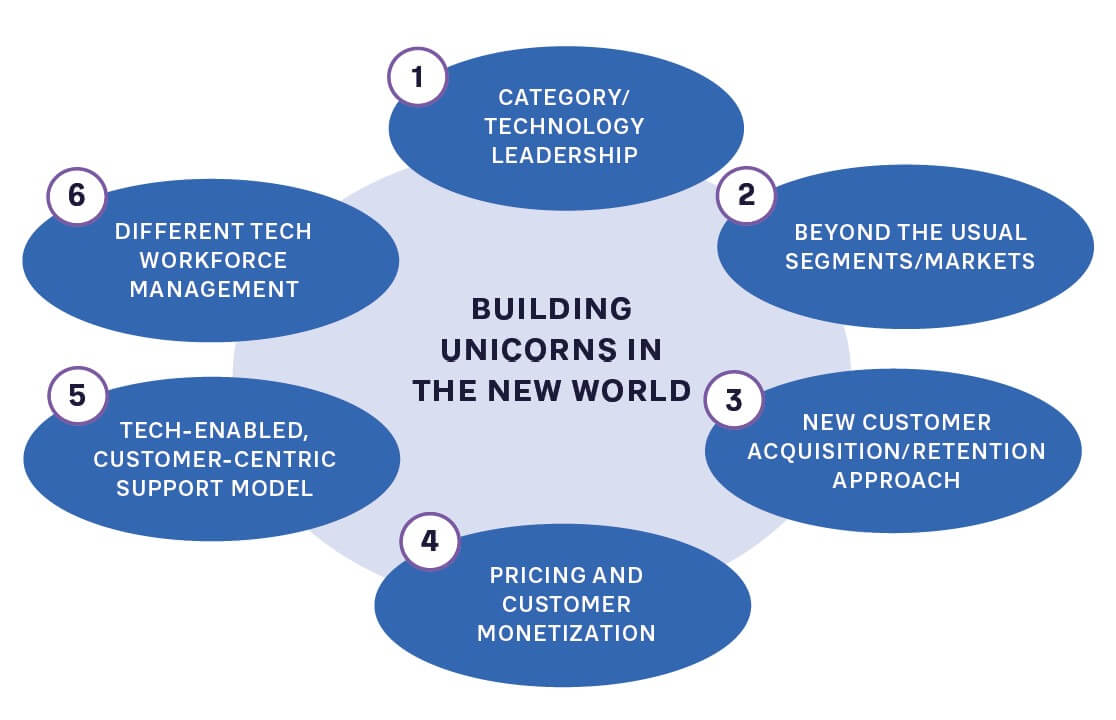

Based on experience working with investors, start-ups, and the wider ecosystem, we see six key dimensions that founders and management teams need to focus on if they are to become unicorns in today’s changed environment. (See Figure 3.)

1: AIM FOR CATEGORY OR TECHNOLOGY LEADERSHIP IN YOUR TARGET SEGMENT

Nowadays, product-market fit is not enough. Instead, customers and investors are looking for “insane product-market fit,” namely, 95 percent or more targeted customers should find the product or service offering compelling in comparison to alternatives available in the market. This will drive longer, deeper customer relationships, lower churn rates and net positive customer lifetime values.

On the operations side, businesses should look to build a more asset-light model with a quick path to profitability and capital efficiency. Unit economics are back in fashion and sustained profitable growth is greatly valued. Consequently, start-ups that can use this time to finesse their product and service and build lean, sustainable, and cost-effective business models will not just weather this prolonged winter, but eventually flourish and thrive.

“We’re looking at disruptors who are using tech to disrupt the ecosystem, and are not just building a tech-based solution.” – Managing Partner at a global tech-focused VC

2: LOOK BEYOND THE USUAL SEGMENTS AND MARKETS

The majority of start-ups begin their journey with pilots targeting specific, familiar markets – for example, B2C tier 1 cities and affluent consumers or B2B large corporates. This results in increasing hyper-competition between start-ups to grab wallet share of customers in these segments.

Yet multiple industries and customer segments remain underserved. Start-ups should therefore target these new addressable markets, such as tier-2 cities, SMEs, or areas such as ESG1.

“Most of the companies in our portfolio are witnessing massive growth from tier-2 cities, showcasing the need to focus on such underserved market segments.” – Managing Partner, Amicus Capital

3: TAKE A NEW APPROACH TO CUSTOMER ACQUISITION AND RETENTION

Rather than aiming to spend large marketing budgets to attract customers, start-ups need to adopt more targeted tactics. Spend is shifting from above-the-line activities such as advertising and sponsorship to below-the-line tactics with growing focus on referrals and word of mouth. Rather than employing glamorous celebrities as brand ambassadors, start-ups are working with lower-cost, more targeted social media influencers. Not only does this positively impact budgets, but it also is more trackable to ensure effectiveness.

Once customers are onboard, much greater emphasis should be placed on retention and upselling, rather than headline acquisition numbers. The focus for investors has now shifted toward metrics such as monthly active users (MAUs) and time spent per session, rather than, for example, app downloads.

“The biggest challenge when you are small is the old saying—revenue is vanity, profit is sanity, cash is reality.” – Shauravi Malik, Co-founder, Slurrp Farm.

4: FOCUS ON PRICING AND LONG-TERM MONETIZATION OF CUSTOMERS

Previously, many start-ups based their revenue models on “freemium” or ad-based approaches. Neither of these deliver the revenue certainty that investors are demanding – for example, economic conditions mean start-ups are finding it tougher to convert customers from free to premium packages once trial periods end. As the focus of investors has shifted from customer acquisition to customer retention, subscription-based revenue models have come into fashion once again.

However, subscription-based offerings should be flexible to keep pace with changing customer needs, as well as showing close, easily understandable alignment between value and price. For instance, beauty and personal-care companies are increasingly using a razor-and- blade pricing model in which the main product offered is cheap, but additions/refills are relatively expensive.

“Great companies are capital efficient, and we like to deal with great companies.” – Founder and Managing Director, early-stage US-based VC

5: BUILD A TECHNOLOGY-ENABLED, CUSTOMER-CENTRIC SUPPORT MODEL

While they’ve often claimed to be customer-centric, many start-ups have not carried this promise through from product creation to post-sales customer service. Following a top-line growth model based on acquiring new customers meant retaining existing ones was not a priority.

The new focus on reducing churn and increasing customer lifetime value, combined with higher customer acquisition costs, make retention a key success metric. While a product-market fit approach brings in customers, high-quality service is essential to maintaining market share. Ideally, service needs to be provided in-house to maintain quality customer service and high retention rates.

However, customer service has traditionally been a labor- and cost-intensive function that grows in tandem with market share. To break this link, startups should look at technology, particularly digital channels, AI, and natural language processing (NLP), to automate customer service through solutions such as chatbots and NLP-powered online FAQs.

“Start-up founders need to be mindful of the fact that their moat can be disrupted by their competitors, and must therefore strive to remain one step ahead.” – Shivathilak Tallam, Unitus Ventures

6: DIFFERENT TECH WORKFORCE MANAGEMENT

Most start-up founders are based in cities established as start-up hubs, such as the Bay Area in the US, Bengaluru (Bangalore) in India, Paris in France, or London/Cambridge in the UK. As they grow, they naturally expand their operations and teams in the same location. However, the rising popularity of these areas has driven increases in the cost of living and real-estate prices. For example, the cost of housing in San Francisco is no less than 238 percent higher than the US average. All of this results in higher salaries and operating costs.

Therefore, as start-ups begin their expansion phases, founders should plan on setting up centers in emerging hubs (such as Denver, Colorado and Austin, Texas in the US, or Hyderabad and Pune in India) where the cost of operations is relatively low. Additionally, start-ups located in developed countries should plan to effectively outsource operations to countries such as India, Poland, or Romania, where a highly qualified talent pool is available at a much lower cost.

On the technical side, as they grow, start-ups should look at improving operational efficiency. This could mean shifting from cloud-based solutions such as Amazon Web Services to managed and co-location services for their IT infrastructure.

“Multiple start-ups have initiated layoffs from their offices situated at high-cost locations because of their inability to justify such high salaries at premium locations.” – Founder, Indian Unicorn

Today’s funding winter is far from being simply a bad news story. It has provided a welcome driver for start-ups to focus on profitability and creating world-class businesses, rather than just growing the top line. They need to use the slowdown as a positive, removing extra fat from the organization and making their businesses lean and IPO ready, if they want to genuinely achieve lasting unicorn status with the benefits it delivers. Today corporates have a new opportunity to make strategic acquisitions, investments, and partnerships with start-ups in a less overheated market and with a more balanced risk/reward profile. They should take advantage while it lasts.

11 min read • Organization & transformation, Strategy, Technology & innovation management

How to build a unicorn in the post-pandemic inflationary world

DATE

The global boom in start-up valuations has abruptly stopped. What felt like never-ending growth in venture capital and private equity investments that created a conveyor belt of new tech disruptors has been replaced by a landscape of failed initial public offerings (IPOs), dramatically lower valuations, and job cuts. Q3 2022 saw 37 new USD1bn+ valued tech unicorns created – a year earlier, the figure had been 165. Venture funding dropped by over 50 percent year-on-year. High-profile companies such as Paytm in India, Palantir in the US, and Klarna in Europe saw their share prices and valuations slide. Large investors such as Softbank and Tiger have lost billions on their portfolios.

All of this has caused many to write off start-ups as a bubble that has well and truly burst, particularly in the context of the wider “tech winter,” which saw an estimated 150,000 US tech workers lose their jobs in 2022.

What does this mean for today’s start-ups, their investors, and corporates that want to tap into their innovation? At a time when disruptive new ideas are seen as vital to solving global megachallenges, does this spell the end of transformative advances and fresh business models? Are unicorns destined to return to being mythical?

The positive news is that, despite current market valuations, money is still being invested. However, what attracts venture capitalists has changed dramatically – no longer is it about “blitz scaling” to create first-mover advantage, an approach that resulted in significant cash burn and limited or no profits.

Instead, start-ups must focus on the bottom line and profitable unit economics, retain (rather than churn) customers, and look at where they site their operations to maximize efficiency. Based on ADL experience and discussions with venture capitalists and start-up CEOs from across the globe, this article explains the new formula for creating unicorns – and retaining that valuation post-IPO.

DRIVING TOP-LINE GROWTH – THE FOCUS OF THE PREVIOUS DECADE

THE MODEL FOR START-UP SUCCESS

The successful emergence of trillion-dollar tech companies such as Amazon, Google, and Meta created a template for start-ups looking to disrupt the status quo. These pioneers attracted enormous private and public capital to bring about transformative shifts in consumer behavior and challenged the industrial incumbents.

Following this model allowed the likes of Uber, Lyft, Grab, and Deliveroo to build completely new business models in traditional markets. Hungry investors provided capital at gravity-defying revenue multiples (20 to 30x), and saw their shares increase in value as new rounds of funding were raised. In this race to back the next big thing, investors started placing huge bets on promising start-ups, focusing on the disruptive potential of technology, online marketplaces, and platforms. Global venture-capital investments grew from USD78bn in 2010 to USD643bn in 2021.

These investments were made against a backdrop of excess global liquidity and historically low interest rates. Alternative investment classes (such as real estate, commodities, gold, and treasury bills) underperformed, which meant cash-rich investors looking for high returns were willing to stomach extra risk in return for potentially outsized rewards when taking equity in start-ups.

TAPPING INTO THE INVESTOR MIND-SET

In most cases the model for start-up success was seen as focusing solely on the top line or growth. The aim was to build a leadership position through customer acquisition, whatever that cost. As this investor mind-set began to dominate, start-ups focused on building businesses with top-line growth and paid minimal attention to the bottom line, which led to huge cash burn driven by high customer acquisition costs.

Valuations soared between funding rounds, which meant backers saw enormous (paper) gains from their investments.

The increased adoption of digital services due to COVID-19 lockdowns, as well as breakthrough innovations in areas such as healthcare, fintech, and electric vehicles, led to enormous investments, notably through blank-check special purpose acquisition companies (SPACs).

THE SHIFT IN THE INVESTMENT MARKET

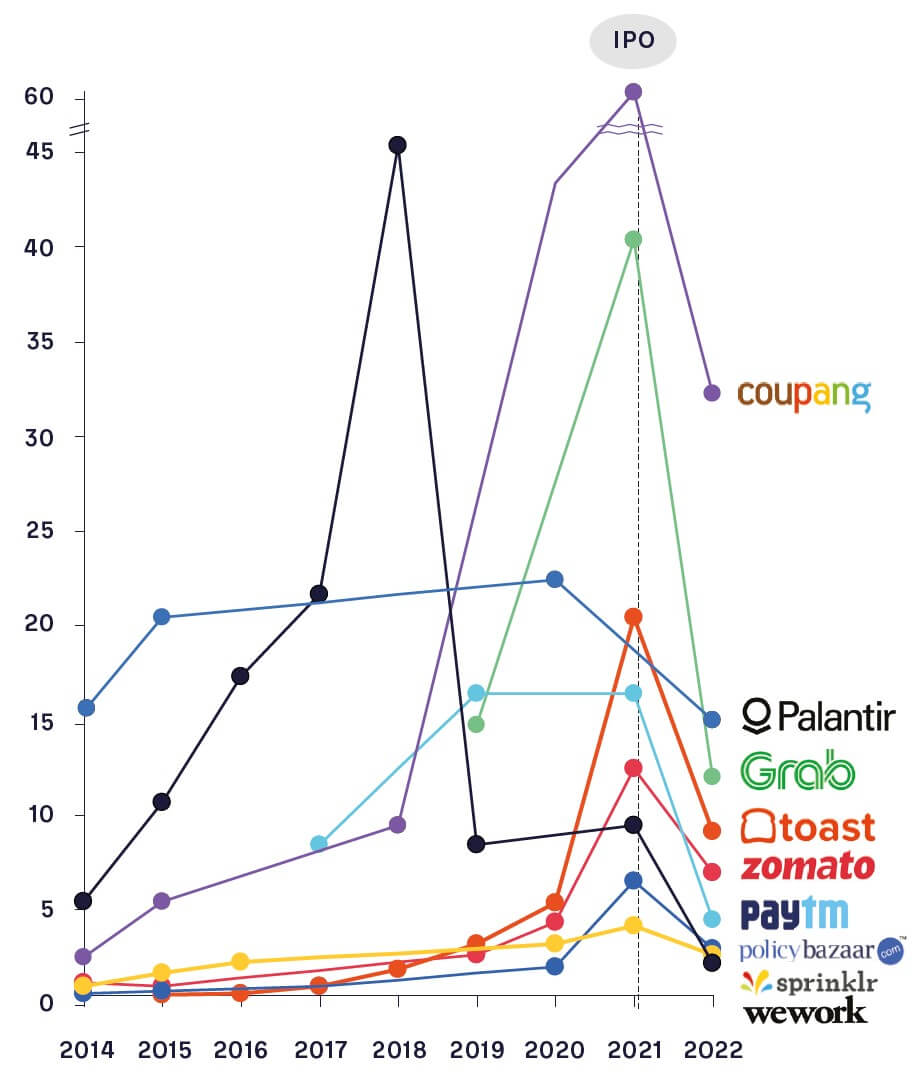

Given the combination of large valuations and perceived market interest, start-up investors across the world saw 2021–22 as the ideal time to get their investments listed and provide an attractive exit option. However, several high-profile failures demonstrated that the valuations they were looking for were not viable for institutional or retail investors. (See Figure 1.)

For example, as of December 2022:

-

Korean e-commerce company Coupang had a pre-IPO valuation of USD60 billion and traded at approximately USD32 billion.

-

Office provider WeWork had a targeted market valuation of USD47 billion in 2019. It had a market capitalization of USD1.9 billion.

-

Mobile payments provider Paytm had a USD16 billion pre-IPO valuation and traded at under USD7 billion.

Other start-ups saw falls in value of between 50 and 70 percent in their first year of being listed. Several start-ups (including Indian e-pharmacy PharmEasy, Canadian e-commerce start-up Hubba, and Australian music streaming company Guvera) have put their plans on the backburner as they could not guarantee high enough valuations. Over 80 percent of the companies that went public through a SPAC between 2020 and 2021 now trade lower than their initial IPO price.

While the IPO market provided early warning signals, the war in Ukraine and subsequent economic disruption deepened the crisis for start-ups and their investors. It has had multiple consequences:

-

Rising interest rates, leading to higher borrowing cost

-

Lower consumer spending in many categories due to high inflation and economic slowdowns

-

A drop in public market valuation that eventually affects private markets. Because of the increased scrutiny of investors, organizations now require stronger financials than before in order to earn the same valuation

-

Increased wariness from risk-averse investors about where they put their money, particularly as traditional investments in fixed income and commodities are delivering higher real returns

This funding winter means start-ups that previously could raise large sums are finding it increasingly difficult to maintain or grow their valuations. For example:

-

The internal valuation of financial services firm Stripe dropped from USD95 billion in 2021 to USD74 billion in November 2022.

-

Supermarket delivery start-up Instacart reduced its internal valuation in March 2022 by 38 percent, from USD39 billion to USD24 billion.

-

Swedish “buy now, pay later” payments start-up Klarna Bank was valued at USD45 billion in June 2021, but in a round of financing in 2022, it secured funding that valued it at USD6.7 billion.

All of these factors mean investors are only willing to place bets on category leaders or start-ups with a highly defensible moat. They expect markets to sustain just a few players, forcing others to exit in the wake of competition and inability to keep up with the rapid change in technology and customer demand.

All of this has led to a shift in risk/reward thresholds (see Figure 2) and slowing of larger investments in favor of early-stage start-ups. Venture capital (VC) companies still spent USD81 billion in Q3 2022. However, how they assess start-ups has radically changed. The focus is not just on top-line growth, but also on businesses with a solid bottom line that could pass the IPO test that their peers have spectacularly failed in the recent past.

Start-ups are pivoting to react to these signals. Many have been taking huge steps toward ensuring profitability, such as through mass layoffs, reduction in customer acquisition costs, and shifting to venture debt funding to sustain the business.

INSIGHTS FOR THE EXECUTIVE – HOW TO BUILD UNICORNS IN THE NEW WORLD

Based on experience working with investors, start-ups, and the wider ecosystem, we see six key dimensions that founders and management teams need to focus on if they are to become unicorns in today’s changed environment. (See Figure 3.)

1: AIM FOR CATEGORY OR TECHNOLOGY LEADERSHIP IN YOUR TARGET SEGMENT

Nowadays, product-market fit is not enough. Instead, customers and investors are looking for “insane product-market fit,” namely, 95 percent or more targeted customers should find the product or service offering compelling in comparison to alternatives available in the market. This will drive longer, deeper customer relationships, lower churn rates and net positive customer lifetime values.

On the operations side, businesses should look to build a more asset-light model with a quick path to profitability and capital efficiency. Unit economics are back in fashion and sustained profitable growth is greatly valued. Consequently, start-ups that can use this time to finesse their product and service and build lean, sustainable, and cost-effective business models will not just weather this prolonged winter, but eventually flourish and thrive.

“We’re looking at disruptors who are using tech to disrupt the ecosystem, and are not just building a tech-based solution.” – Managing Partner at a global tech-focused VC

2: LOOK BEYOND THE USUAL SEGMENTS AND MARKETS

The majority of start-ups begin their journey with pilots targeting specific, familiar markets – for example, B2C tier 1 cities and affluent consumers or B2B large corporates. This results in increasing hyper-competition between start-ups to grab wallet share of customers in these segments.

Yet multiple industries and customer segments remain underserved. Start-ups should therefore target these new addressable markets, such as tier-2 cities, SMEs, or areas such as ESG1.

“Most of the companies in our portfolio are witnessing massive growth from tier-2 cities, showcasing the need to focus on such underserved market segments.” – Managing Partner, Amicus Capital

3: TAKE A NEW APPROACH TO CUSTOMER ACQUISITION AND RETENTION

Rather than aiming to spend large marketing budgets to attract customers, start-ups need to adopt more targeted tactics. Spend is shifting from above-the-line activities such as advertising and sponsorship to below-the-line tactics with growing focus on referrals and word of mouth. Rather than employing glamorous celebrities as brand ambassadors, start-ups are working with lower-cost, more targeted social media influencers. Not only does this positively impact budgets, but it also is more trackable to ensure effectiveness.

Once customers are onboard, much greater emphasis should be placed on retention and upselling, rather than headline acquisition numbers. The focus for investors has now shifted toward metrics such as monthly active users (MAUs) and time spent per session, rather than, for example, app downloads.

“The biggest challenge when you are small is the old saying—revenue is vanity, profit is sanity, cash is reality.” – Shauravi Malik, Co-founder, Slurrp Farm.

4: FOCUS ON PRICING AND LONG-TERM MONETIZATION OF CUSTOMERS

Previously, many start-ups based their revenue models on “freemium” or ad-based approaches. Neither of these deliver the revenue certainty that investors are demanding – for example, economic conditions mean start-ups are finding it tougher to convert customers from free to premium packages once trial periods end. As the focus of investors has shifted from customer acquisition to customer retention, subscription-based revenue models have come into fashion once again.

However, subscription-based offerings should be flexible to keep pace with changing customer needs, as well as showing close, easily understandable alignment between value and price. For instance, beauty and personal-care companies are increasingly using a razor-and- blade pricing model in which the main product offered is cheap, but additions/refills are relatively expensive.

“Great companies are capital efficient, and we like to deal with great companies.” – Founder and Managing Director, early-stage US-based VC

5: BUILD A TECHNOLOGY-ENABLED, CUSTOMER-CENTRIC SUPPORT MODEL

While they’ve often claimed to be customer-centric, many start-ups have not carried this promise through from product creation to post-sales customer service. Following a top-line growth model based on acquiring new customers meant retaining existing ones was not a priority.

The new focus on reducing churn and increasing customer lifetime value, combined with higher customer acquisition costs, make retention a key success metric. While a product-market fit approach brings in customers, high-quality service is essential to maintaining market share. Ideally, service needs to be provided in-house to maintain quality customer service and high retention rates.

However, customer service has traditionally been a labor- and cost-intensive function that grows in tandem with market share. To break this link, startups should look at technology, particularly digital channels, AI, and natural language processing (NLP), to automate customer service through solutions such as chatbots and NLP-powered online FAQs.

“Start-up founders need to be mindful of the fact that their moat can be disrupted by their competitors, and must therefore strive to remain one step ahead.” – Shivathilak Tallam, Unitus Ventures

6: DIFFERENT TECH WORKFORCE MANAGEMENT

Most start-up founders are based in cities established as start-up hubs, such as the Bay Area in the US, Bengaluru (Bangalore) in India, Paris in France, or London/Cambridge in the UK. As they grow, they naturally expand their operations and teams in the same location. However, the rising popularity of these areas has driven increases in the cost of living and real-estate prices. For example, the cost of housing in San Francisco is no less than 238 percent higher than the US average. All of this results in higher salaries and operating costs.

Therefore, as start-ups begin their expansion phases, founders should plan on setting up centers in emerging hubs (such as Denver, Colorado and Austin, Texas in the US, or Hyderabad and Pune in India) where the cost of operations is relatively low. Additionally, start-ups located in developed countries should plan to effectively outsource operations to countries such as India, Poland, or Romania, where a highly qualified talent pool is available at a much lower cost.

On the technical side, as they grow, start-ups should look at improving operational efficiency. This could mean shifting from cloud-based solutions such as Amazon Web Services to managed and co-location services for their IT infrastructure.

“Multiple start-ups have initiated layoffs from their offices situated at high-cost locations because of their inability to justify such high salaries at premium locations.” – Founder, Indian Unicorn

Today’s funding winter is far from being simply a bad news story. It has provided a welcome driver for start-ups to focus on profitability and creating world-class businesses, rather than just growing the top line. They need to use the slowdown as a positive, removing extra fat from the organization and making their businesses lean and IPO ready, if they want to genuinely achieve lasting unicorn status with the benefits it delivers. Today corporates have a new opportunity to make strategic acquisitions, investments, and partnerships with start-ups in a less overheated market and with a more balanced risk/reward profile. They should take advantage while it lasts.